Question: Can someone Explain this. PLEASE READ END QUESTION Ringo Manufacturing is considering the purchase of a new machine for $60,000. The machine is expected to

Can someone Explain this. PLEASE READ END QUESTION

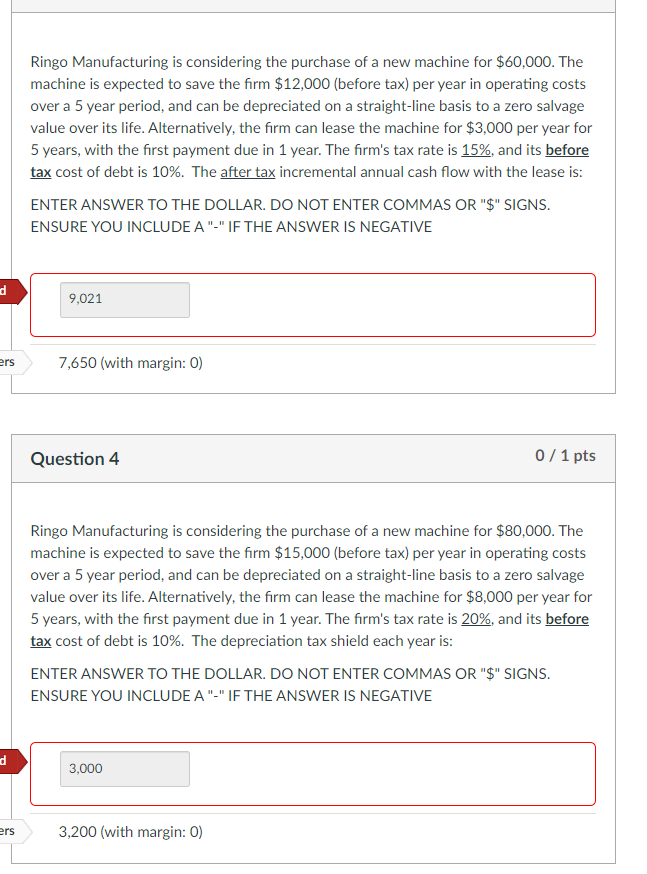

Ringo Manufacturing is considering the purchase of a new machine for $60,000. The machine is expected to save the firm $12,000 (before tax) per year in operating costs over a 5 year period, and can be depreciated on a straight-line basis to a zero salvage value over its life. Alternatively, the firm can lease the machine for $3,000 per year for 5 years, with the first payment due in 1 year. The firm's tax rate is 15%, and its before tax cost of debt is 10%. The after tax incremental annual cash flow with the lease is: ENTER ANSWER TO THE DOLLAR. DO NOT ENTER COMMAS OR "$" SIGNS. ENSURE YOU INCLUDE A "-"IF THE ANSWER IS NEGATIVE d 9,021 ers 7,650 (with margin: 0) Question 4 0 / 1 pts Ringo Manufacturing is considering the purchase of a new machine for $80,000. The machine is expected to save the firm $15,000 (before tax) per year in operating costs over a 5 year period, and can be depreciated on a straight-line basis to a zero salvage value over its life. Alternatively, the firm can lease the machine for $8,000 per year for 5 years, with the first payment due in 1 year. The firm's tax rate is 20%, and its before tax cost of debt is 10%. The depreciation tax shield each year is: ENTER ANSWER TO THE DOLLAR. DO NOT ENTER COMMAS OR "$" SIGNS. ENSURE YOU INCLUDE A "-"IF THE ANSWER IS NEGATIVE d 3,000 ers 3,200 (with margin: 0)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts