Question: QUESTION 4 a) Mrs Smith made the following three lifetime gifts: On 1 April 2015 Mrs Smith gave cash to her son of 90,000 on

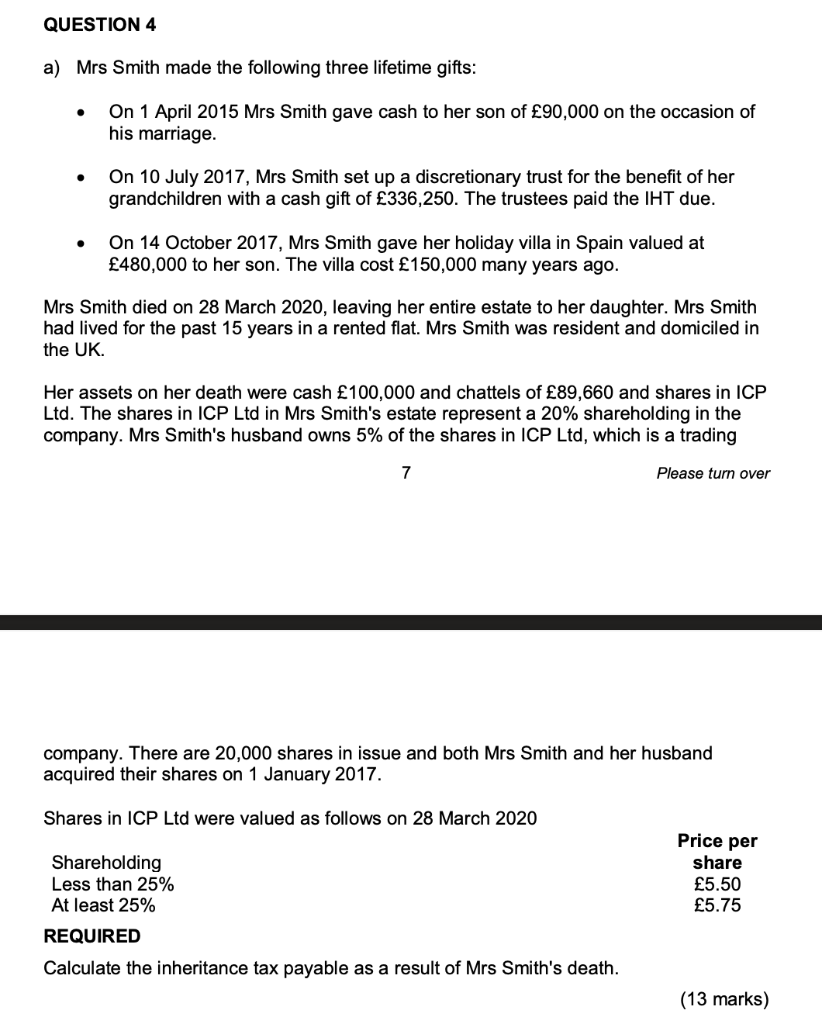

QUESTION 4 a) Mrs Smith made the following three lifetime gifts: On 1 April 2015 Mrs Smith gave cash to her son of 90,000 on the occasion of his marriage. On 10 July 2017, Mrs Smith set up a discretionary trust for the benefit of her grandchildren with a cash gift of 336,250. The trustees paid the IHT due. On 14 October 2017, Mrs Smith gave her holiday villa in Spain valued at 480,000 to her son. The villa cost 150,000 many years ago. Mrs Smith died on 28 March 2020, leaving her entire estate to her daughter. Mrs Smith had lived for the past 15 years in a rented flat. Mrs Smith was resident and domiciled in the UK. Her assets on her death were cash 100,000 and chattels of 89,660 and shares in ICP Ltd. The shares in ICP Ltd in Mrs Smith's estate represent a 20% shareholding in the company. Mrs Smith's husband owns 5% of the shares in ICP Ltd, which is a trading 7 Please turn over company. There are 20,000 shares in issue and both Mrs Smith and her husband acquired their shares on 1 January 2017. Shares in ICP Ltd were valued as follows on 28 March 2020 Price per share 5.50 5.75 Shareholding Less than 25% At least 25% REQUIRED Calculate the inheritance tax payable as a result of Mrs Smith's death. (13 marks) QUESTION 4 a) Mrs Smith made the following three lifetime gifts: On 1 April 2015 Mrs Smith gave cash to her son of 90,000 on the occasion of his marriage. On 10 July 2017, Mrs Smith set up a discretionary trust for the benefit of her grandchildren with a cash gift of 336,250. The trustees paid the IHT due. On 14 October 2017, Mrs Smith gave her holiday villa in Spain valued at 480,000 to her son. The villa cost 150,000 many years ago. Mrs Smith died on 28 March 2020, leaving her entire estate to her daughter. Mrs Smith had lived for the past 15 years in a rented flat. Mrs Smith was resident and domiciled in the UK. Her assets on her death were cash 100,000 and chattels of 89,660 and shares in ICP Ltd. The shares in ICP Ltd in Mrs Smith's estate represent a 20% shareholding in the company. Mrs Smith's husband owns 5% of the shares in ICP Ltd, which is a trading 7 Please turn over company. There are 20,000 shares in issue and both Mrs Smith and her husband acquired their shares on 1 January 2017. Shares in ICP Ltd were valued as follows on 28 March 2020 Price per share 5.50 5.75 Shareholding Less than 25% At least 25% REQUIRED Calculate the inheritance tax payable as a result of Mrs Smith's death. (13 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts