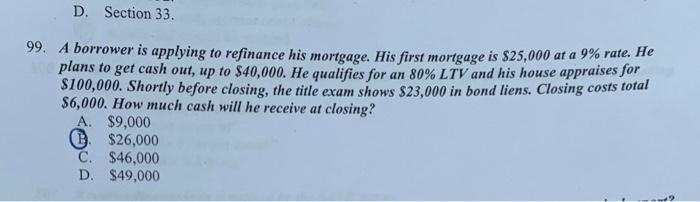

Question: Can someone explain this? D. Section 33. 99. A borrower is applying to refinance his mortgage. His first mortgage is $25,000 at a 9% rate.

D. Section 33. 99. A borrower is applying to refinance his mortgage. His first mortgage is $25,000 at a 9% rate. He plans to get cash out, up to $40,000. He qualifies for an 80% LTV and his house appraises for $100,000. Shortly before closing the title exam shows $23,000 in bond liens. Closing costs total $6,000. How much cash will he receive at closing? A. $9,000 0 $26,000 C. $46,000 D. $49,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts