Question: Can someone help me for solving this problem? Thank you so much. X Retirement funds data Type Risk Star Rating 3YrReturn% Growth High Three 62.89

Can someone help me for solving this problem? Thank you so much.

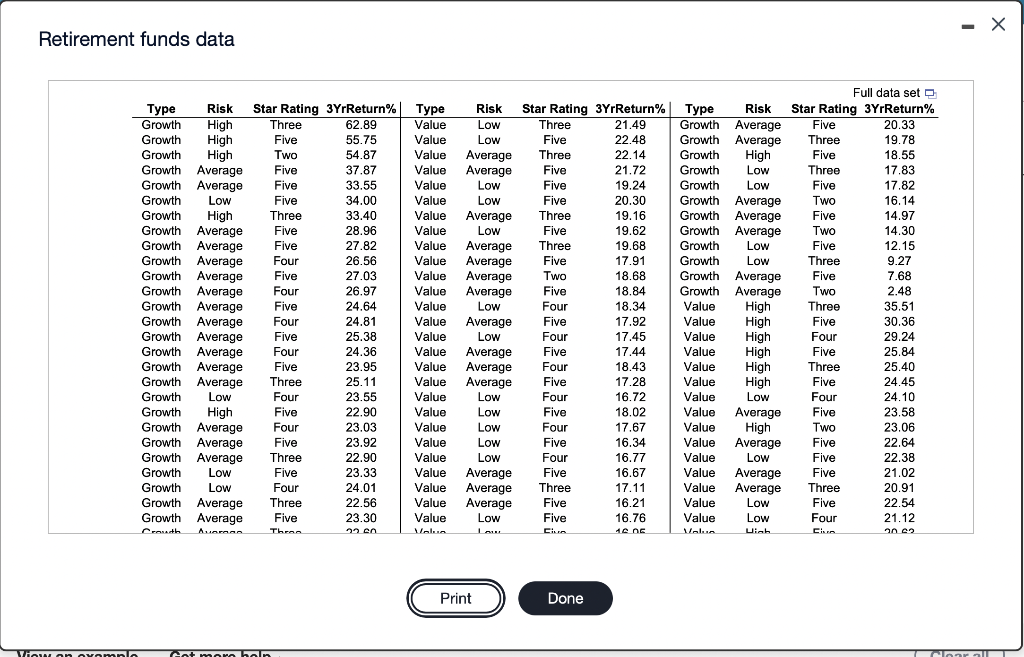

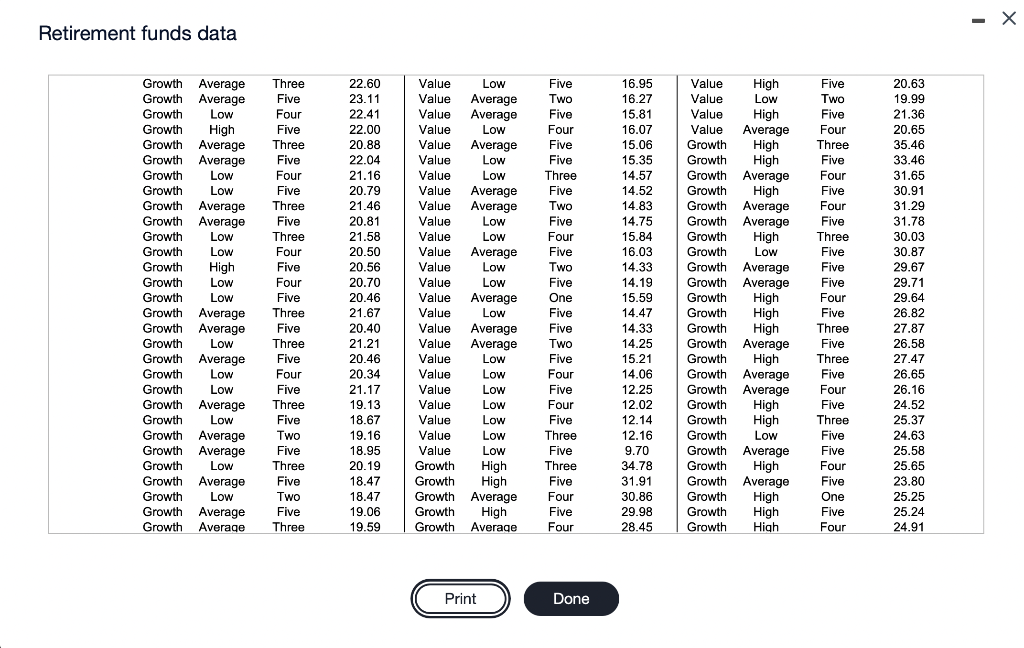

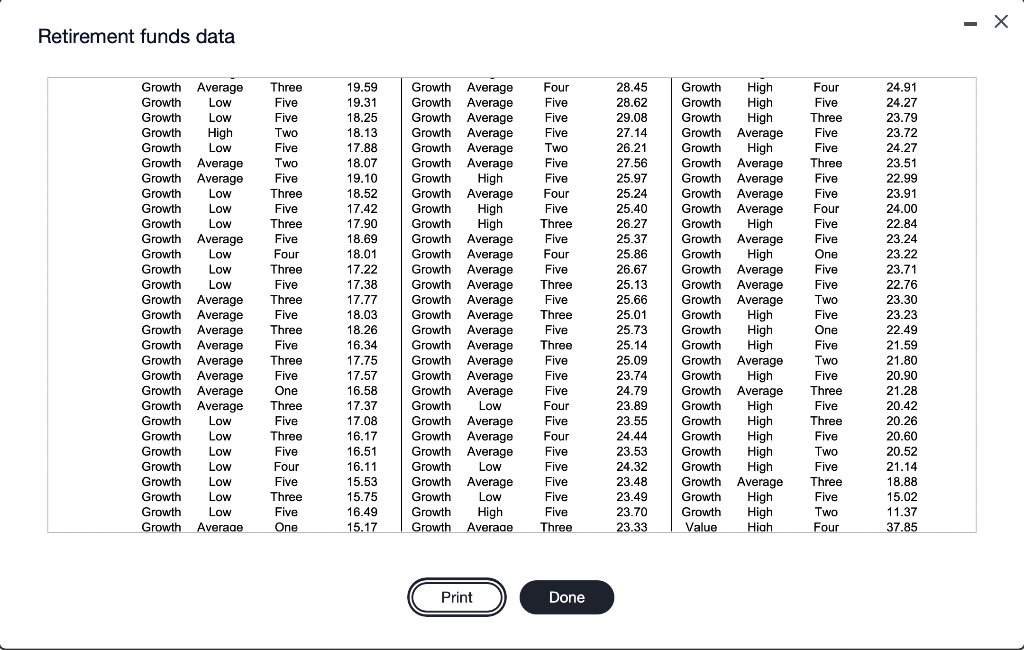

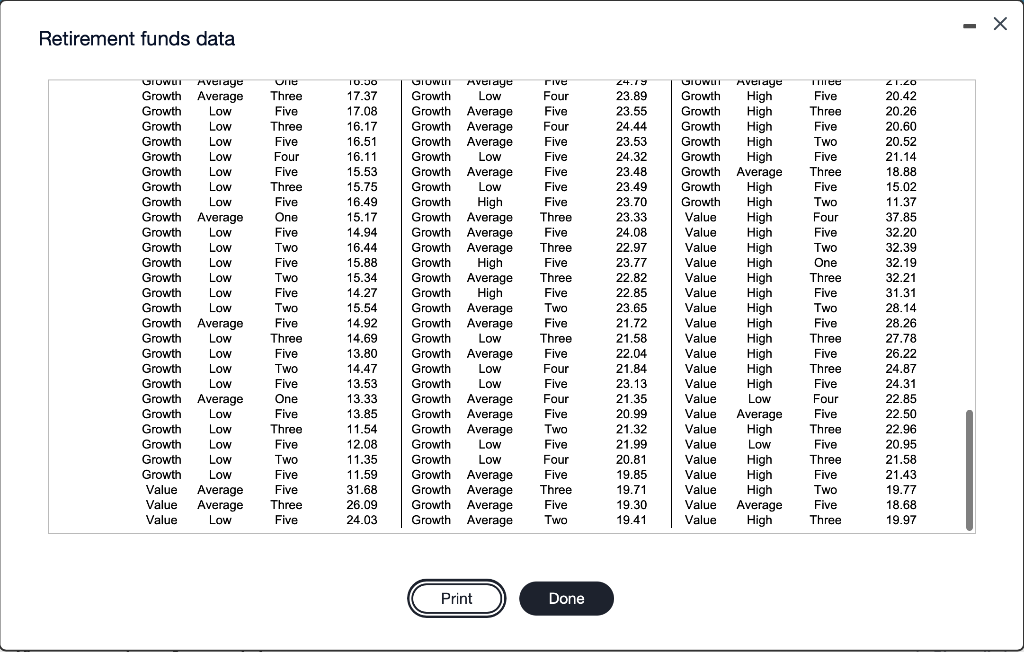

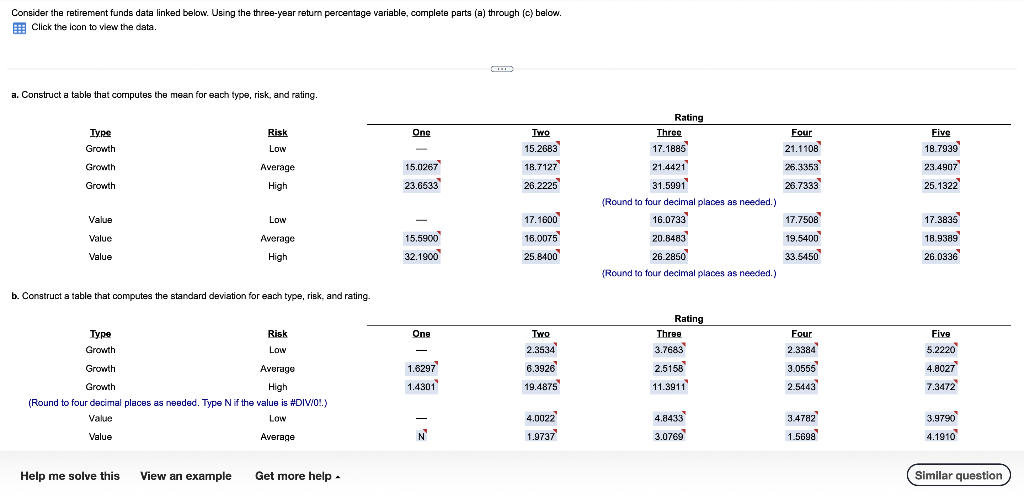

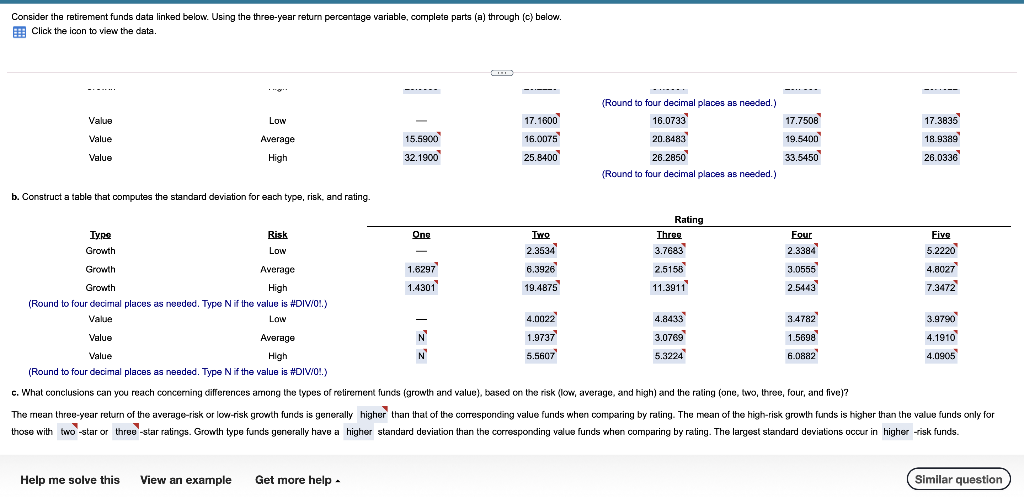

X Retirement funds data Type Risk Star Rating 3YrReturn% Growth High Three 62.89 Growth High Five 55.75 Growth High Two 54.87 Growth Average Five 37.87 Growth Average Five 33.55 Growth Low Five 34.00 Growth High Three 33.40 Growth Average Five 28.96 Growth Average Five 27.82 Growth Average Four 26.56 Growth Average Five 27.03 Growth Average Four 26.97 Growth Average Five 24.64 Growth Average Four 24.81 Growth Average Five 25.38 Growth Average Four 24.36 Growth Average Five 23.95 Growth Average Three 25.11 Growth Low Four 23.55 Growth High Five 22.90 Growth Average Four 23.03 Growth Average Five 23.92 Growth Average Three 22.90 Growth Low Five 23.33 Growth Low Four 24.01 Growth Average Three 22.56 Growth Average Five 23.30 Cruth AUSAS 22 Type Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Risk Low Low Average Average Low Low Average Low Average Average Average Average Low Average Low Average Average Average Low Low Low Low Low Average Average Average Low Star Rating 3YrReturn% Three 21.49 Five 22.48 Three 22.14 Five 21.72 Five 19.24 Five 20.30 Three 19.16 Five 19.62 Three 19.68 Five 17.91 Two 18.68 Five 18.84 Four 18.34 Five 17.92 Four 17.45 Five 17.44 Four 18.43 Five 17.28 Four 16.72 Five 18.02 Four 17.67 Five 16.34 Four 16.77 Five 16.67 Three 17.11 Five 16.21 Five 16.76 Cins 10 na Type Risk Growth Average Growth Average Growth High Growth Low Growth Low Growth Average Growth Average Growth Average Growth Low Growth Low Growth Average Growth Average Value High Value High Value High Value High Value High Value High Value Low Value Average Value High Value Average Value Low Value Average Value Average Value Low Value Low Uich Full data set Star Rating 3YrReturn% Five 20.33 Three 19.78 Five 18.55 Three 17.83 Five 17.82 Two 16.14 Five 14.97 Two 14.30 Five 12.15 Three 9.27 Five 7.68 Two 2.48 Three 35.51 Five 30.36 Four 29.24 Five 25.84 Three 25.40 Five 24.45 Four 24.10 Five 23.58 Two 23.06 Five 22.64 Five 22.38 Five 21.02 Three 20.91 Five 22.54 Four 21.12 Cina 20. Thrad Print Done Woman oyamnla Got mom hain DITT - X - Retirement funds data Five Two Five Four Five Five Five Two Five Four Three Five Four Five Four Five Three Five Five Five Growth Average Growth Average Growth Low Growth High Growth Average Growth Average Growth Low Growth Low Growth Average Growth Average Growth Low Growth Low Growth High Growth Low Growth Low Growth Average Growth Average Growth Low Growth Average Growth Low Growth Low Growth Average Growth Low Growth Average Growth Average Growth Low Growth Average Growth Low Growth Average Growth Average Three Five Four Five Three Five Four Five Three Five Three " Four Five Four Five Three Five Three Five Four Five Three Five Two Five Three Five Two Five Three 22.60 23.11 22.41 22.00 20.88 22.04 21.16 20.79 21.46 20.81 21.58 20.50 20.56 20.70 20.46 21.67 20.40 21.21 20.46 20.34 21.17 19.13 18.67 19.16 18.95 20.19 18.47 18.47 19.06 19.59 Four Value Low Value Average Value Average Value Low Value Average Value Low Value Low Value Average Value Average Value Low Value Low Value Average Value Low Value Low Low Value Average Value Low Value Average Value Average Value Low Value Low Value Low Value Low Value Low Value Low Value Low Growth High Growth High Growth Average Growth High Growth Average 16.95 16.27 15.81 16.07 15.06 15.35 14.57 14.52 14.83 14.75 15.84 16.03 14.33 14.19 15.59 14.47 14.33 14.25 15.21 14.06 12.25 12.02 12.14 12.16 9.70 34.78 31.91 30.86 29.98 28.45 Value High Value Low Value High Value Average Growth High Growth High Growth Average Growth High Growth Average Growth Average Growth High down Growth Low Growth Average Growth Average Growth High Growth High Growth High Growth Average Growth High Growth Average Growth Average Growth High Growth High Growth Low Growth Average Growth High Growth Average Growth High Growth High Growth High Three Five Two Five Four Five Two Five One Five Five Two Five Four Five Four Five Three Five Three Five Four Five Four 20.63 19.99 21.36 20.65 35.46 33.46 31.65 30.91 31.29 31.78 30.03 30.87 29.67 29.71 29.64 26.82 27.87 26.58 27.47 26.65 26.16 24.52 25.37 24.63 25.58 25.65 23.80 25.25 25.24 24.91 Five Three Five Three Five Four Five Three Five Five Four Five One Five Four Print Done - X Retirement funds data Growth Average Growth Low Growth Low Growth High Growth Low Growth Average Growth Average Growth Low Growth Low Growth Low Growth Average Growth Low Growth Low Growth Low Growth Average Growth Average Growth Average Growth Average Growth Average Growth Average Growth Average Growth Average Growth Low Growth Low Growth Low Growth Low Growth Low Growth Low Growth Low Growth Average High Three Five Five Two Five Two Five Three Five Three Five Four Three Five Three Five Three Five Three Five One Three Five Three Five Four Five Three Five One 19.59 19.31 18.25 18.13 17.88 18.07 19.10 18.52 17.42 17.90 18.69 18.01 17.22 17.38 17.77 18.03 Growth Average Growth Average Growth Average Growth Average Growth Average Growth Average Growth High Growth Average Growth High Growth High Growth Average Growth Average Growth Average Growth Average Growth Average Growth Average Growth Average Growth Average Growth Average Growth Average Growth Average Growth Low Growth Average Growth Average Growth Average Growth Low Growth Average Growth Low Growth High Growth Average Four Five Five Five Two Five Five Four Five Three Five Four Five Three Five Three Five Three Five Five Five Four Five Four Five Five Five Five Five Three 28.45 28.62 29.08 27.14 26.21 27.56 25.97 25.24 25.40 26.27 25.37 25.86 26.67 25.13 25.66 25.01 25.73 25.14 25.09 23.74 24.79 23.89 23.55 24.44 23.53 24.32 23.48 23.49 23.70 23.33 Growth High Growth High Growth High Growth Average Growth High Growth Average Growth Average Growth Average Growth Average Growth Growth Average Growth High Growth Average Growth Average Growth Average Growth High Growth High Growth High Growth Average Growth High Growth Average Growth High Growth High Growth High Growth High Growth High Growth Average Growth High Growth High Value Hiah Four Five Three Five Five Three Five Five Four Five Five One Five Five TWO Five One Five Two Five Three Five Three Five Two Five Three Five Two Four 24.91 24.27 23.79 23.72 24.27 23.51 22.99 23.91 24.00 22.84 23.24 23.22 23.71 22.76 23.30 23.23 22.49 21.59 21.80 20.90 21.28 20.42 20.26 20.60 20.52 21.14 18.88 15.02 11.37 37.85 18.26 16.34 17.75 17.57 16.58 17.37 17.08 16.17 16.51 16.11 15.53 15.75 16.49 15.17 Print Done Retirement funds data Une Three Tree Five Three Five Two Five Three Five Two Four UIUWUN Average Growth Average Growth Low Growth Low Growth Low Growth Low Growth Low Growth Low Growth Low Growth Average Growth Low Growth Low Growth Low Growth Low Growth Low Growth Low Growth Average Growth Low Growth Low Growth Low Growth Low Growth Average Growth Low Growth Low Growth Low Growth Low Growth Low Value Average Value Average Value Low Five Three Five Four Five Three Five One Five Two Five Two Five Two Five Three Five Two Five One Five Three Five TWO Five Five Three Five 10.30 17.37 17.08 16.17 16.51 16.11 15.53 15.75 16.49 15.17 14.94 16.44 15.88 15.34 14.27 15.54 14.92 14.69 13.80 14.47 13.53 13.33 13.85 11.54 12.08 11.35 11.59 31.68 26.09 24.03 UIUWLT Average Growth Low Growth Average Growth Average Growth Average Growth Low Growth Average Growth Low Growth High Growth Average Growth Average Growth Average Growth High Growth Average Growth High Growth Average Growth Average Growth Low Growth Average Growth Low Growth Low Growth Average Growth Average Growth Average Growth Low Growth Low Growth Average Growth Average Growth Average Growth Average rive Four Five Four Five Five Five Five Five Three Five Three Five Three Five Two Five Three Five Four Five Four Five Two Five Four Five Three Five Two 24.79 23.89 23.55 24.44 23.53 24.32 23.48 23.49 23.70 23.33 24.08 22.97 23.77 22.82 22.85 23.65 21.72 21.58 22.04 21.84 23.13 21.35 20.99 21.32 21.99 20.81 19.85 19.71 19.30 19.41 UIUWLIT Average Growth High Growth High Growth High Growth High Growth High Growth Average Growth High Growth High Value High Value High Value High Value High Value High Value High Value High Value High Value High Value High Value High Value High Value Low Value Average Value High Value Low Value High Value High Value High Value Average Value High Five Two One Three Five Two Five Three Five Three Five Four Five Three Five Three Five Two Five Three 21.20 20.42 20.26 20.60 20.52 21.14 18.88 15.02 11.37 37.85 32.20 32.39 32.19 32.21 31.31 28.14 28.26 27.78 26.22 24.87 24.31 22.85 22.50 22.96 20.95 21.58 21.43 19.77 18.68 19.97 Print Done Consider the retirement funds data linked below. Using the three-year return percentage variable, complete parts (a) through (c) below. Click the icon to view the data. a. Construct a table that computes the mean for each type, risk, and rating. Risk One Type Growth Low Two 15.2683 18.7127 Four 21.1108 26.3353 26.7333 Five 18.7939 23.4907 25. 1322 Growth 15.0267 23.6533 Average Growth High 26.2225 Rating Three 17.1886 21.4421 31.5991 (Round to four decimal places as needed.) 16.0733 20.8483 26.2850 {Round to four decimal places as needed.) Value Low Value 17.3835 18.9389 Average 17.1600 16.0075 25.8400 15,5900 17.7508 19.5400 33.5450 Value High 32.1900 26.0336 b. Construct a table that computes the standard deviation for each type, risk, and rating. Risk One Four Type Growth Rating Three 3.7683 2.5158 Low 2.3384 TWO 2.3534 6.3926 19.4875 1.8297 1.4301 Five 5.2220 4.8027 7.3472 3.0555 11.3911 2.5443" Growth Average Growth High (Round to four decimal places as needed. Type N if the value is #DIV/0!) Value Low Value Average 4.0022 1.9737 4.8433 3.0769 3.4782 1.5698 3.9790 4.1910 N Help me solve this View an example Get more help Similar question Consider the retirement funds data linked below. Using the three-year return percentage variable, complete parts (a) through (c) below. Click the icon to view the data. - --- ------ Value Low Average Value 15.5900 32.1900 17.1600 16.0075 25.8400 (Round to four decimal places as needed.) 16.0733 20.8483 26.2850 {Round to four decimal places as needed.) 17.7506 19.5400 33.5450 17.3835 18.9389 26.0336 Value High b. Construct a table that computes the standard deviation for each type, risk, and rating. One Rating Thren 3.7683 Four 2.3384 Two 2.3534 6.3926 19.4875 Five 5.2220 4.8027 7.3472 2.5158 1.6297 1.43019 3.0555 2.5443 11.3911 Risk Growth Low Growth Average Growth High (Round to four decimal places as needed. Type N if the value is #DIV/0!) Value Low Value Average Value High (Round to four decimal places as needed. Type N if the value is #DIV/0!) 4.0022 1.9737 5.5607 N N 4.8433 3.0769 5.3224 3.4782 1.5698 6.0882 3.9790 4.1910 4.0905 c. What conclusions can you reach concerning differences arnong the types of retirement funds (growth and value), based on the risk (low, average, and high) and the rating (one, two, three, four, and five)? The mean three-year return of the average-risk or low-risk growth funds is generally higher than that of the corresponding value funds when comparing by rating. The mean of the high-risk growth funds is higher than the value funds only for those with two-star or three-star ratings. Growth type funds generally have a higher standard deviation than the corresponding value funds when comparing by rating. The largest standard deviations occur in higher -risk funds. Help me solve this View an example Get more help Similar question X Retirement funds data Type Risk Star Rating 3YrReturn% Growth High Three 62.89 Growth High Five 55.75 Growth High Two 54.87 Growth Average Five 37.87 Growth Average Five 33.55 Growth Low Five 34.00 Growth High Three 33.40 Growth Average Five 28.96 Growth Average Five 27.82 Growth Average Four 26.56 Growth Average Five 27.03 Growth Average Four 26.97 Growth Average Five 24.64 Growth Average Four 24.81 Growth Average Five 25.38 Growth Average Four 24.36 Growth Average Five 23.95 Growth Average Three 25.11 Growth Low Four 23.55 Growth High Five 22.90 Growth Average Four 23.03 Growth Average Five 23.92 Growth Average Three 22.90 Growth Low Five 23.33 Growth Low Four 24.01 Growth Average Three 22.56 Growth Average Five 23.30 Cruth AUSAS 22 Type Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Risk Low Low Average Average Low Low Average Low Average Average Average Average Low Average Low Average Average Average Low Low Low Low Low Average Average Average Low Star Rating 3YrReturn% Three 21.49 Five 22.48 Three 22.14 Five 21.72 Five 19.24 Five 20.30 Three 19.16 Five 19.62 Three 19.68 Five 17.91 Two 18.68 Five 18.84 Four 18.34 Five 17.92 Four 17.45 Five 17.44 Four 18.43 Five 17.28 Four 16.72 Five 18.02 Four 17.67 Five 16.34 Four 16.77 Five 16.67 Three 17.11 Five 16.21 Five 16.76 Cins 10 na Type Risk Growth Average Growth Average Growth High Growth Low Growth Low Growth Average Growth Average Growth Average Growth Low Growth Low Growth Average Growth Average Value High Value High Value High Value High Value High Value High Value Low Value Average Value High Value Average Value Low Value Average Value Average Value Low Value Low Uich Full data set Star Rating 3YrReturn% Five 20.33 Three 19.78 Five 18.55 Three 17.83 Five 17.82 Two 16.14 Five 14.97 Two 14.30 Five 12.15 Three 9.27 Five 7.68 Two 2.48 Three 35.51 Five 30.36 Four 29.24 Five 25.84 Three 25.40 Five 24.45 Four 24.10 Five 23.58 Two 23.06 Five 22.64 Five 22.38 Five 21.02 Three 20.91 Five 22.54 Four 21.12 Cina 20. Thrad Print Done Woman oyamnla Got mom hain DITT - X - Retirement funds data Five Two Five Four Five Five Five Two Five Four Three Five Four Five Four Five Three Five Five Five Growth Average Growth Average Growth Low Growth High Growth Average Growth Average Growth Low Growth Low Growth Average Growth Average Growth Low Growth Low Growth High Growth Low Growth Low Growth Average Growth Average Growth Low Growth Average Growth Low Growth Low Growth Average Growth Low Growth Average Growth Average Growth Low Growth Average Growth Low Growth Average Growth Average Three Five Four Five Three Five Four Five Three Five Three " Four Five Four Five Three Five Three Five Four Five Three Five Two Five Three Five Two Five Three 22.60 23.11 22.41 22.00 20.88 22.04 21.16 20.79 21.46 20.81 21.58 20.50 20.56 20.70 20.46 21.67 20.40 21.21 20.46 20.34 21.17 19.13 18.67 19.16 18.95 20.19 18.47 18.47 19.06 19.59 Four Value Low Value Average Value Average Value Low Value Average Value Low Value Low Value Average Value Average Value Low Value Low Value Average Value Low Value Low Low Value Average Value Low Value Average Value Average Value Low Value Low Value Low Value Low Value Low Value Low Value Low Growth High Growth High Growth Average Growth High Growth Average 16.95 16.27 15.81 16.07 15.06 15.35 14.57 14.52 14.83 14.75 15.84 16.03 14.33 14.19 15.59 14.47 14.33 14.25 15.21 14.06 12.25 12.02 12.14 12.16 9.70 34.78 31.91 30.86 29.98 28.45 Value High Value Low Value High Value Average Growth High Growth High Growth Average Growth High Growth Average Growth Average Growth High down Growth Low Growth Average Growth Average Growth High Growth High Growth High Growth Average Growth High Growth Average Growth Average Growth High Growth High Growth Low Growth Average Growth High Growth Average Growth High Growth High Growth High Three Five Two Five Four Five Two Five One Five Five Two Five Four Five Four Five Three Five Three Five Four Five Four 20.63 19.99 21.36 20.65 35.46 33.46 31.65 30.91 31.29 31.78 30.03 30.87 29.67 29.71 29.64 26.82 27.87 26.58 27.47 26.65 26.16 24.52 25.37 24.63 25.58 25.65 23.80 25.25 25.24 24.91 Five Three Five Three Five Four Five Three Five Five Four Five One Five Four Print Done - X Retirement funds data Growth Average Growth Low Growth Low Growth High Growth Low Growth Average Growth Average Growth Low Growth Low Growth Low Growth Average Growth Low Growth Low Growth Low Growth Average Growth Average Growth Average Growth Average Growth Average Growth Average Growth Average Growth Average Growth Low Growth Low Growth Low Growth Low Growth Low Growth Low Growth Low Growth Average High Three Five Five Two Five Two Five Three Five Three Five Four Three Five Three Five Three Five Three Five One Three Five Three Five Four Five Three Five One 19.59 19.31 18.25 18.13 17.88 18.07 19.10 18.52 17.42 17.90 18.69 18.01 17.22 17.38 17.77 18.03 Growth Average Growth Average Growth Average Growth Average Growth Average Growth Average Growth High Growth Average Growth High Growth High Growth Average Growth Average Growth Average Growth Average Growth Average Growth Average Growth Average Growth Average Growth Average Growth Average Growth Average Growth Low Growth Average Growth Average Growth Average Growth Low Growth Average Growth Low Growth High Growth Average Four Five Five Five Two Five Five Four Five Three Five Four Five Three Five Three Five Three Five Five Five Four Five Four Five Five Five Five Five Three 28.45 28.62 29.08 27.14 26.21 27.56 25.97 25.24 25.40 26.27 25.37 25.86 26.67 25.13 25.66 25.01 25.73 25.14 25.09 23.74 24.79 23.89 23.55 24.44 23.53 24.32 23.48 23.49 23.70 23.33 Growth High Growth High Growth High Growth Average Growth High Growth Average Growth Average Growth Average Growth Average Growth Growth Average Growth High Growth Average Growth Average Growth Average Growth High Growth High Growth High Growth Average Growth High Growth Average Growth High Growth High Growth High Growth High Growth High Growth Average Growth High Growth High Value Hiah Four Five Three Five Five Three Five Five Four Five Five One Five Five TWO Five One Five Two Five Three Five Three Five Two Five Three Five Two Four 24.91 24.27 23.79 23.72 24.27 23.51 22.99 23.91 24.00 22.84 23.24 23.22 23.71 22.76 23.30 23.23 22.49 21.59 21.80 20.90 21.28 20.42 20.26 20.60 20.52 21.14 18.88 15.02 11.37 37.85 18.26 16.34 17.75 17.57 16.58 17.37 17.08 16.17 16.51 16.11 15.53 15.75 16.49 15.17 Print Done Retirement funds data Une Three Tree Five Three Five Two Five Three Five Two Four UIUWUN Average Growth Average Growth Low Growth Low Growth Low Growth Low Growth Low Growth Low Growth Low Growth Average Growth Low Growth Low Growth Low Growth Low Growth Low Growth Low Growth Average Growth Low Growth Low Growth Low Growth Low Growth Average Growth Low Growth Low Growth Low Growth Low Growth Low Value Average Value Average Value Low Five Three Five Four Five Three Five One Five Two Five Two Five Two Five Three Five Two Five One Five Three Five TWO Five Five Three Five 10.30 17.37 17.08 16.17 16.51 16.11 15.53 15.75 16.49 15.17 14.94 16.44 15.88 15.34 14.27 15.54 14.92 14.69 13.80 14.47 13.53 13.33 13.85 11.54 12.08 11.35 11.59 31.68 26.09 24.03 UIUWLT Average Growth Low Growth Average Growth Average Growth Average Growth Low Growth Average Growth Low Growth High Growth Average Growth Average Growth Average Growth High Growth Average Growth High Growth Average Growth Average Growth Low Growth Average Growth Low Growth Low Growth Average Growth Average Growth Average Growth Low Growth Low Growth Average Growth Average Growth Average Growth Average rive Four Five Four Five Five Five Five Five Three Five Three Five Three Five Two Five Three Five Four Five Four Five Two Five Four Five Three Five Two 24.79 23.89 23.55 24.44 23.53 24.32 23.48 23.49 23.70 23.33 24.08 22.97 23.77 22.82 22.85 23.65 21.72 21.58 22.04 21.84 23.13 21.35 20.99 21.32 21.99 20.81 19.85 19.71 19.30 19.41 UIUWLIT Average Growth High Growth High Growth High Growth High Growth High Growth Average Growth High Growth High Value High Value High Value High Value High Value High Value High Value High Value High Value High Value High Value High Value High Value Low Value Average Value High Value Low Value High Value High Value High Value Average Value High Five Two One Three Five Two Five Three Five Three Five Four Five Three Five Three Five Two Five Three 21.20 20.42 20.26 20.60 20.52 21.14 18.88 15.02 11.37 37.85 32.20 32.39 32.19 32.21 31.31 28.14 28.26 27.78 26.22 24.87 24.31 22.85 22.50 22.96 20.95 21.58 21.43 19.77 18.68 19.97 Print Done Consider the retirement funds data linked below. Using the three-year return percentage variable, complete parts (a) through (c) below. Click the icon to view the data. a. Construct a table that computes the mean for each type, risk, and rating. Risk One Type Growth Low Two 15.2683 18.7127 Four 21.1108 26.3353 26.7333 Five 18.7939 23.4907 25. 1322 Growth 15.0267 23.6533 Average Growth High 26.2225 Rating Three 17.1886 21.4421 31.5991 (Round to four decimal places as needed.) 16.0733 20.8483 26.2850 {Round to four decimal places as needed.) Value Low Value 17.3835 18.9389 Average 17.1600 16.0075 25.8400 15,5900 17.7508 19.5400 33.5450 Value High 32.1900 26.0336 b. Construct a table that computes the standard deviation for each type, risk, and rating. Risk One Four Type Growth Rating Three 3.7683 2.5158 Low 2.3384 TWO 2.3534 6.3926 19.4875 1.8297 1.4301 Five 5.2220 4.8027 7.3472 3.0555 11.3911 2.5443" Growth Average Growth High (Round to four decimal places as needed. Type N if the value is #DIV/0!) Value Low Value Average 4.0022 1.9737 4.8433 3.0769 3.4782 1.5698 3.9790 4.1910 N Help me solve this View an example Get more help Similar question Consider the retirement funds data linked below. Using the three-year return percentage variable, complete parts (a) through (c) below. Click the icon to view the data. - --- ------ Value Low Average Value 15.5900 32.1900 17.1600 16.0075 25.8400 (Round to four decimal places as needed.) 16.0733 20.8483 26.2850 {Round to four decimal places as needed.) 17.7506 19.5400 33.5450 17.3835 18.9389 26.0336 Value High b. Construct a table that computes the standard deviation for each type, risk, and rating. One Rating Thren 3.7683 Four 2.3384 Two 2.3534 6.3926 19.4875 Five 5.2220 4.8027 7.3472 2.5158 1.6297 1.43019 3.0555 2.5443 11.3911 Risk Growth Low Growth Average Growth High (Round to four decimal places as needed. Type N if the value is #DIV/0!) Value Low Value Average Value High (Round to four decimal places as needed. Type N if the value is #DIV/0!) 4.0022 1.9737 5.5607 N N 4.8433 3.0769 5.3224 3.4782 1.5698 6.0882 3.9790 4.1910 4.0905 c. What conclusions can you reach concerning differences arnong the types of retirement funds (growth and value), based on the risk (low, average, and high) and the rating (one, two, three, four, and five)? The mean three-year return of the average-risk or low-risk growth funds is generally higher than that of the corresponding value funds when comparing by rating. The mean of the high-risk growth funds is higher than the value funds only for those with two-star or three-star ratings. Growth type funds generally have a higher standard deviation than the corresponding value funds when comparing by rating. The largest standard deviations occur in higher -risk funds. Help me solve this View an example Get more help Similar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts