Question: Can someone help me break down part A? very confused... Damon Corporation, a sports equipment manufacturer, has a machine currently in use that was originally

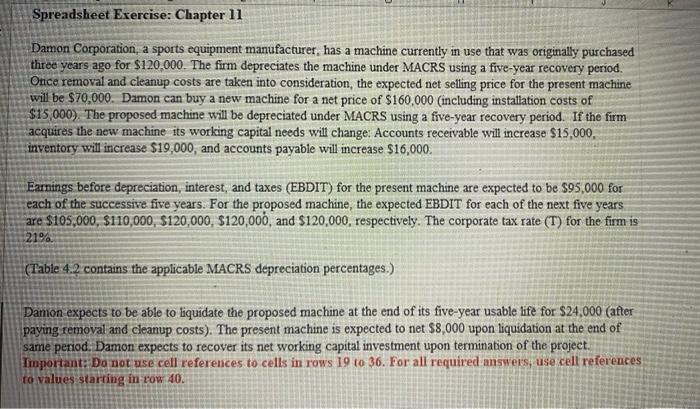

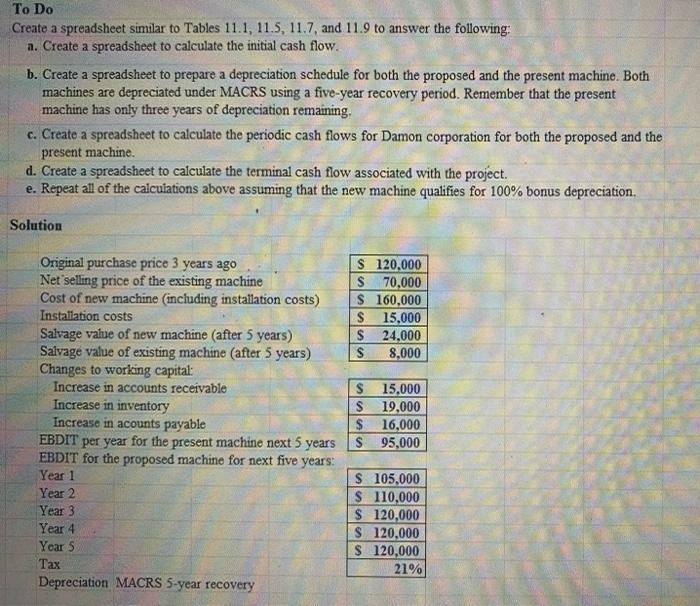

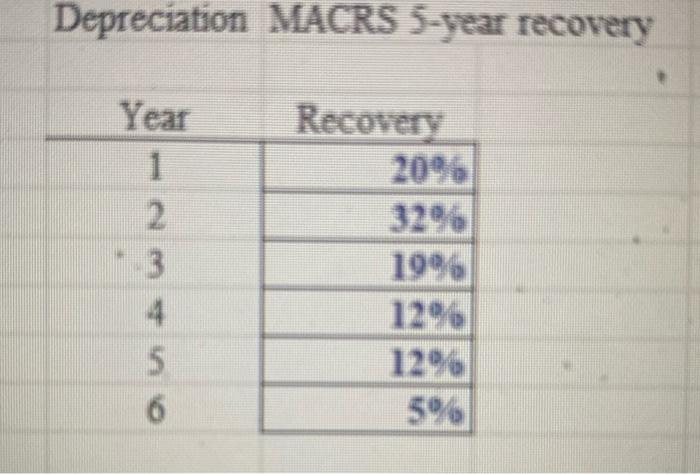

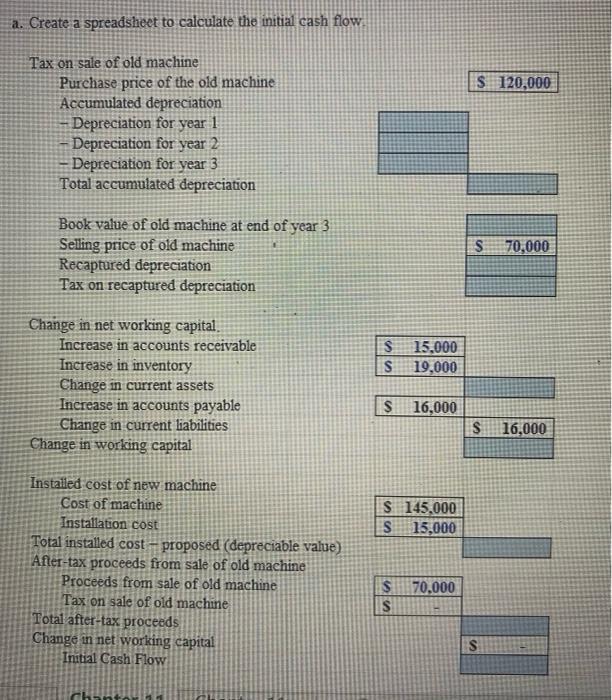

Damon Corporation, a sports equipment manufacturer, has a machine currently in use that was originally purchased three years ago for $120,000. The firm depreciates the machine under MACRS using a five-year recovery period. Orice removal and cleanup costs are taken into consideration, the expected net selling price for the present machine will be $70,000. Damon can buy a new machine for a net price of $160,000 (including installation costs of $15,000 ). The proposed machine will be depreciated under MACRS using a five-year recovery period. If the firm acquires the new machine its working capital needs will change: Accounts receivable will increase $15,000, inventory will increase $19,000, and accounts payable will increase $16,000. Earnings before depreciation, interest, and taxes (EBDIT) for the present machine are expected to be $95,000 for each of the successive five years. For the proposed machine, the expected EBDIT for each of the next five years are $105,000,$110,000,$120,000,$120,000, and $120,000, respectively. The corporate tax rate (T) for the firm is 21% (Table 4.2 contains the applicable MACRS depreciation percentages.) Damon expects to be able to liquidate the proposed machine at the end of its five-year usable life for $24,000 (after paying removal and cleanup costs). The present machine is expected to net $8,000 upon liquidation at the end of same period. Damon expects to recover its net working capital investment upon termination of the project. Important: Bo not use cell references. to cells in rows 19 to 36. For all required answers; use cell references to values starting in row 40. Create a spreadsheet similar to Tables 11.1,11.5,11.7, and 11.9 to answer the following: a. Create a spreadsheet to calculate the initial cash flow. b. Create a spreadsheet to prepare a depreciation schedule for both the proposed and the present machine. Both machines are depreciated under MACRS using a five-year recovery period. Remember that the present machine has only three years of depreciation remaining. c. Create a spreadsheet to calculate the periodic cash flows for Damon corporation for both the proposed and the present machine. d. Create a spreadsheet to calculate the terminal cash flow associated with the project. e. Repeat all of the calculations above assuming that the new machine qualifies for 100% bonus depreciation. Depreciation MACRS 5-year recovery a. Create a spreadsheet to calculate the initial cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts