Question: Can someone explain to me how to do these problems please and thanks 7. A 10-year treasury bond is issued at par. The bond has

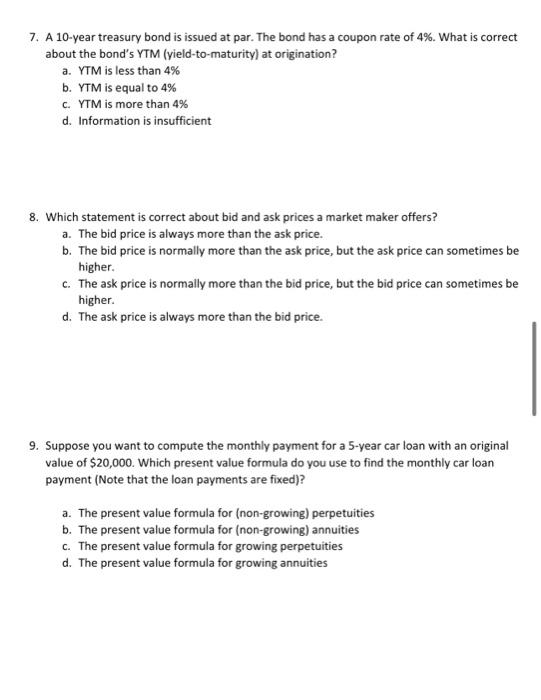

7. A 10-year treasury bond is issued at par. The bond has a coupon rate of 4%. What is correct about the bond's YTM (yield-to-maturity) at origination? a. YTM is less than 4% b. YTM is equal to 4% c. YTM is more than 4% d. Information is insufficient 8. Which statement is correct about bid and ask prices a market maker offers? a. The bid price is always more than the ask price. b. The bid price is normally more than the ask price, but the ask price can sometimes be higher. c. The ask price is normally more than the bid price, but the bid price can sometimes be higher. d. The ask price is always more than the bid price. 9. Suppose you want to compute the monthly payment for a 5-year car loan with an original value of $20,000. Which present value formula do you use to find the monthly car loan payment (Note that the loan payments are fixed)? a. The present value formula for (non-growing) perpetuities b. The present value formula for (non-growing) annuities c. The present value formula for growing perpetuities d. The present value formula for growing annuities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts