Question: for this question part B when calculating the 4 year bonds no-arbitrage price should i the different rates for each year, or should i just

for this question part B when calculating the 4 year bonds no-arbitrage price should i the different rates for each year, or should i just use the same rate of z4 when discounting all cash flows of bond B

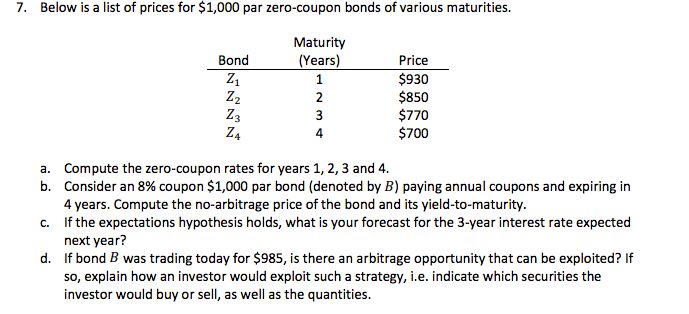

7. Below is a list of prices for $1,000 par zero-coupon bonds of various maturities. Maturity (Years) Bond Price $930 $850 $770 $700 a. Compute the zero-coupon rates for years 1, 2, 3 and 4. b. Consider an 8% coupon $1,000 par bond (denoted by B) paying annual coupons and expiring in 4 years. Compute the no-arbitrage price of the bond and its yield-to-maturity. c. If the expectations hypothesis holds, what is your forecast for the 3-year interest rate expected next year? d. If bond B was trading today for $985, is there an arbitrage opportunity that can be exploited? If so, explain how an investor would exploit such a strategy, i.e. indicate which securities the investor would buy or sell, as well as the quantities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts