Question: Can someone help me? Estimating Future Retirement Needs Afex and Jesse know that you are completing a personal finance course and that you understand how

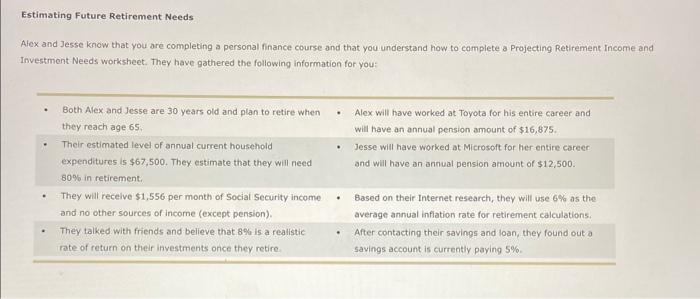

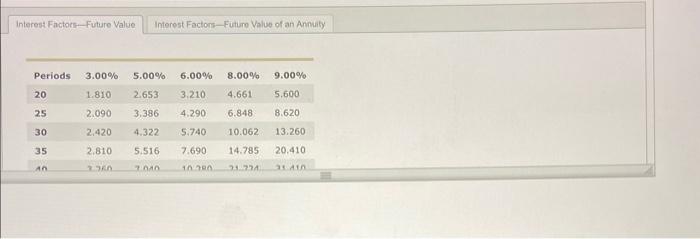

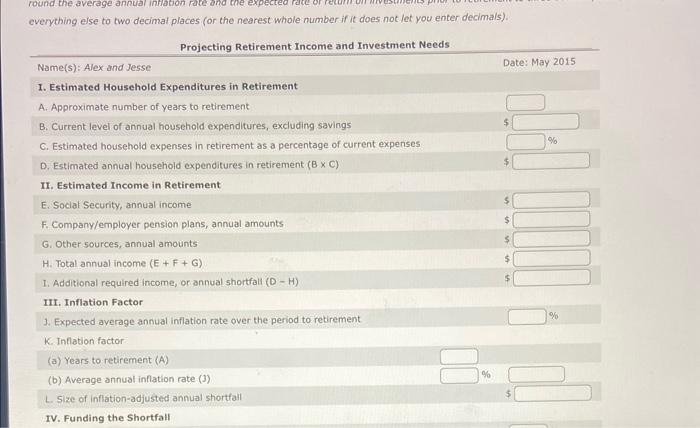

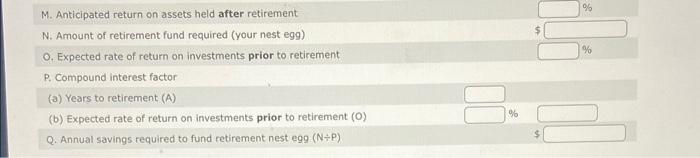

Estimating Future Retirement Needs Afex and Jesse know that you are completing a personal finance course and that you understand how to complete a Projecting Retirement Income and Investment Needs worksheet. They have gathered the following information for you: Interest Factoci-. Future Value Interest Factors-Futuro Value of an Anmity \begin{tabular}{llllll} \hline Periods & 3.00% & 5.00% & 6.00% & 8.00% & 9.00% \\ 20 & 1.810 & 2.653 & 3.210 & 4.661 & 5.600 \\ 25 & 2.090 & 3.386 & 4.290 & 6.848 & 8.620 \\ 30 & 2.420 & 4.322 & 5.740 & 10.062 & 13.260 \\ 35 & 2.810 & 5.516 & 7.690 & 14.785 & 20.410 \\ An & 2.7kn & 7.040 & 10.720 & 7.724 & 32.110 \end{tabular} everything else to two decimal places (or the nearest whole number if it does not let you enter decimals). M. Anticipated return on assets held after retirement % N. Amount of retirement fund required (your nest egg) O. Expected rate of return on investments prior to retirement % P. Compound interest factor (a) Years to retirement (A) (b) Expected rate of return on investments prior to retirement (O) % Q. Annual savings required to fund retirement nest egg (NP) Estimating Future Retirement Needs Afex and Jesse know that you are completing a personal finance course and that you understand how to complete a Projecting Retirement Income and Investment Needs worksheet. They have gathered the following information for you: Interest Factoci-. Future Value Interest Factors-Futuro Value of an Anmity \begin{tabular}{llllll} \hline Periods & 3.00% & 5.00% & 6.00% & 8.00% & 9.00% \\ 20 & 1.810 & 2.653 & 3.210 & 4.661 & 5.600 \\ 25 & 2.090 & 3.386 & 4.290 & 6.848 & 8.620 \\ 30 & 2.420 & 4.322 & 5.740 & 10.062 & 13.260 \\ 35 & 2.810 & 5.516 & 7.690 & 14.785 & 20.410 \\ An & 2.7kn & 7.040 & 10.720 & 7.724 & 32.110 \end{tabular} everything else to two decimal places (or the nearest whole number if it does not let you enter decimals). M. Anticipated return on assets held after retirement % N. Amount of retirement fund required (your nest egg) O. Expected rate of return on investments prior to retirement % P. Compound interest factor (a) Years to retirement (A) (b) Expected rate of return on investments prior to retirement (O) % Q. Annual savings required to fund retirement nest egg (NP)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts