Question: can someone do this question for me please 5. Bob recently turned 30, an event causing him to give thought to some long-range financial planning.

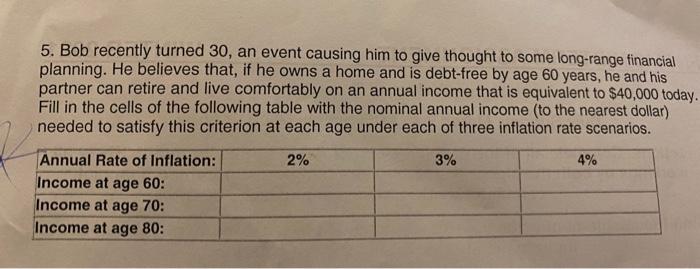

5. Bob recently turned 30, an event causing him to give thought to some long-range financial planning. He believes that, if he owns a home and is debt-free by age 60 years, he and his partner can retire and live comfortably on an annual income that is equivalent to $40,000 today. Fill in the cells of the following table with the nominal annual income (to the nearest dollar) needed to satisfy this criterion at each age under each of three inflation rate scenarios. Annual Rate of Inflation: 2% 3% Income at age 60: Income at age 70: Income at age 80: 4%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts