Question: can someone answer this please? with solution too (4) Adrian died on 13 March 2020. Both Adrian and his wife are UK domiciled. Adrian had

can someone answer this please? with solution too

can someone answer this please? with solution too

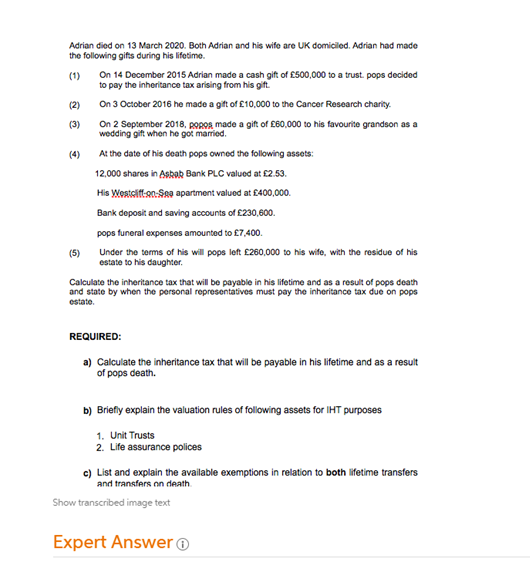

(4) Adrian died on 13 March 2020. Both Adrian and his wife are UK domiciled. Adrian had made the following gifts during his lifetime. (1) On 14 December 2015 Adrian made a cash gift of 500,000 to a trust. pops decided to pay the inheritance tax arising from his gift. (2) On 3 October 2016 he made a gift of 10,000 to the Cancer Research charity. (3) On 2 September 2018, BORO8 made a gift of 60,000 to his favourite grandson as a wedding gift when he got married At the date of his death pops owned the following assets: 12,000 shares in Asbak Bank PLC valued at 12.53. His Westsift:20-Sne apartment valued at 400,000 Bank deposit and saving accounts of 230,600. pops funeral expenses amounted to 7,400 (5) Under the terms of his will pops left 250,000 to his wife, with the residue of his estate to his daughter. Calculate the inheritance tax that will be payable in his lifetime and as a result of pops death and state by when the personal representatives must pay the inheritance tax due on pops ostate REQUIRED: a) Calculate the inheritance tax that will be payable in his lifetime and as a result of pops death. b) Briefly explain the valuation rules of following assets for IHT purposes 1. Unit Trusts 2. Life assurance polices c) List and explain the available exemptions in relation to both lifetime transfers and transfers on death Show transcribed image text Expert Answer (4) Adrian died on 13 March 2020. Both Adrian and his wife are UK domiciled. Adrian had made the following gifts during his lifetime. (1) On 14 December 2015 Adrian made a cash gift of 500,000 to a trust. pops decided to pay the inheritance tax arising from his gift. (2) On 3 October 2016 he made a gift of 10,000 to the Cancer Research charity. (3) On 2 September 2018, BORO8 made a gift of 60,000 to his favourite grandson as a wedding gift when he got married At the date of his death pops owned the following assets: 12,000 shares in Asbak Bank PLC valued at 12.53. His Westsift:20-Sne apartment valued at 400,000 Bank deposit and saving accounts of 230,600. pops funeral expenses amounted to 7,400 (5) Under the terms of his will pops left 250,000 to his wife, with the residue of his estate to his daughter. Calculate the inheritance tax that will be payable in his lifetime and as a result of pops death and state by when the personal representatives must pay the inheritance tax due on pops ostate REQUIRED: a) Calculate the inheritance tax that will be payable in his lifetime and as a result of pops death. b) Briefly explain the valuation rules of following assets for IHT purposes 1. Unit Trusts 2. Life assurance polices c) List and explain the available exemptions in relation to both lifetime transfers and transfers on death Show transcribed image text Expert

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts