Question: Can someone help ans check my work is this correct? Acme has branched out to rentals of office furniture to start-up companies . Consider a

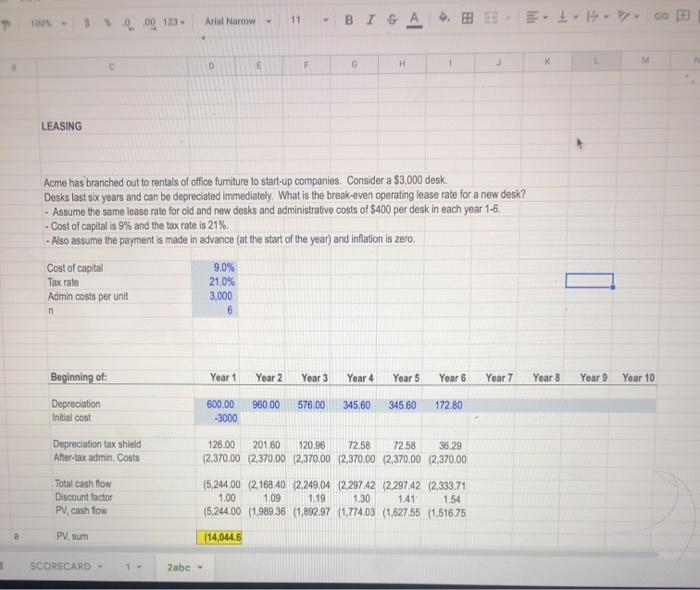

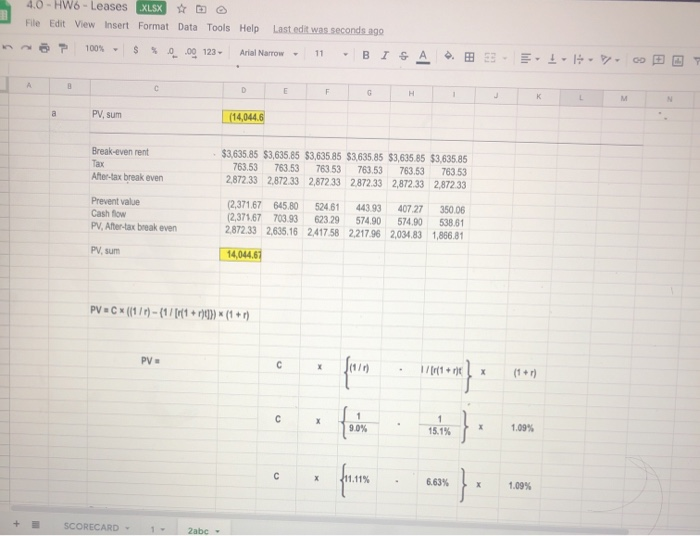

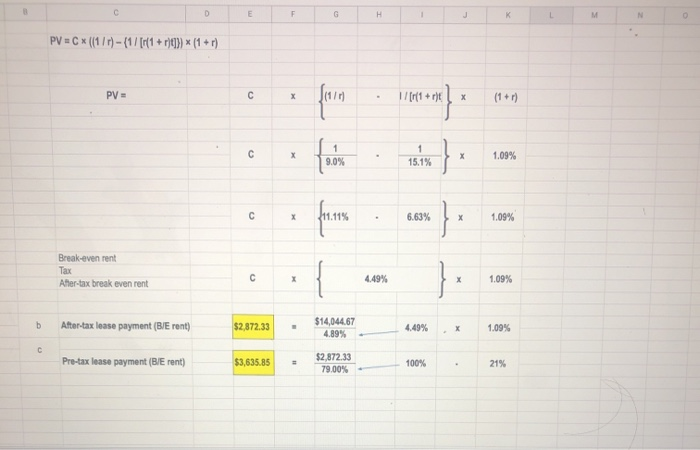

1001 - $0.00 123 Arial Narrow 11 Is A E D G H LEASING Acme has branched out to rentals of office furniture to start-up companies. Consider a $3,000 desk. Desks last six years and can be depreciated immediately. What is the break-even operating lease rate for a new desk? - Assume the same lease rate for old and new desks and administrative costs of $400 per desk in each year 1-6. - Cost of capital is 9% and the tax rate is 21%. - Also assume the payment is made in advance at the start of the year) and inflation is zero. Cost of capital Tax rate Admin costs per unit n 9.0% 21.0% 3,000 6 Beginning of: Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 960.00 345.60 576.00 345,60 Depreciation Initial cost 172.80 600.00 -3000 Depreciation tax shield After-tax admin. Costs 126.00 201.60 120.96 72.58 72.58 36.29 (2,370.00 (2,370.00 (2,370.00 (2.370.00 (2,370.00 2,370.00 Total cash flow Discount factor PV, cash fow (5,244.00 (2.168.40 (2,249.04 (2.297.42 (2,297 42 (2,333.71 1.00 1.09 1.19 1.30 1.41 1.54 (5,244.00 (1.989.36 (1,892.97 (1.774.03 (1,627.55 (1,516.75 PV, sum (14,044.6 SCORECARD 2abc- 4.0 - HW6 - Leases XLSX File Edit View Insert Format Data Tools Help Last edit was seconds ago 100% $ 0.00 123- Arial Narrow 11 BISA I-00 A D E F G H 1 j K M a PV, sum (14,044.6 Break-even rent Tax After-tax break even $3,635,85 $3,635,85 $3,635 85 $3,635,85 $3,635,85 $3,635.85 763.53 763.53 783 53 763.53 763.53 763 53 2,872.33 2.87233 2,87233 2872.33 2,872.33 2,872 33 Prevent value Cash flow PV, After-tax break even (2,371.67 645.80 52461 44393 407.27 350.06 (2,371.67 703.93 623.29 574.90 574.90 538.61 2.87233 2,635.16 2.41758 2.217.96 2.034.83 1,866.81 PV, sum 14,044.61 PV = C (1/1) - (17[rf1 + r)]))*(1 + r) PV X from 1/+r6 X 11 +1) X 1 9.0% is X 15.1% 1.09% } } X fu.16 6.63% 1.09% SCORECARD 2abc c D E F G H J K L M N PV = C*(1/1) - {1/[r(1 + r)t}}) * (1 + r) PV = x 114 08} * (1 + r) X fore { fan19 1 9.0% 1 15.1% X 1.09% X 6.63% } X 1.09% Break-even rent Tax X After-tax break even rent 4.49% 1.09% b After-tax lease payment (BIE rent) $2,872.33 $14,044.67 4.89% 4.49% X 1.09% C Pre-tax lease payment (B/E rent) $3,635.85 $2,872.33 79.00% 100% 21%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts