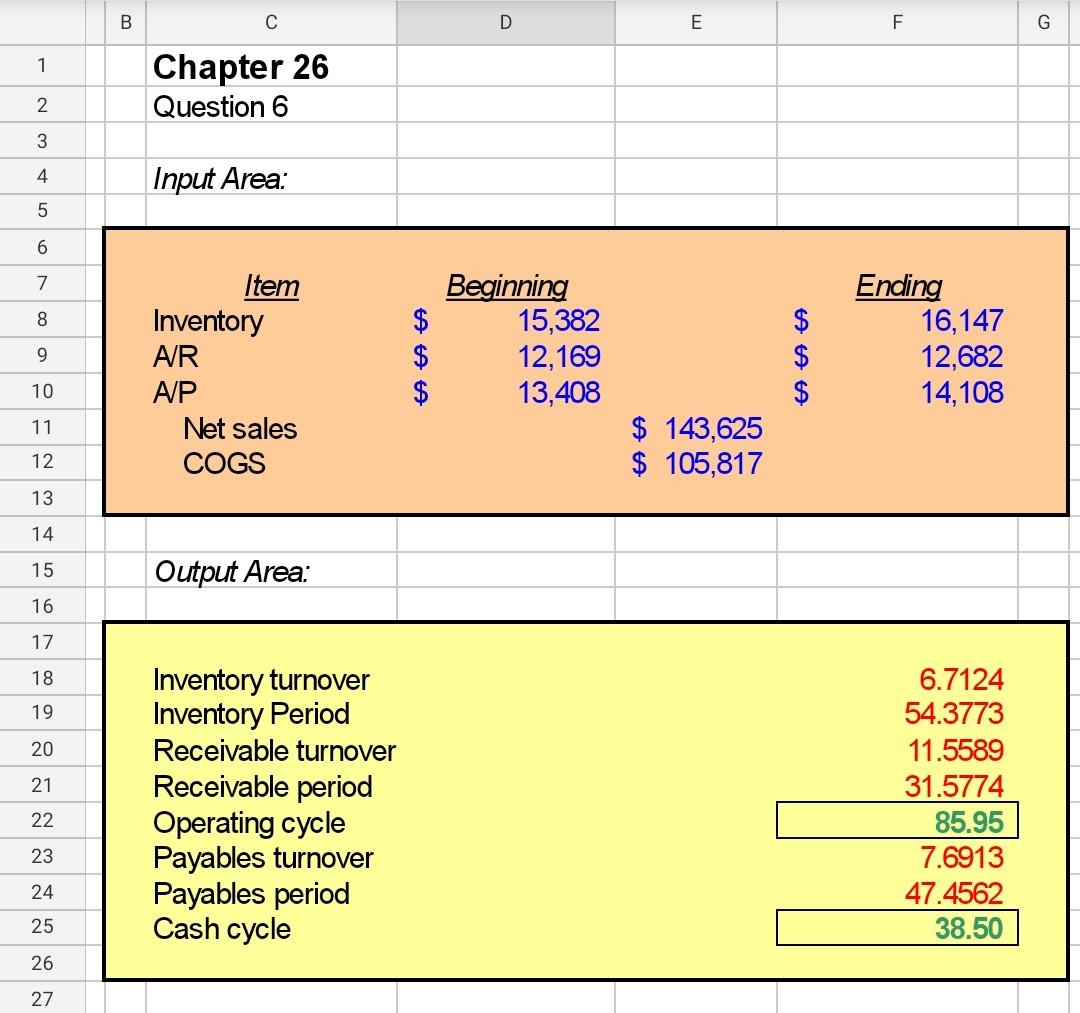

Question: can someone help finish this with formulas thanks B D E F G 1 Chapter 26 Question 6 4 von A WN Input Area: 8

can someone help finish this with formulas thanks

can someone help finish this with formulas thanks

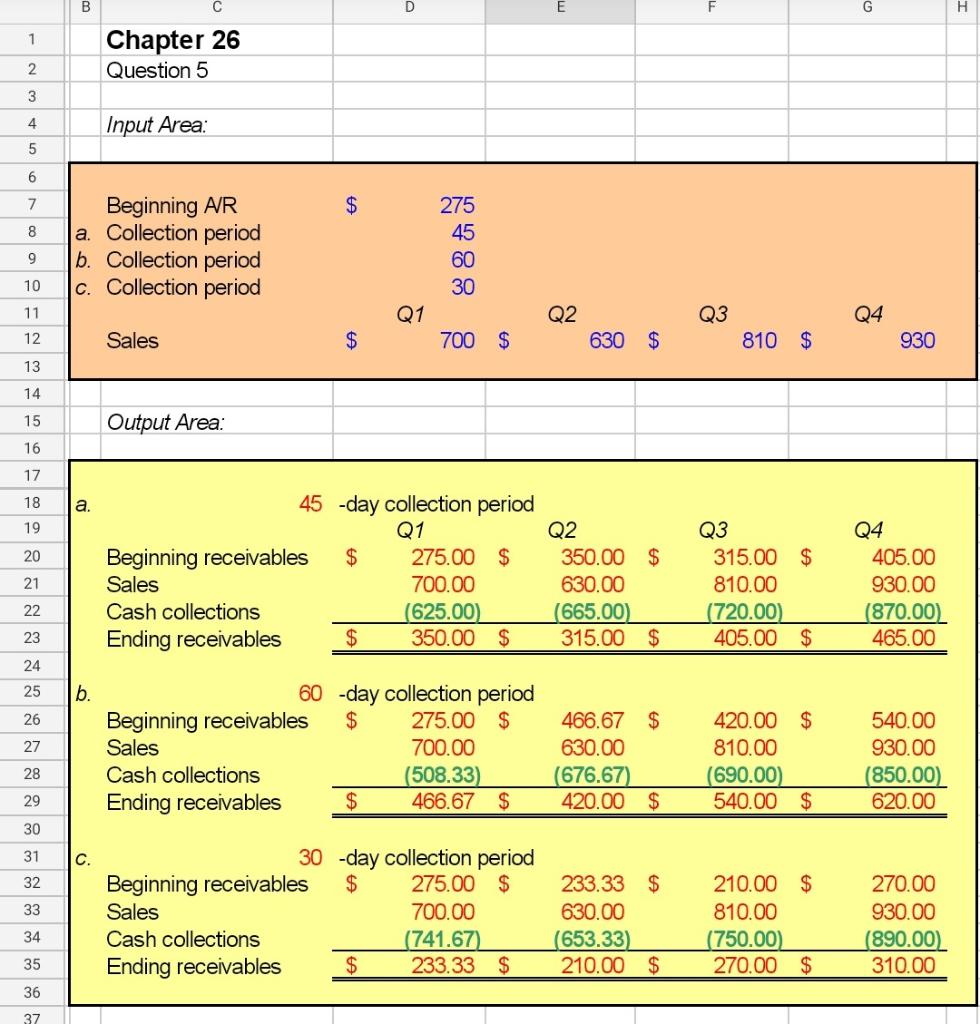

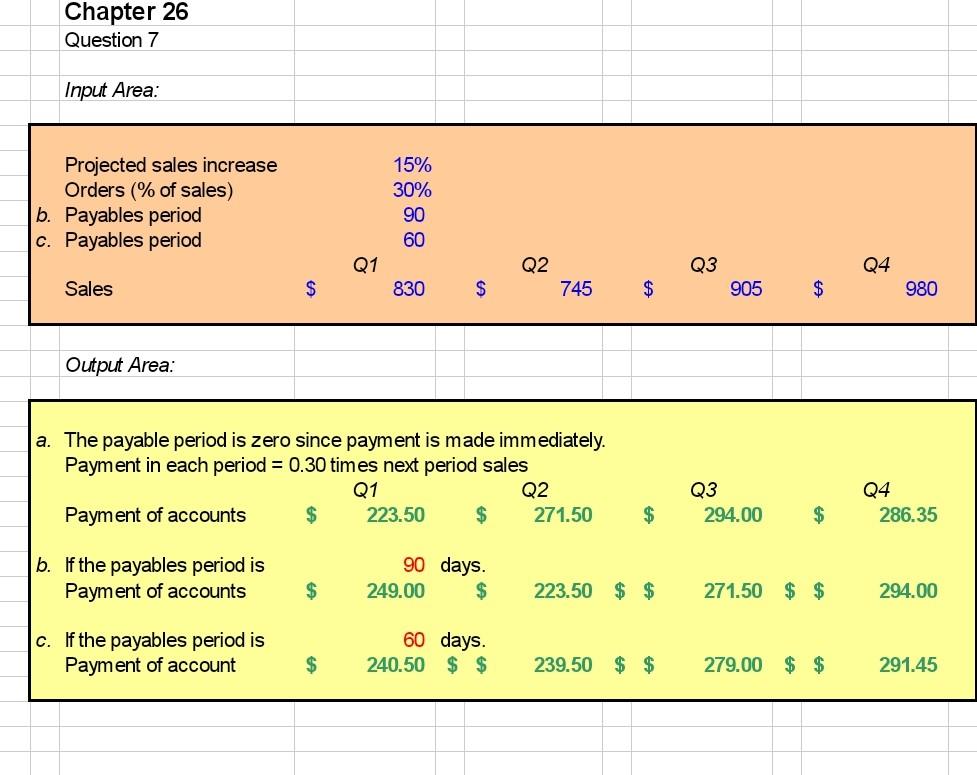

B D E F G 1 Chapter 26 Question 6 4 von A WN Input Area: 8 $ $ Item Inventory AR AVP Net sales COGS Beginning 15,382 12,169 13,408 9 Ending 16,147 12,682 14,108 A A A 10 11 $ 143,625 $ 105,817 12 13 14 15 Output Area: 16 17 18 19 20 21 Inventory turnover Inventory Period Receivable turnover Receivable period Operating cycle Payables turnover Payables period Cash cycle 6.7124 54.3773 11.5589 31.5774 85.95 7.6913 47.4562 38.50 22 23 24 25 26 27 B E G H 1 Chapter 26 Question 5 2. 3 4 Input Area: 5 6 7 $ 8 Beginning AJR a. Collection period b. Collection period C. Collection period 275 45 60 30 9 10 11 Q1 Q2 Q3 04 12 Sales $ 700 $ 630 $ 810 $ 930 13 14 15 Output Area: 16 17 18 a. 19 20 45 -day collection period Q1 Q2 Beginning receivables $ 275.00 $ 350.00 $ Sales 700.00 630.00 Cash collections (625.00) (665.00) Ending receivables $ 350.00 $ 315.00 $ 21 Q3 315.00 $ 810.00 (720.00) 405.00 $ Q4 405.00 930.00 (870.00) 465.00 22 23 24 25 b. 26 27 60 -day collection period Beginning receivables $ 275.00 $ Sales 700.00 Cash collections (508.33) Ending receivables $ 466.67 $ 466.67 $ 630.00 (676.67) 420.00 $ 420.00 $ 810.00 (690.00) 540.00 $ 540.00 930.00 (850.00) 620.00 28 29 30 31 C. 32 33 30 -day collection period Beginning receivables $ 275.00 $ Sales 700.00 Cash collections (741.67) Ending receivables $ 233.33 $ 233.33 $ 630.00 (653.33) 210.00 $ 210.00 $ 810.00 (750.00) 270.00 $ 270.00 930.00 (890.00) 310.00 34 35 36 37 Chapter 26 Question 7 Input Area: Projected sales increase Orders (% of sales) b. Payables period c. Payables period 15% 30% 90 60 Q1 Q2 Q4 Sales $ Q3 905 830 $ 745 $ $ 980 Output Area: a. The payable period is zero since payment is made immediately. Payment in each period = 0.30 times next period sales Q1 Q2 Payment of accounts $ 223.50 $ 271.50 Q3 294.00 Q4 286.35 $ $ b. If the payables period is Payment of accounts 90 days. 249.00 $ $ 223.50 $ $ 271.50 $ $ 294.00 c. If the payables period is Payment of account 60 days. 240.50 $ $ $ 239.50 $ $ 279.00 $ $ 291.45 1 Chapter 26 Keafer Manufacturing Working Capital Management 2 3 4 Input Area: 5 6 7 $ 8 9 10 11 12 13 14 A/R Percent uncollectible Collection period (ACP) % of purchases for next Q sales Suppliers paid (APP) % of sales for expenses Interest and dividends Outlay in third Q Beginning cash balance Target cash balance Borrowing rate Invested securities Beginning short-term borrowing ta ta ta ta 553,000 10% 57 Days 50% 53 Days 25% 148,000 260,000 149,500 90,000 1.2% Not needed for 0.5% computing Cash Budget 15 16 17 18 19 $ 20 21 Q1 Q2 761,000 $ Q3 817,000 $ 22 Last years' sales $ 735,000 $ 709,000 23 24 Growth rate in sales 8.00% 25 26 27 Output Area: 28 29 30 Sales next year Sales following year 31 32 33 Quarterly cash flow Q1 Q2 34 Q3 Q4 35 36 37 38 Collections from previous quarter Collections from current quarter sales Payments to suppliers for previous quarter Payments to suppliers for current quarter Expenses Dividends and interest Outlay Net cash flow 39 40 41 42 43 44 Cash Balance Q1 45 Q2 Q3 Q4 46 47 48 Beginning cash balance Net cash inflow Ending cash balance Minimum cash balance Cumulative surplus (deficit) 49 50 51 52 B D E F G 1 Chapter 26 Question 6 4 von A WN Input Area: 8 $ $ Item Inventory AR AVP Net sales COGS Beginning 15,382 12,169 13,408 9 Ending 16,147 12,682 14,108 A A A 10 11 $ 143,625 $ 105,817 12 13 14 15 Output Area: 16 17 18 19 20 21 Inventory turnover Inventory Period Receivable turnover Receivable period Operating cycle Payables turnover Payables period Cash cycle 6.7124 54.3773 11.5589 31.5774 85.95 7.6913 47.4562 38.50 22 23 24 25 26 27 B E G H 1 Chapter 26 Question 5 2. 3 4 Input Area: 5 6 7 $ 8 Beginning AJR a. Collection period b. Collection period C. Collection period 275 45 60 30 9 10 11 Q1 Q2 Q3 04 12 Sales $ 700 $ 630 $ 810 $ 930 13 14 15 Output Area: 16 17 18 a. 19 20 45 -day collection period Q1 Q2 Beginning receivables $ 275.00 $ 350.00 $ Sales 700.00 630.00 Cash collections (625.00) (665.00) Ending receivables $ 350.00 $ 315.00 $ 21 Q3 315.00 $ 810.00 (720.00) 405.00 $ Q4 405.00 930.00 (870.00) 465.00 22 23 24 25 b. 26 27 60 -day collection period Beginning receivables $ 275.00 $ Sales 700.00 Cash collections (508.33) Ending receivables $ 466.67 $ 466.67 $ 630.00 (676.67) 420.00 $ 420.00 $ 810.00 (690.00) 540.00 $ 540.00 930.00 (850.00) 620.00 28 29 30 31 C. 32 33 30 -day collection period Beginning receivables $ 275.00 $ Sales 700.00 Cash collections (741.67) Ending receivables $ 233.33 $ 233.33 $ 630.00 (653.33) 210.00 $ 210.00 $ 810.00 (750.00) 270.00 $ 270.00 930.00 (890.00) 310.00 34 35 36 37 Chapter 26 Question 7 Input Area: Projected sales increase Orders (% of sales) b. Payables period c. Payables period 15% 30% 90 60 Q1 Q2 Q4 Sales $ Q3 905 830 $ 745 $ $ 980 Output Area: a. The payable period is zero since payment is made immediately. Payment in each period = 0.30 times next period sales Q1 Q2 Payment of accounts $ 223.50 $ 271.50 Q3 294.00 Q4 286.35 $ $ b. If the payables period is Payment of accounts 90 days. 249.00 $ $ 223.50 $ $ 271.50 $ $ 294.00 c. If the payables period is Payment of account 60 days. 240.50 $ $ $ 239.50 $ $ 279.00 $ $ 291.45 1 Chapter 26 Keafer Manufacturing Working Capital Management 2 3 4 Input Area: 5 6 7 $ 8 9 10 11 12 13 14 A/R Percent uncollectible Collection period (ACP) % of purchases for next Q sales Suppliers paid (APP) % of sales for expenses Interest and dividends Outlay in third Q Beginning cash balance Target cash balance Borrowing rate Invested securities Beginning short-term borrowing ta ta ta ta 553,000 10% 57 Days 50% 53 Days 25% 148,000 260,000 149,500 90,000 1.2% Not needed for 0.5% computing Cash Budget 15 16 17 18 19 $ 20 21 Q1 Q2 761,000 $ Q3 817,000 $ 22 Last years' sales $ 735,000 $ 709,000 23 24 Growth rate in sales 8.00% 25 26 27 Output Area: 28 29 30 Sales next year Sales following year 31 32 33 Quarterly cash flow Q1 Q2 34 Q3 Q4 35 36 37 38 Collections from previous quarter Collections from current quarter sales Payments to suppliers for previous quarter Payments to suppliers for current quarter Expenses Dividends and interest Outlay Net cash flow 39 40 41 42 43 44 Cash Balance Q1 45 Q2 Q3 Q4 46 47 48 Beginning cash balance Net cash inflow Ending cash balance Minimum cash balance Cumulative surplus (deficit) 49 50 51 52

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts