Question: . Freixas and Rochet Section 7.1 Consider the model with 3 periods, t=0,1.2 where a continuum of agents have $1 endowment of a good at

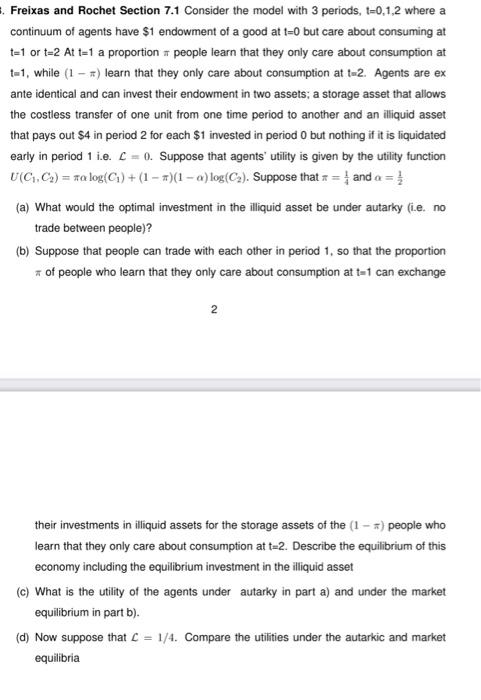

. Freixas and Rochet Section 7.1 Consider the model with 3 periods, t=0,1.2 where a continuum of agents have $1 endowment of a good at 1=0 but care about consuming at t=1 or t=2 At t=1 a proportion people learn that they only care about consumption at t-1, while (1 - A) learn that they only care about consumption at t-2. Agents are ex ante identical and can invest their endowment in two assets; a storage asset that allows the costless transfer of one unit from one time period to another and an illiquid asset that pays out $4 in period 2 for each $1 invested in period o but nothing if it is liquidated early in period 1 i.e. C = 0. Suppose that agents' utility is given by the utility function U( CC) = nalog(C) + (1 - 1) (1 - a) log(C). Suppose that a = and a = } (a) What would the optimal investment in the illiquid asset be under autarky (ie. no trade between people)? (b) Suppose that people can trade with each other in period 1, so that the proportion of people who learn that they only care about consumption at t=1 can exchange N 2 2 their investments in illiquid assets for the storage assets of the (1 - ) people who learn that they only care about consumption at t=2. Describe the equilibrium of this economy including the equilibrium investment in the illiquid asset (c) What is the utility of the agents under autarky in part a) and under the market equilibrium in part b). (d) Now suppose that c = 1/4. Compare the utilities under the autarkic and market equilibria . Freixas and Rochet Section 7.1 Consider the model with 3 periods, t=0,1.2 where a continuum of agents have $1 endowment of a good at 1=0 but care about consuming at t=1 or t=2 At t=1 a proportion people learn that they only care about consumption at t-1, while (1 - A) learn that they only care about consumption at t-2. Agents are ex ante identical and can invest their endowment in two assets; a storage asset that allows the costless transfer of one unit from one time period to another and an illiquid asset that pays out $4 in period 2 for each $1 invested in period o but nothing if it is liquidated early in period 1 i.e. C = 0. Suppose that agents' utility is given by the utility function U( CC) = nalog(C) + (1 - 1) (1 - a) log(C). Suppose that a = and a = } (a) What would the optimal investment in the illiquid asset be under autarky (ie. no trade between people)? (b) Suppose that people can trade with each other in period 1, so that the proportion of people who learn that they only care about consumption at t=1 can exchange N 2 2 their investments in illiquid assets for the storage assets of the (1 - ) people who learn that they only care about consumption at t=2. Describe the equilibrium of this economy including the equilibrium investment in the illiquid asset (c) What is the utility of the agents under autarky in part a) and under the market equilibrium in part b). (d) Now suppose that c = 1/4. Compare the utilities under the autarkic and market equilibria

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts