Question: can someone explain how to do this case study? Thank you in advance! In this case study, I need to figure out what each childs

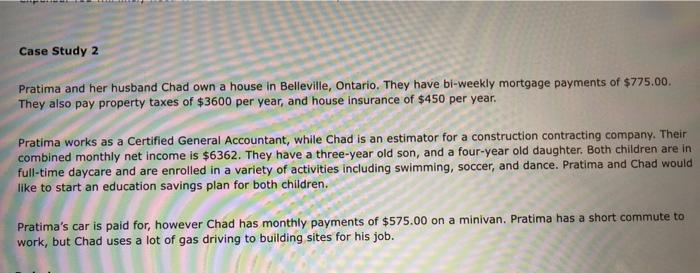

Case Study 2 Pratima and her husband Chad own a house in Belleville, Ontario. They have bi-weekly mortgage payments of $775.00 They also pay property taxes of $3600 per year, and house insurance of $450 per year. Pratima works as a Certified General Accountant, while Chad is an estimator for a construction contracting company. Their combined monthly net income is $6362. They have a three-year old son, and a four-year old daughter. Both children are in full-time daycare and are enrolled in a variety of activities including swimming, soccer, and dance. Pratima and Chad would like to start an education savings plan for both children. Pratima's car is paid for, however Chad has monthly payments of $575.00 on a minivan. Pratima has a short commute to work, but Chad uses a lot of gas driving to building sites for his job

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts