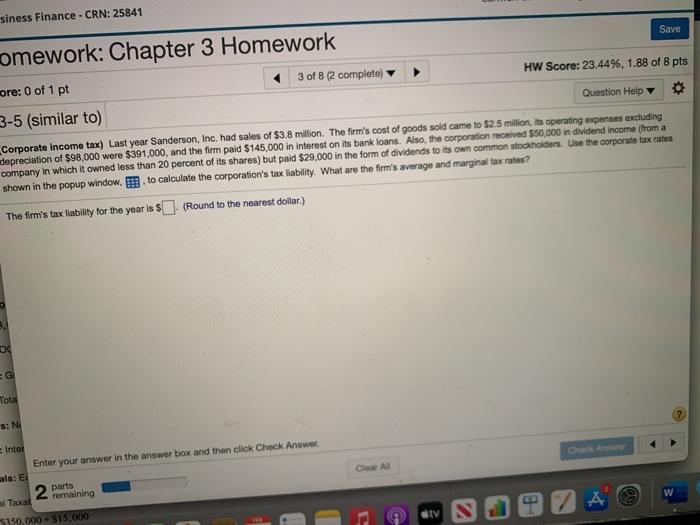

Question: siness Finance - CRN: 25841 Save omework: Chapter 3 Homework ore: 0 of 1 pt 3 of 8 (2 complete) HW Score: 23.44%, 1.88 of

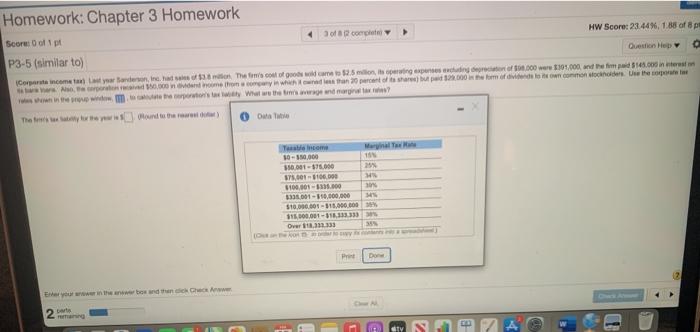

siness Finance - CRN: 25841 Save omework: Chapter 3 Homework ore: 0 of 1 pt 3 of 8 (2 complete) HW Score: 23.44%, 1.88 of 8 pts 3-5 (similar to) Question Help Corporate income tax) Last year Sanderson, Inc. had sales of $3.8 million. The firm's cost of goods sold came to $2.5 million, its operating expenses excluding depreciation of $98,000 were $391,000, and the firm paid $145,000 in interest on its bank loans. Also, the corporation received $50,000 in dividend income from a company in which it owned less than 20 percent of its shares) but paid $29,000 in the form of dividends to its own common stockholders Use the corporate tax rates shown in the popup window, to calculate the corporation's tax liability. What are the firm's average and marginal tax rates? The firm's tax liability for the year is s (Round to the nearest dollar.) Tote 3: N Clear Intet Enter your answer in the answer box and then click Check Answer als: Ei parts remaining w Taxat av A 550.000 - 515.000 Homework: Chapter 3 Homework HW Score: 23.44%, 1.88 of 8p 38 corte Score oft Question Ho P3-5 (similar to) Corporate income tayar Baderon. The cost of good at 25 min, its wing expuses were were 101.000 and the time. In terms e. memory in what percent of 128000 form of division conmochodes Uw how The wound to be rewrite) Out som 30-350.000 0001-75.000 57,001 - 1100.000 100001-5335.000 3331001 - 350.000.000 $10.000.00-118.000.000 115.000.001-31,10333 Over 1.133333 30 Pr Dom 2 S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts