Question: Can someone dumb it down for me, please? I am having a hard time with this chapter. Thank you On January 1, 2023, Crane Corporation

Can someone dumb it down for me, please? I am having a hard time with this chapter. Thank you

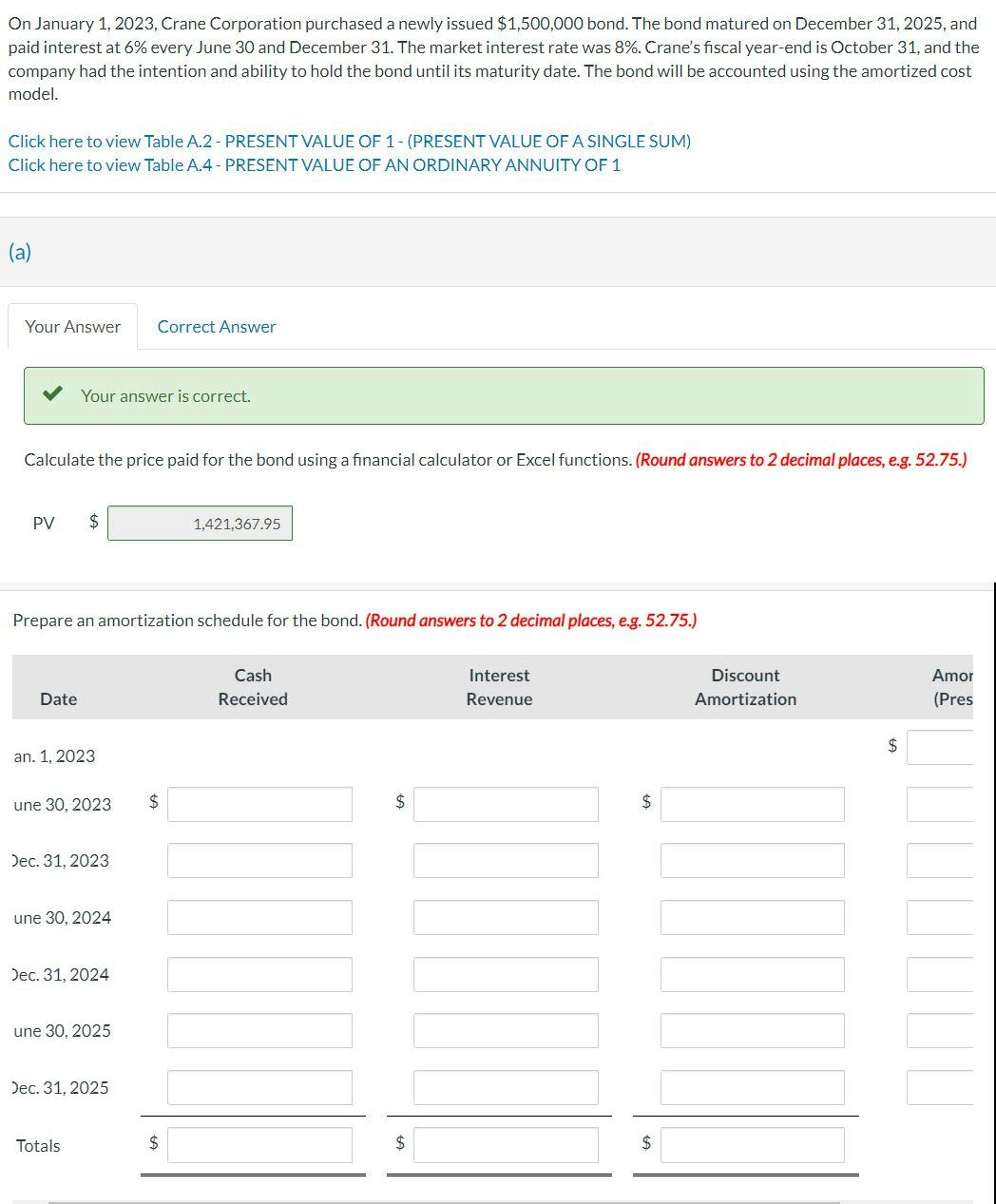

On January 1, 2023, Crane Corporation purchased a newly issued $1,500,000 bond. The bond matured on December 31,2025 , and paid interest at 6% every June 30 and December 31 . The market interest rate was 8%. Crane's fiscal year-end is October 31 , and the company had the intention and ability to hold the bond until its maturity date. The bond will be accounted using the amortized cost model. Click here to view Table A.2 - PRESENT VALUE OF 1 - (PRESENT VALUE OF A SINGLE SUM) Click here to view Table A.4 - PRESENT VALUE OF AN ORDINARY ANNUITY OF 1 (a) Your answer is correct. Calculate the price paid for the bond using a financial calculator or Excel functions. (Round answers to 2 decimal places, e.g. 52.75.) PV \$ Prepare an amortization schedule for the bond. (Round answers to 2 decimal places, e.g. 52.75.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts