Question: Can someone explain the steps a bit more clearly so that I understand how to arrive at the correct answer? Even though I feel like

Can someone explain the steps a bit more clearly so that I understand how to arrive at the correct answer? Even though I feel like Im following the steps correctly in the book and video I keep getting the wrong answer.

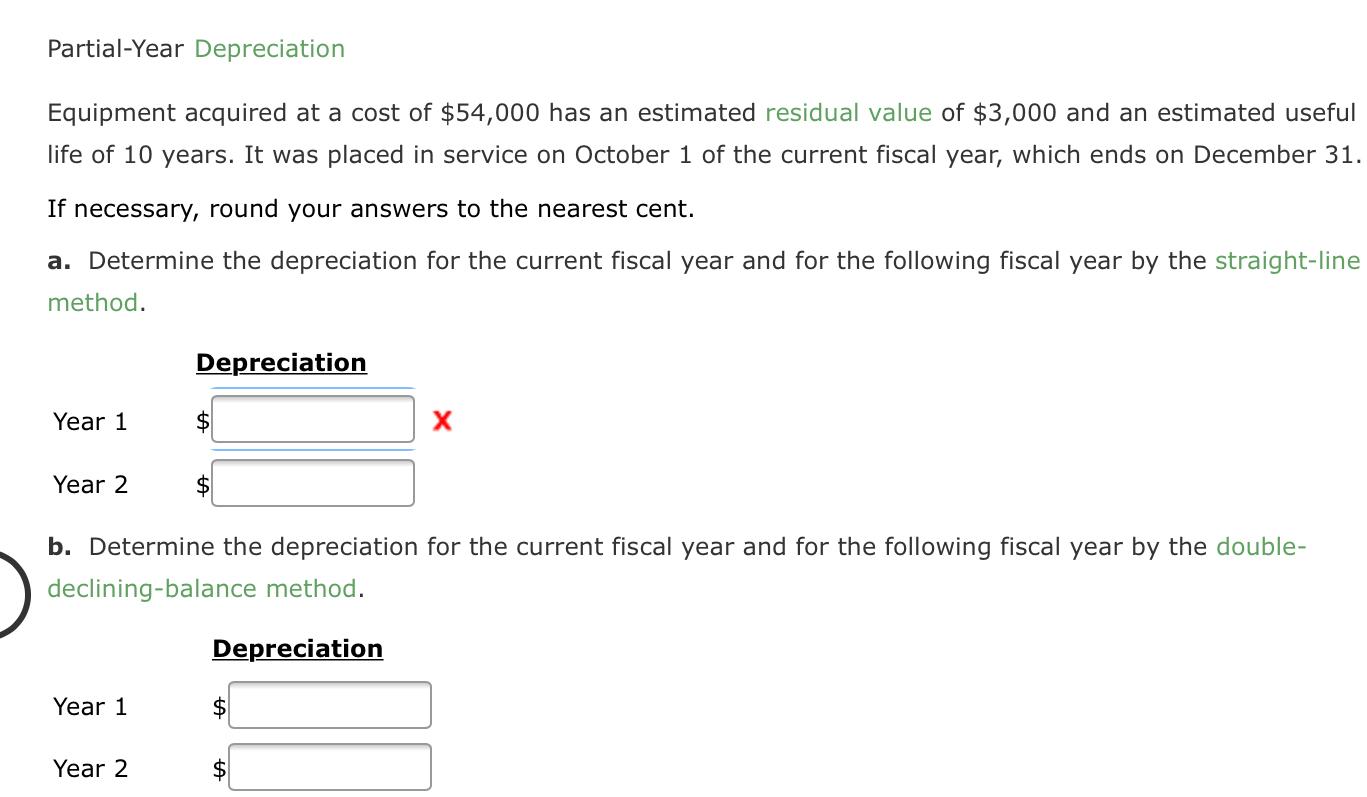

Partial-Year Depreciation Equipment acquired at a cost of $54,000 has an estimated residual value of $3,000 and an estimated useful life of 10 years. It was placed in service on October 1 of the current fiscal year, which ends on December 31. If necessary, round your answers to the nearest cent. a. Determine the depreciation for the current fiscal year and for the following fiscal year by the straight-line method. Depreciation Year 1 $ Year 2 b. Determine the depreciation for the current fiscal year and for the following fiscal year by the double- declining-balance method. Depreciation Year 1 $ Year 2 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts