Question: can someone help me w/ these multiple choice? im really stuck right now Long term debt (bonds payable), the proceeds of which were used by

can someone help me w/ these multiple choice? im really stuck right now

can someone help me w/ these multiple choice? im really stuck right now

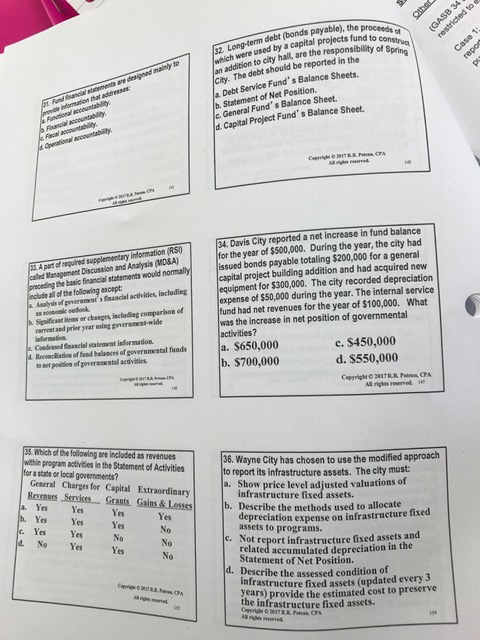

Long term debt (bonds payable), the proceeds of which were used by a capital projects fund to construct an addition to city hall, are the responsibility of spring city. The debt should be reported in the a. Debt service Fund's Balance sheets. b. Statement of Net position. C. General Fund's balance sheet. d. Capital project Fund's Balance sheet. Davis city reported a net increase in fund balance for the year of $500,000. During the year, the city had issued bonds payable totaling $200,000 for a general capital project building addition and had acquired new equipment for $300,000. The city recorded depreciation expense of $50,000 during the year. the internal service fund had net revenues for the year of $100,000. What is the increase in net position of government activities? a. $650,000 b. $700,000 c. $450,000 d. $550,000 Wayne city has chosen to use the modified approach to report its infrastructure assets. The city must: a. Show price level adjusted valuations of infrastructure fixed assets. b. Describe the methods used to allocate depreciation expense on infrastructure fixture assets to programs. c. Not report infrastructure fixed assets and related accumulated depreciation in the statement of Net Position. d. Describe the assessed condition of infrastructure fixed assets (updated every 3 years) provide the estimate cost to preserve the infrastructure fixed assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts