Question: Can someone help me with part e and f ? 2. Roland acquires 70% of Felix on January 1, 2011. The terms of purchase is

Can someone help me with part e and f ?

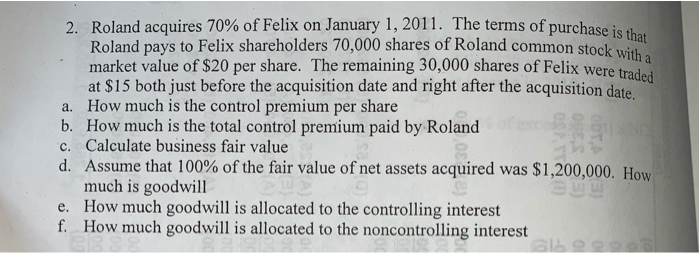

2. Roland acquires 70% of Felix on January 1, 2011. The terms of purchase is that Roland pays to Felix shareholders 70,000 shares of Roland common stock with a market value of $20 per share. The remaining 30,000 shares of Felix were traded at $15 both just before the acquisition date and right after the acquisition date. a. How much is the control premium per share b. How much is the total control premium paid by Roland c. Calculate business fair value d. Assume that 100% of the fair value of net assets acquired was $1,200,000. How much is goodwill e. How much goodwill is allocated to the controlling interest f. How much goodwill is allocated to the noncontrolling interest S30 2. Roland acquires 70% of Felix on January 1, 2011. The terms of purchase is that Roland pays to Felix shareholders 70,000 shares of Roland common stock with a market value of $20 per share. The remaining 30,000 shares of Felix were traded at $15 both just before the acquisition date and right after the acquisition date. a. How much is the control premium per share b. How much is the total control premium paid by Roland c. Calculate business fair value d. Assume that 100% of the fair value of net assets acquired was $1,200,000. How much is goodwill e. How much goodwill is allocated to the controlling interest f. How much goodwill is allocated to the noncontrolling interest S30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts