Question: can someone explain what i need to do to finish this problem The following data is provided for Garcon Company and Pepper Company. Beginning finished

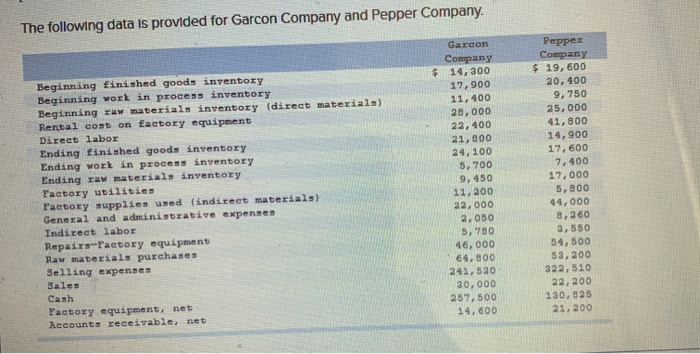

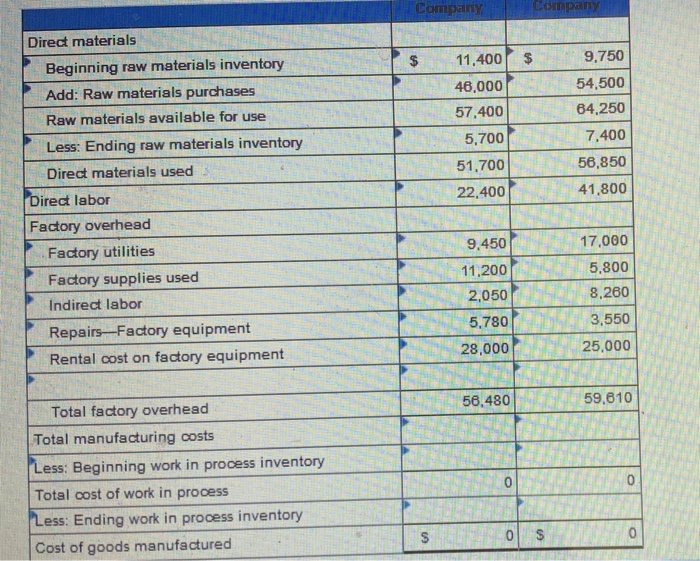

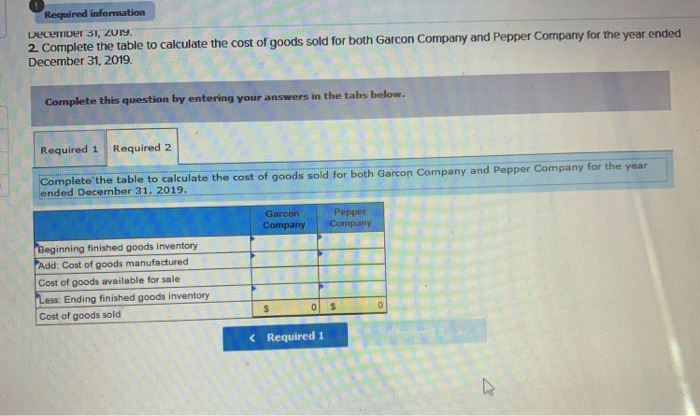

The following data is provided for Garcon Company and Pepper Company. Beginning finished goods inventory Beginning work in process inventory Beginning raw materials inventory (direct materials) Rental cost on factory equipment Direct labor Ending finished goods inventory Ending work in process inventory Ending raw materials inventory Factory utilities Factory supplies used (indireet materials) General and administrative expenses Indirect labor Repairs-Factory equipment Raw materials purchases Selling expenses Sales Cash Factory equipment, net Accounts receivable, net Garcon Company $ 14,300 17,900 11,400 20,000 22,400 21,800 24,100 5,700 9,450 11,200 22,000 2,050 5,780 46,000 64.800 241, 530 30,000 257,500 14,600 Pepper Company $ 19,600 20,400 9,750 25,000 41,800 14,900 17,600 7.400 17.000 5, 300 44,000 8,260 3,550 34,500 53,200 322, 510 22, 200 130, 825 21,200 Company Company $ $ 11,400 48,000 57,400 5,700 9,750 54,500 84.250 7.400 56,850 41,800 51,700 22.400 Direct materials Beginning raw materials inventory Add: Raw materials purchases Raw materials available for use Less: Ending raw materials inventory Direct materials used Direct labor Factory overhead Factory utilities Factory supplies used Indirect labor Repairs-Factory equipment Rental cost on factory equipment 9,450 11,200 2,050 5,780 17,000 5,800 8,260 3,550 25,000 28,000 56,480 59,610 Total factory overhead Total manufacturing costs Less: Beginning work in process inventory Total cost of work in process Less: Ending work in process inventory Cost of goods manufactured 0 0 S 0 $ Required information December 31, 2019, 2. Complete the table to calculate the cost of goods sold for both Garcon Company and Pepper Company for the year ended December 31, 2019 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete the table to calculate the cost of goods sold for both Garcon Company and Pepper Company for the year ended December 31, 2019. Garcon Company Pepper Company Beginning finished goods inventory Add: Cost of goods manufactured Cost of goods available for sale Less: Ending finished goods inventory Cost of goods sold $ 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts