Question: can someone help me with these?? please show work HOMEWORK 2 PART 1: Use the information below to answer the questions on the next page.

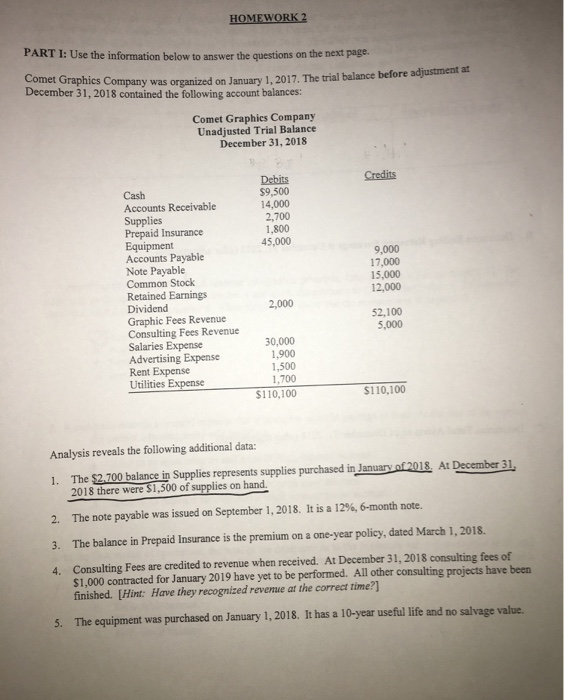

HOMEWORK 2 PART 1: Use the information below to answer the questions on the next page. Comet Graphics Company was organized on January 1, 2017. The trial balance before adjustment December 31, 2018 contained the following account balances: Comet Graphics Company Unadjusted Trial Balance December 31, 2018 Credits Debits $9,500 14,000 2,700 1.800 45,000 Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accounts Payable Note Payable Common Stock Retained Earnings Dividend Graphic Fees Revenue Consulting Fees Revenue Salaries Expense Advertising Expense Rent Expense Utilities Expense 9,000 17,000 15,000 12.000 2,000 52,100 5,000 30,000 1.900 1,500 1,700 $110,100 $110.100 Analysis reveals the following additional data: 1. The $2.700 balance in Supplies represents supplies purchased in January of 2018. At December 31, 2018 there were $1,500 of supplies on hand. 2. The note payable was issued on September 1, 2018. It is a 12%, 6-month note. 3. The balance in Prepaid Insurance is the premium on a one-year policy, dated March 1, 2018. 4. Consulting Fees are credited to revenue when received. At December 31, 2018 Consulting fees of $1.000 contracted for January 2019 have yet to be performed. All other consulting projects have been finished. (Hint: Have they recognized revenue at the correct time?] 5. The equipment was purchased on January 1, 2018. It has a 10-year useful life and no salvage value. Required: A. Journalize the appropriate adjusting entries in correct general journal form. B. Determine Ending Retained Earnings at December 31, 2018 (after adjustments). c. Determine Total Assets as of December 31, 2018 (after adjustments)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts