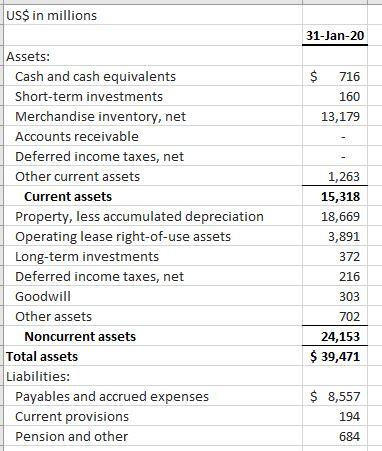

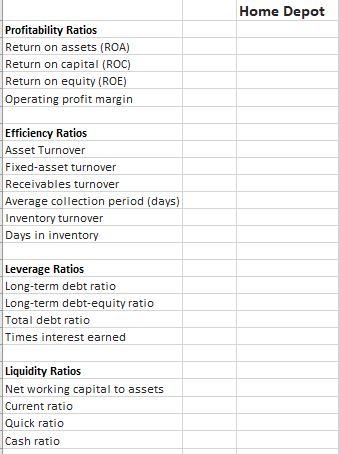

Question: Can someone help me create a ratio table using the 2019 Lowes income statement and balance sheet? They are attached. I have also included what

Can someone help me create a ratio table using the 2019 Lowes income statement and balance sheet? They are attached. I have also included what I need to fill out.

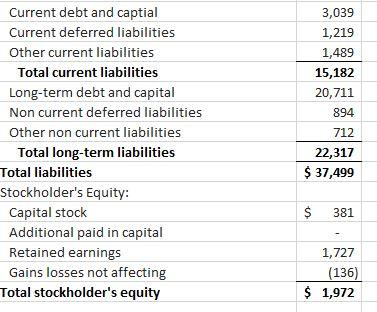

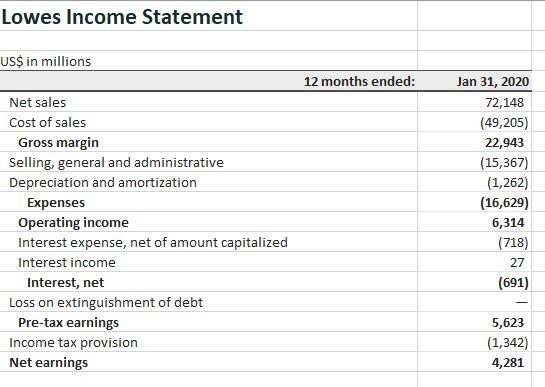

US$ in millions 31-Jan-20 $ 716 160 13,179 Assets: Cash and cash equivalents Short-term investments Merchandise inventory, net Accounts receivable Deferred income taxes, net Other current assets Current assets Property, less accumulated depreciation Operating lease right-of-use assets Long-term investments Deferred income taxes, net Goodwill Other assets Noncurrent assets Total assets Liabilities: Payables and accrued expenses Current provisions Pension and other 1,263 15,318 18,669 3,891 372 216 303 702 24,153 $ 39,471 $ 8,557 194 684 3,039 1,219 1,489 15,182 20,711 894 Current debt and captial Current deferred liabilities Other current liabilities Total current liabilities Long-term debt and capital Non current deferred liabilities Other non current liabilities Total long-term liabilities Total liabilities Stockholder's Equity: Capital stock Additional paid in capital Retained earnings Gains losses not affecting Total stockholder's equity 712 22,317 $ 37,499 $ $ 381 1,727 (136) $ 1,972 Lowes Income Statement US$ in millions 12 months ended: Net sales Cost of sales Gross margin Selling, general and administrative Depreciation and amortization Expenses Operating income Interest expense, net of amount capitalized Interest income Interest, net Loss on extinguishment of debt Pre-tax earnings Income tax provision Net earnings Jan 31, 2020 72,148 (49,205) 22,943 (15,367) (1,262) (16,629) 6,314 (718) 27 (691) 5,623 (1,342) 4,281 Home Depot Profitability Ratios Return on assets (ROA) Return on capital (ROC) Return on equity (ROE) Operating profit margin Efficiency Ratios Asset Turnover Fixed-asset turnover Receivables turnover Average collection period (days) Inventory turnover Days in inventory Leverage Ratios Long-term debt ratio Long-term debt-equity ratio Total debt ratio Times interest earned Liquidity Ratios Net working capital to assets Current ratio Quick ratio Cash ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts