Question: can someone help ? 1. Using the Merrill Lynch profile sheets provided in the Module, fill in the Chart Below: Merrill Edge - Profile_ATVI -

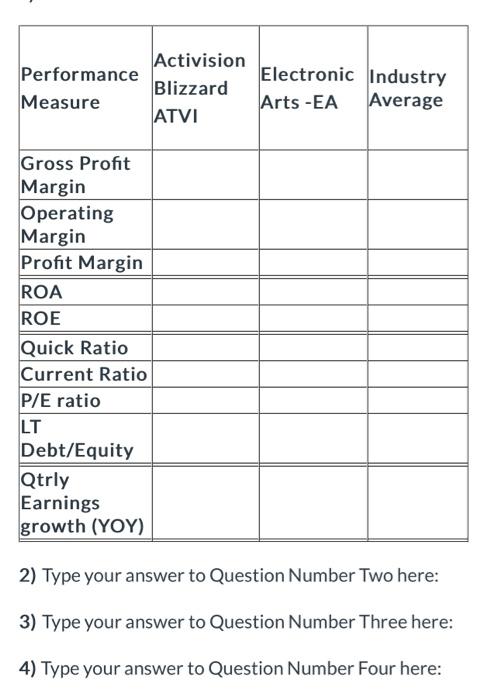

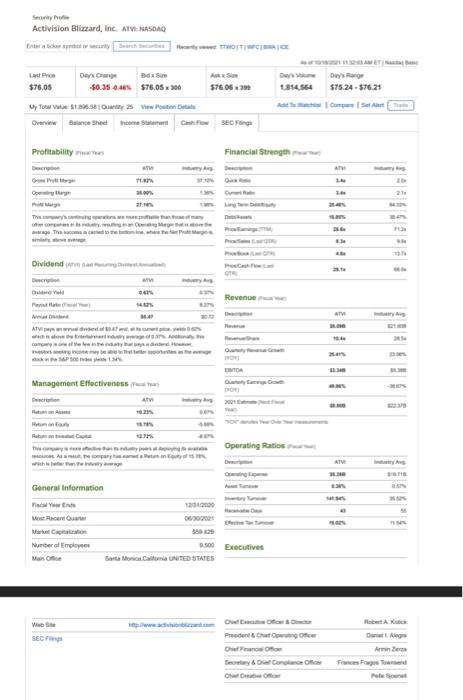

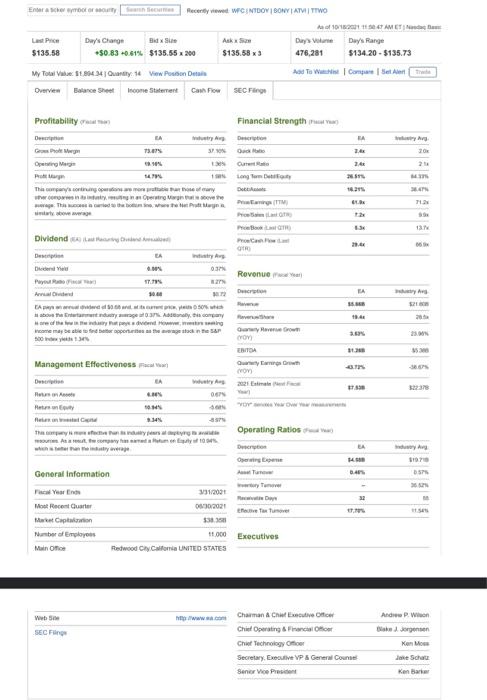

1. Using the Merrill Lynch profile sheets provided in the Module, fill in the Chart Below: Merrill Edge - Profile_ATVI - ACTIVISION BLIZZARD, INC. - Fundamentals.pdf Merrill Edge - Profile_EA - ELECTRONIC ARTS INC. - Fundamentals.pdf 2. Based on the completed chart, how do ATVI and EA compare with the Industry averages?. 3. Which stock, or both, is undervalued based on the financial data?. 4. Finally, if you had $10,000 to invest right now, which stock (or both) would you invest in and why? 2) Type your answer to Question Number Two here: 3) Type your answer to Question Number Three here: 4) Type your answer to Question Number Four here: Senery fider Activision Bllezard, Inc. ATVe nhsbad Mansgement Effectiveness faum General Information Financial Strength fwer Revenve fun mer Dperating Raties pow an Exbcutives Wubsin seCfins Guefrimade beow i bisar Coet Fravea of of Feurley 8 Cod Conulmar Ofles Gref Creise Gitio Matert A kinet Danier A. Ange Armm aeca Femien Feges Townsev Pele stomen Profitability reia man beints adove averat Divldond Revenue ifwedyent Noome map be able to fint bethor appentihes an the anowags afoch in the sar soo wiser yeite 130 ts Operating Ratios prin mes 1. Using the Merrill Lynch profile sheets provided in the Module, fill in the Chart Below: Merrill Edge - Profile_ATVI - ACTIVISION BLIZZARD, INC. - Fundamentals.pdf Merrill Edge - Profile_EA - ELECTRONIC ARTS INC. - Fundamentals.pdf 2. Based on the completed chart, how do ATVI and EA compare with the Industry averages?. 3. Which stock, or both, is undervalued based on the financial data?. 4. Finally, if you had $10,000 to invest right now, which stock (or both) would you invest in and why? 2) Type your answer to Question Number Two here: 3) Type your answer to Question Number Three here: 4) Type your answer to Question Number Four here: Senery fider Activision Bllezard, Inc. ATVe nhsbad Mansgement Effectiveness faum General Information Financial Strength fwer Revenve fun mer Dperating Raties pow an Exbcutives Wubsin seCfins Guefrimade beow i bisar Coet Fravea of of Feurley 8 Cod Conulmar Ofles Gref Creise Gitio Matert A kinet Danier A. Ange Armm aeca Femien Feges Townsev Pele stomen Profitability reia man beints adove averat Divldond Revenue ifwedyent Noome map be able to fint bethor appentihes an the anowags afoch in the sar soo wiser yeite 130 ts Operating Ratios prin mes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts