Question: Can someone help me with these multiple choice questions? I know number 1. Is C GENERAL FUND As stated, fixed assets acquired by governmental funds

Can someone help me with these multiple choice questions? I know number 1. Is C GENERAL FUND

Can someone help me with these multiple choice questions? I know number 1. Is C GENERAL FUND

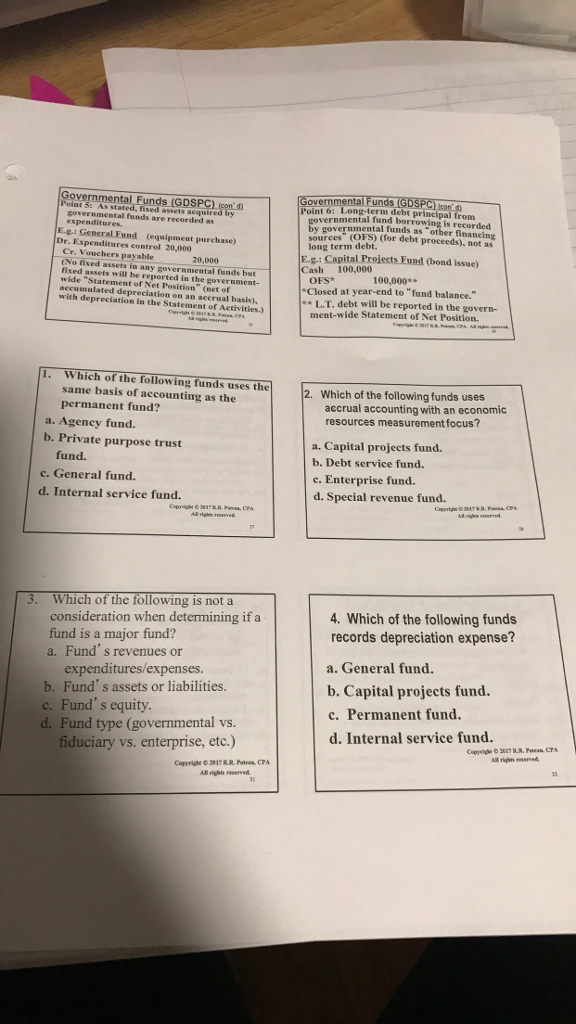

As stated, fixed assets acquired by governmental funds are recorded as expenditures. E.g.: General Fund (equipment purchase) Dr. Expenditures control 20,000 Cr. Vouchers payable 20,000 (No fixed assets in any governmental funds buts fixed assets will be reported in the government-wide "Statement of Net Position" (net of accumulated depreciation on an accrual basis), with depreciation in the Statement of Activities.) Long-term debt principal from governmental funds borrowing is recorded by governmental funds as "other financing sources" (OFS) (for debt proceeds), not as long term debt. E.g.: Capital Projects Fund (bond issue) Cash 100,000 OFS* 100,000** *Closed at year-end to "fund balance." ** L.T. debt will be reported in the government-wide Statement of Net Position. Which of the following funds uses the same basis of accounting as the permanent fund? a. Agency fund. b. Private purpose trust fund. c. General fund. d. Internal service fund. Which of the following funds uses accrual accounting with an economic resources measurement focus? a. Capital projects fund. b. Debt service fund. c. Enterprise fund. d. Special revenue fund. Which of the following is not a consideration when determining if a fund is a major fund? a. Fund' s revenues or expenditures/expenses. b. Fund' s assets or liabilities. c. Fund' s equity. d. Fund type (governmental vs. fiduciary vs. enterprise, etc.) Which of the following funds records depreciation expense? a. General fund. b. Capital projects fund. c. Permanent fund. d. Internal service fund

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts