Question: CAN SOMEONE HELP IN PART G PLEASE ? Project A and B of equal risk, are alternatives for expanding Rosa Company's capacity. The firm's cost

CAN SOMEONE HELP IN PART G PLEASE ?

CAN SOMEONE HELP IN PART G PLEASE ?

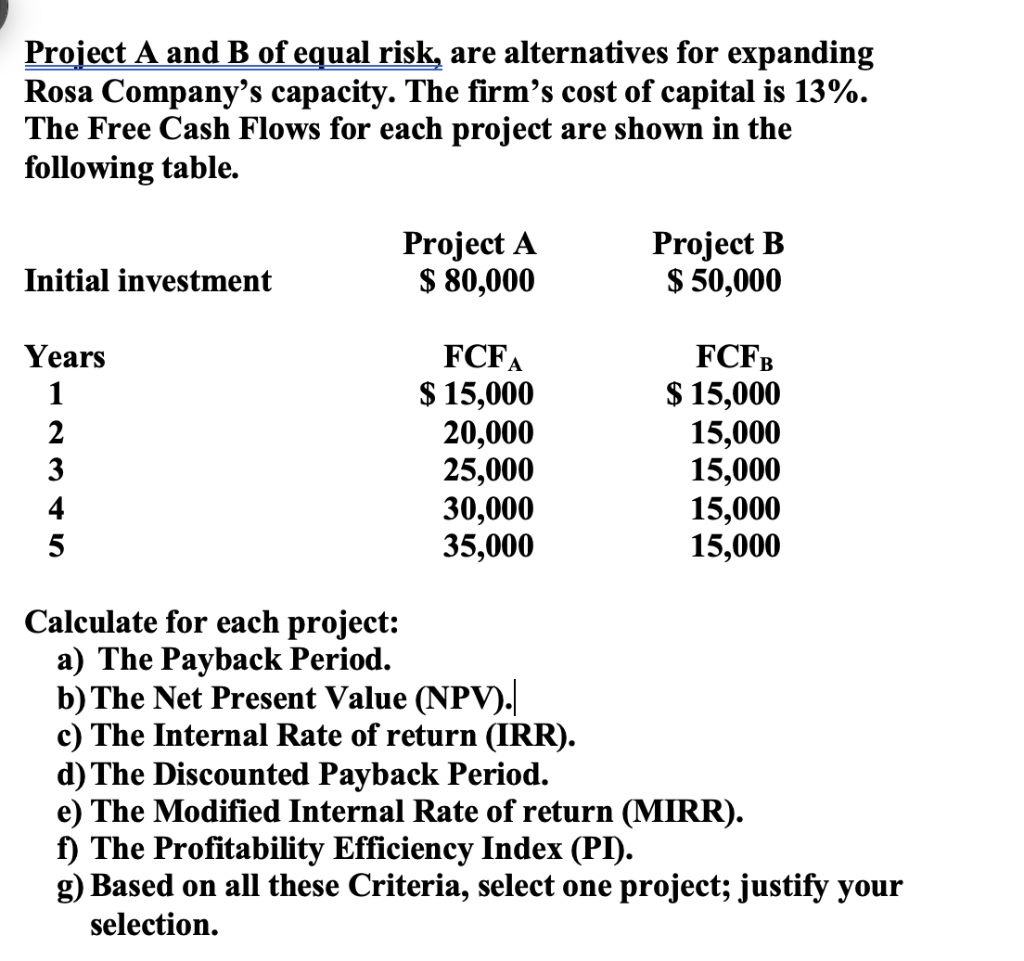

Project A and B of equal risk, are alternatives for expanding Rosa Company's capacity. The firm's cost of capital is 13%. The Free Cash Flows for each project are shown in the following table. Project A $ 80,000 Project B $ 50,000 Initial investment FCFA FCFB Years 1 2 3 4 5 $ 15,000 20,000 25,000 30,000 35,000 $ 15,000 15,000 15,000 15,000 15,000 Calculate for each project: a) The Payback Period. b) The Net Present Value (NPV). c) The Internal Rate of return (IRR). d) The Discounted Payback Period. e) The Modified Internal Rate of return (MIRR). f) The Profitability Efficiency Index (PI). g) Based on all these Criteria, select one project; justify your selection

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts