Question: Can someone help me to do this excel lab? please include the formula too. Thank you 6 Points Possible: 10 To receive full credit, you

Can someone help me to do this excel lab? please include the formula too. Thank you

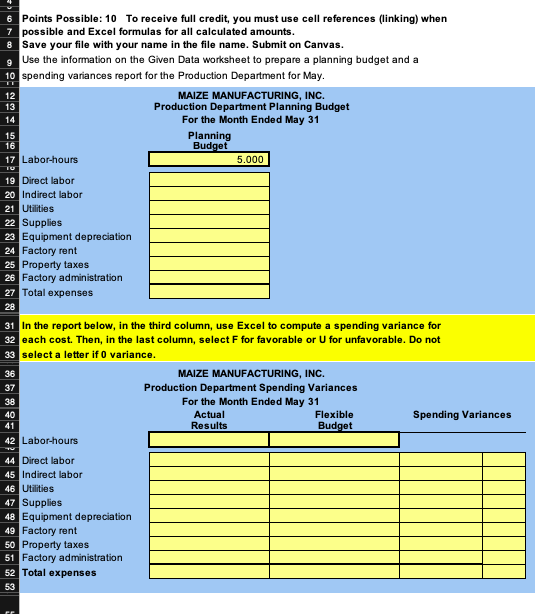

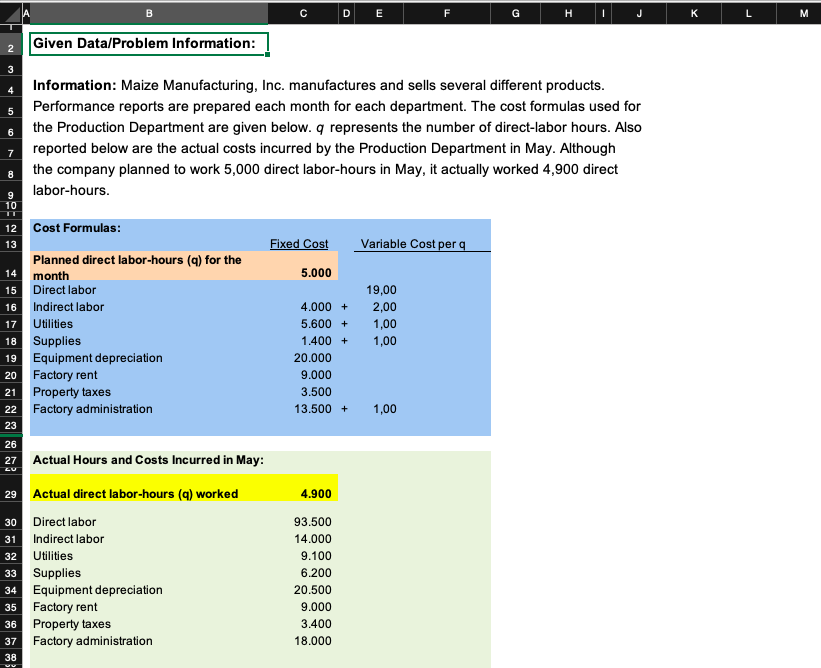

6 Points Possible: 10 To receive full credit, you must use cell references (linking) when 7 possible and Excel formulas for all calculated amounts. 8 Save your file with your name in the file name. Submit on Canvas. Use the information on the Given Data worksheet to prepare a planning budget and a 10 spending variances report for the Production Department for May. 12 MAIZE MANUFACTURING, INC. 13 Production Department Planning Budget For the Month Ended May 31 14 15 Planning Budget 16 17 Labor-hours 5.000 19 Direct labor 20 Indirect labor 21 Utilities 22 Supplies 23 Equipment depreciation 24 Factory rent 25 Property taxes 26 Factory administration 27 Total expenses 28 31 In the report below, in the third column, use Excel to compute a spending variance for 32 each cost. Then, in the last column, select F for favorable or U for unfavorable. Do not 33 select a letter if 0 variance. 36 MAIZE MANUFACTURING, INC. 37 Production Department Spending Variances For the Month Ended May 31 38 40 Actual Results Flexible Budget 41 42 Labor-hours 44 Direct labor 45 Indirect labor 46 Utilities 47 Supplies 48 Equipment depreciation 49 Factory rent 50 Property taxes 51 Factory administration 52 Total expenses 53 Spending Variances B DE HI K Given Data/Problem Information: 2 3 4 5 6 Information: Maize Manufacturing, Inc. manufactures and sells several different products. Performance reports are prepared each month for each department. The cost formulas used for the Production Department are given below. q represents the number of direct-labor hours. Also reported below are the actual costs incurred by the Production Department in May. Although the company planned to work 5,000 direct labor-hours in May, it actually worked 4,900 direct labor-hours. 7 8 9 10 12 Cost Formulas: 13 Fixed Cost Variable Cost per q Planned direct labor-hours (q) for the 14 month 5.000 15 Direct labor 19,00 16 Indirect labor 4.000 + 2,00 17 Utilities 5.600 + 1,00 18 Supplies 1.400 + 1,00 19 Equipment depreciation 20.000 20 Factory rent 9.000 21 Property taxes 3.500 22 Factory administration 13.500 + 1,00 23 26 27 Actual Hours and Costs Incurred in May: ZU 29 Actual direct labor-hours (q) worked 4.900 30 Direct labor 93.500 31 Indirect labor 14.000 32 Utilities 9.100 33 Supplies 6.200 34 Equipment depreciation 20.500 35 Factory rent 9.000 36 Property taxes 3.400 37 Factory administration 18.000 38 M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts