Question: Can someone help answer A-E for this please!? Looking to have the correct answers to review for an upcoming test As part of your job

Can someone help answer A-E for this please!? Looking to have the correct answers to review for an upcoming test

Can someone help answer A-E for this please!? Looking to have the correct answers to review for an upcoming test

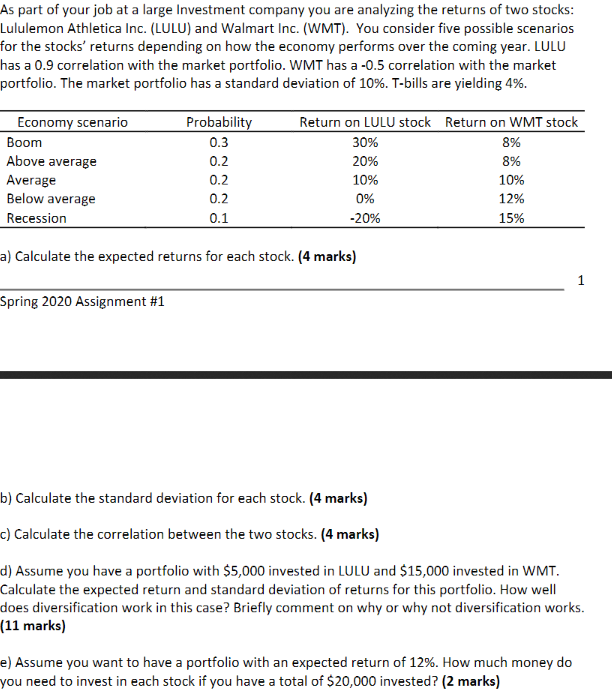

As part of your job at a large Investment company you are analyzing the returns of two stocks: Lululemon Athletica Inc. (LULU) and Walmart Inc. (WMT). You consider five possible scenarios for the stocks' returns depending on how the economy performs over the coming year. LULU has a 0.9 correlation with the market portfolio. WMT has a -0.5 correlation with the market portfolio. The market portfolio has a standard deviation of 10%. T-bills are yielding 4%. Probability 0.3 Economy scenario Boom Above average Average Below average Recession 0.2 Return on LULU stock Return on WMT stock 30% 8% 20% 8% 10% 10% 0% 12% -20% 15% 0.2 0.2 0.1 a) Calculate the expected returns for each stock. (4 marks) 1 Spring 2020 Assignment #1 b) Calculate the standard deviation for each stock. (4 marks) c) Calculate the correlation between the two stocks. (4 marks) d) Assume you have a portfolio with $5,000 invested in LULU and $15,000 invested in WMT. Calculate the expected return and standard deviation of returns for this portfolio. How well does diversification work in this case? Briefly comment on why or why not diversification works. (11 marks) e) Assume you want to have a portfolio with an expected return of 12%. How much money do you need to invest in each stock if you have a total of $20,000 invested? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts