Question: Please Read The question and Answer please. THE LAST PART IS DIFFERENT THAN WHAT IS THERE IN CHEGG Thanks Question 1 0 / 1 pts

Please Read The question and Answer please. THE LAST PART IS DIFFERENT THAN WHAT IS THERE IN CHEGG

Thanks

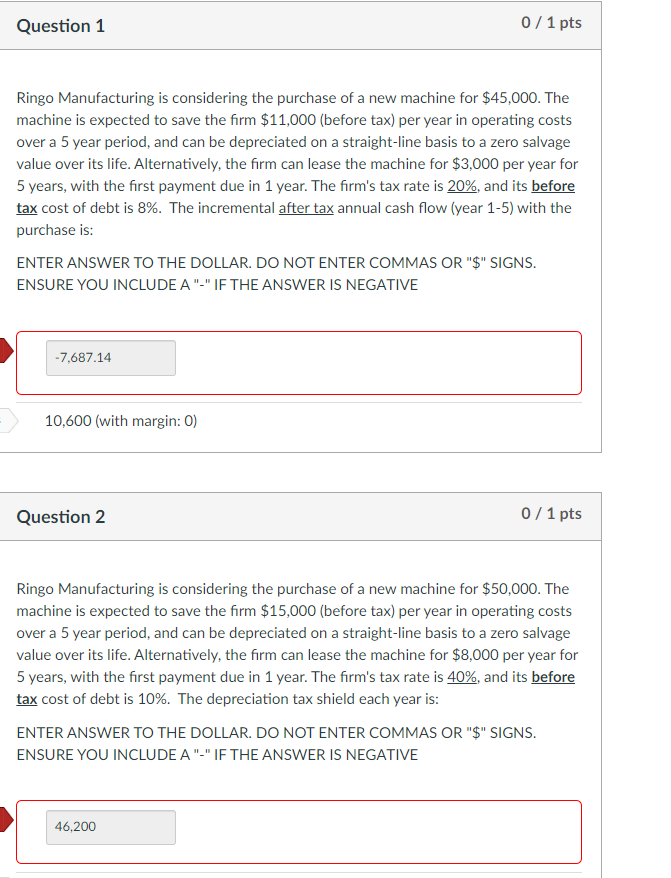

Question 1 0 / 1 pts Ringo Manufacturing is considering the purchase of a new machine for $45,000. The machine is expected to save the firm $11,000 (before tax) per year in operating costs over a 5 year period, and can be depreciated on a straight-line basis to a zero salvage value over its life. Alternatively, the firm can lease the machine for $3,000 per year for 5 years, with the first payment due in 1 year. The firm's tax rate is 20%, and its before tax cost of debt is 8%. The incremental after tax annual cash flow (year 1-5) with the purchase is: ENTER ANSWER TO THE DOLLAR. DO NOT ENTER COMMAS OR "$" SIGNS. ENSURE YOU INCLUDE A "-"IF THE ANSWER IS NEGATIVE -7,687.14 10,600 (with margin: 0) Question 2 0/ 1 pts Ringo Manufacturing is considering the purchase of a new machine for $50,000. The machine is expected to save the firm $15,000 (before tax) per year in operating costs over a 5 year period, and can be depreciated on a straight-line basis to a zero salvage value over its life. Alternatively, the firm can lease the machine for $8,000 per year for 5 years, with the first payment due in 1 year. The firm's tax rate is 40%, and its before tax cost of debt is 10%. The depreciation tax shield each year is: ENTER ANSWER TO THE DOLLAR. DO NOT ENTER COMMAS OR "$" SIGNS. ENSURE YOU INCLUDE A "-"IF THE ANSWER IS NEGATIVE 46,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts