Question: Can someone help me answer the red x in the question below?I'd really appreciate it. Problem 19-37 (LO. 1, 3) Black Corporation and Tom each

Can someone help me answer the red x in the question below?I'd really appreciate it.

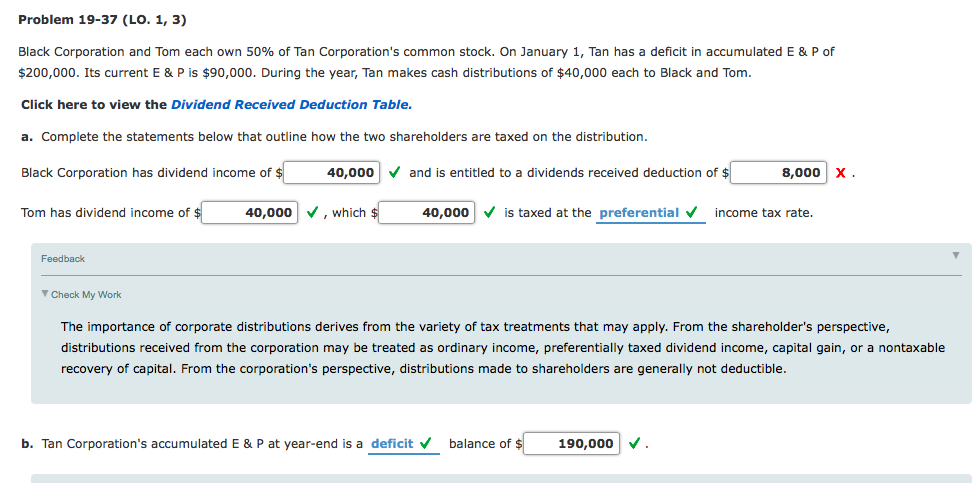

Problem 19-37 (LO. 1, 3) Black Corporation and Tom each own 50% of Tan Corporation's common stock. On January 1, Tan has a deficit in accumulated E & P of $200,000. Its current E & P is $90,000. During the year, Tan makes cash distributions of $40,000 each to Black and Tom Click here to view the Dividend Received Deduction Table. a. Complete the statements below that outline how the two shareholders are taxed on the distribution 8,000 X Black Corporation has dividend income of $ and is entitled to a dividends received deduction of $ 40,000 Tom has dividend income of $ 40,000 , which $ is taxed at the preferential 40,000 income tax rate. Feedback Check My Work The importance of corporate distributions derives from the variety of tax treatments that may apply. From the shareholder's perspective, distributions received from the corporation may be treated as ordinary income, preferentially taxed dividend income, capital gain, or a nontaxable recovery of capital. From the corporation's perspective, distributions made to shareholders are generally not deductible. b. Tan Corporation's accumulated E & P at year-end is a deficit balance of $ 190,000 Problem 19-37 (LO. 1, 3) Black Corporation and Tom each own 50% of Tan Corporation's common stock. On January 1, Tan has a deficit in accumulated E & P of $200,000. Its current E & P is $90,000. During the year, Tan makes cash distributions of $40,000 each to Black and Tom Click here to view the Dividend Received Deduction Table. a. Complete the statements below that outline how the two shareholders are taxed on the distribution 8,000 X Black Corporation has dividend income of $ and is entitled to a dividends received deduction of $ 40,000 Tom has dividend income of $ 40,000 , which $ is taxed at the preferential 40,000 income tax rate. Feedback Check My Work The importance of corporate distributions derives from the variety of tax treatments that may apply. From the shareholder's perspective, distributions received from the corporation may be treated as ordinary income, preferentially taxed dividend income, capital gain, or a nontaxable recovery of capital. From the corporation's perspective, distributions made to shareholders are generally not deductible. b. Tan Corporation's accumulated E & P at year-end is a deficit balance of $ 190,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts