Question: please use excel template given under the question. thank you! 1. Walton Enterprises, Inc. is considering a proposal for a joint venture that will require

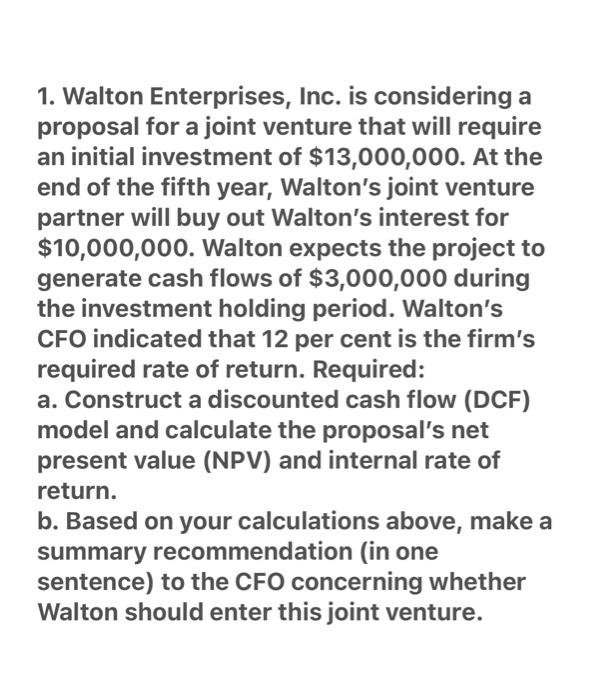

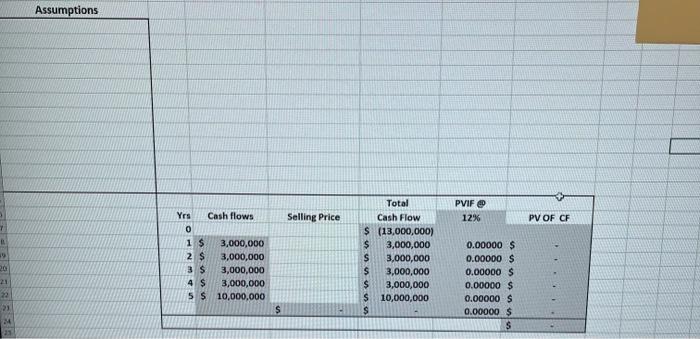

1. Walton Enterprises, Inc. is considering a proposal for a joint venture that will require an initial investment of $13,000,000. At the end of the fifth year, Walton's joint venture partner will buy out Walton's interest for $10,000,000. Walton expects the project to generate cash flows of $3,000,000 during the investment holding period. Walton's CFO indicated that 12 per cent is the firm's required rate of return. Required: a. Construct a discounted cash flow (DCF) model and calculate the proposal's net present value (NPV) and internal rate of return. b. Based on your calculations above, make a summary recommendation (in one sentence) to the CFO concerning whether Walton should enter this joint venture. Assumptions 1. Walton Enterprises, Inc. is considering a proposal for a joint venture that will require an initial investment of $13,000,000. At the end of the fifth year, Walton's joint venture partner will buy out Walton's interest for $10,000,000. Walton expects the project to generate cash flows of $3,000,000 during the investment holding period. Walton's CFO indicated that 12 per cent is the firm's required rate of return. Required: a. Construct a discounted cash flow (DCF) model and calculate the proposal's net present value (NPV) and internal rate of return. b. Based on your calculations above, make a summary recommendation (in one sentence) to the CFO concerning whether Walton should enter this joint venture. Assumptions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts