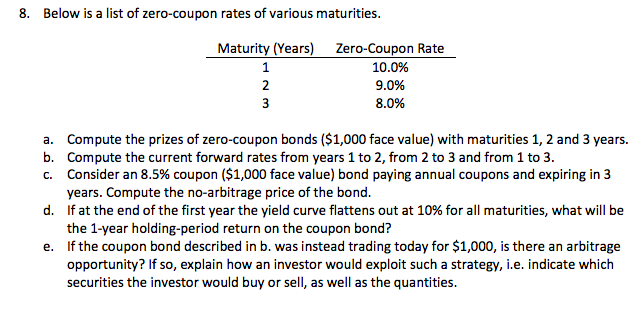

Question: can someone explain this question please 8. Below is a list of zero-coupon rates of various maturities. Maturity (Years) Zero-Coupon Rate 10.0% 9.0% 8.0% a.

can someone explain this question please

8. Below is a list of zero-coupon rates of various maturities. Maturity (Years) Zero-Coupon Rate 10.0% 9.0% 8.0% a. Compute the prizes of zero-coupon bonds ($1,000 face value) with maturities 1, 2 and 3 years. b. Compute the current forward rates from years 1 to 2, from 2 to 3 and from 1 to 3. C. Consider an 8.5% coupon ($1,000 face value) bond paying annual coupons and expiring in 3 years. Compute the no-arbitrage price of the bond. d. If at the end of the first year the yield curve flattens out at 10% for all maturities, what will be the 1-year holding-period return on the coupon bond? e. If the coupon bond described in b. was instead trading today for $1,000, is there an arbitrage opportunity? If so, explain how an investor would exploit such a strategy, i.e. indicate which securities the investor would buy or sell, as well as the quantities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts