Question: Can someone help explain this U.S. Dollar/Euro question ............. Chart is shown below............. U.S. Dollar/Euro. The table, a , indicates that a 1-year call option

Can someone help explain this U.S. Dollar/Euro question ............. Chart is shown below.............

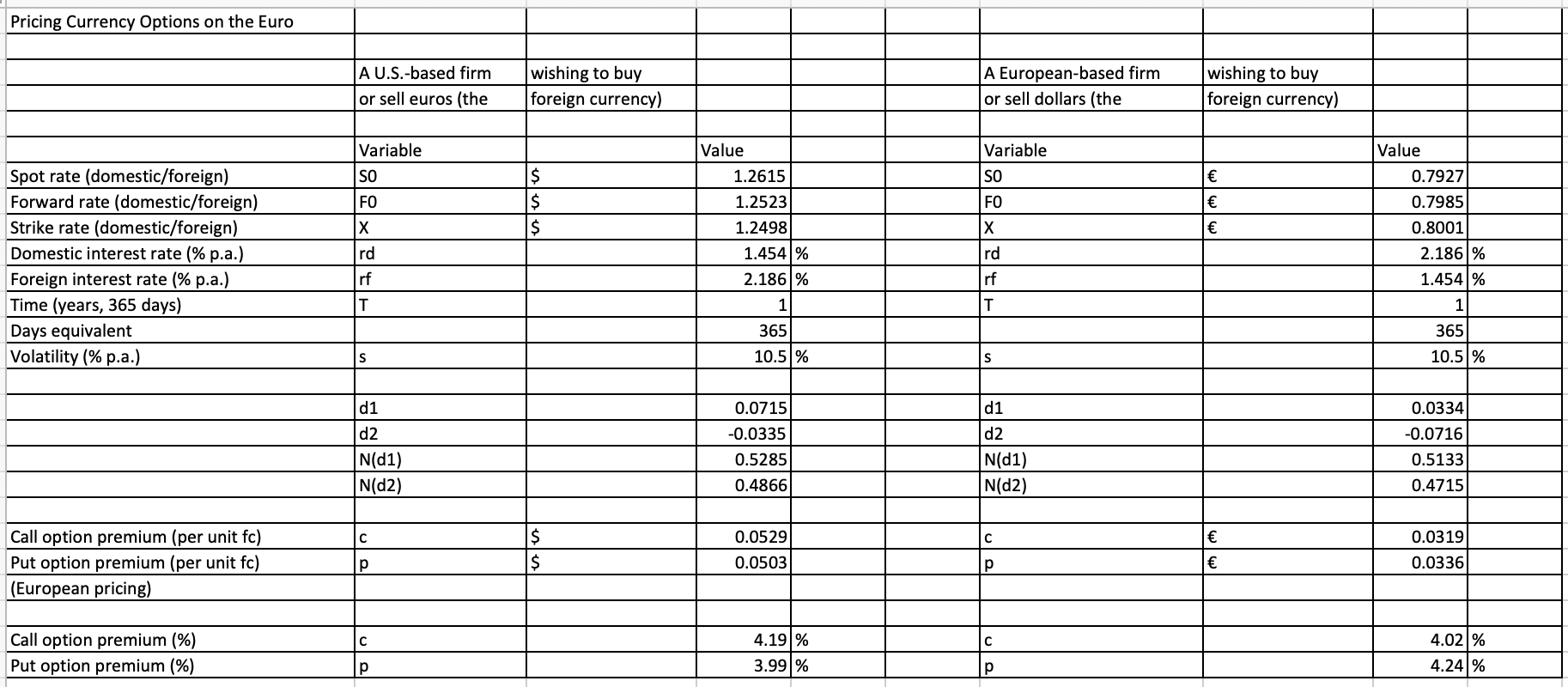

U.S. Dollar/Euro. The table, a , indicates that a 1-year call option on euros at a strike rate of $1 .2498 I (5 will cost the buyer $0.0529 / E, or 4.19%. But that assumed a volatility of 10.500% when the spot rate was $1 .2615/ . What would the same call option cost if the volatility was reduced to 10.500% when the spot rate fell to $12475 / ? The same call option cost if the volatility was reduced to 10.500% when the spot rate fell to $1 .2475/ would be $|:/. (Round to four decimal places.) Pricing Currency Options on the Euro A U.S.-based firm wishing to buy A European-based firm wishing to buy or sell euros (the foreign currency] or sell dollars (the foreign currency) Variable Variable Spot rate (domestic/foreign) . 50 Forward rate (domestic/foreign) Foreign interest rate (% p. a.) Time (years, 365 days) Days equivalent Volatility (96 p.a.) Call option premium (per unit fc) Put option premium (per unit fc) Call option premium l%) _ 4-19 % c Put option premium (96) 3.99 96 p 4.24 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts