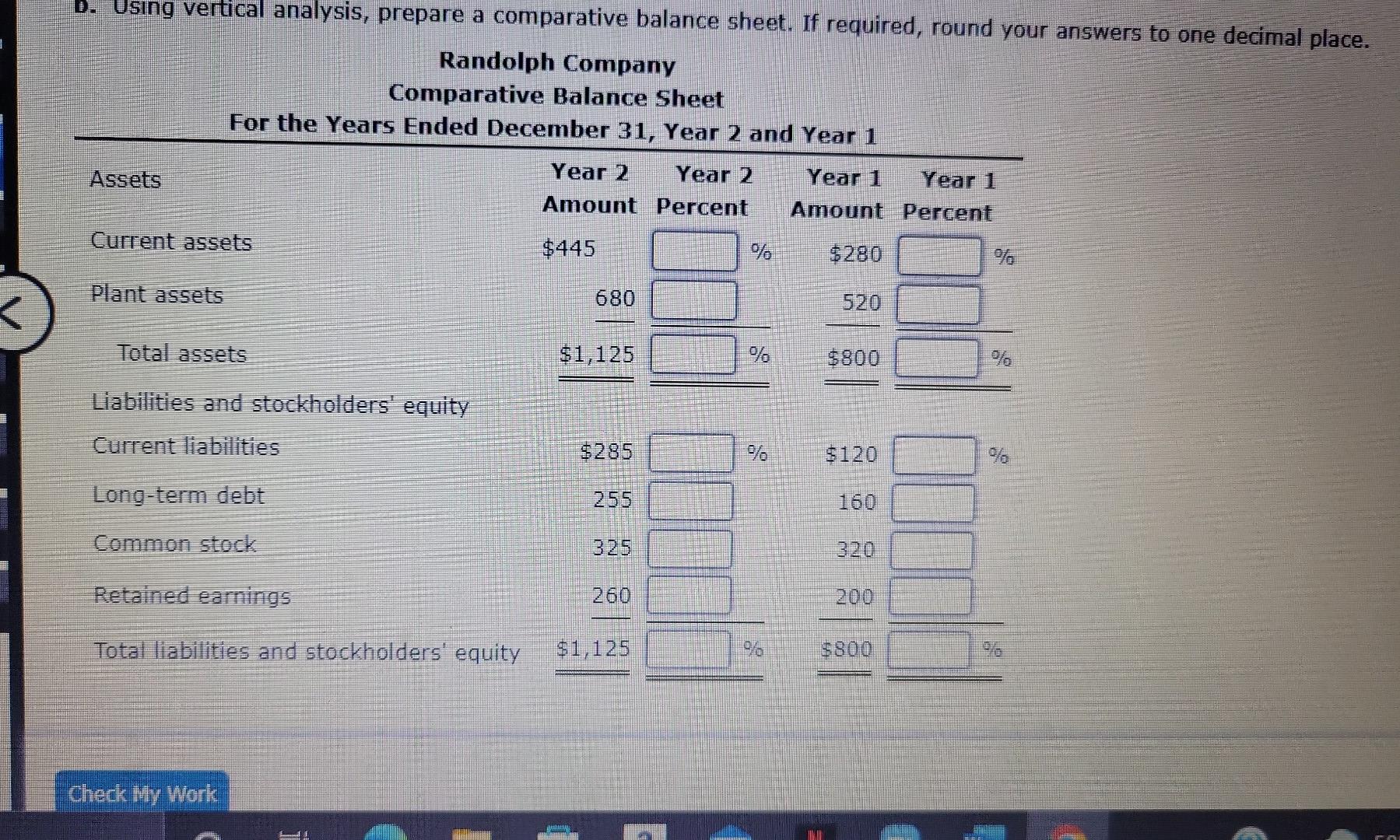

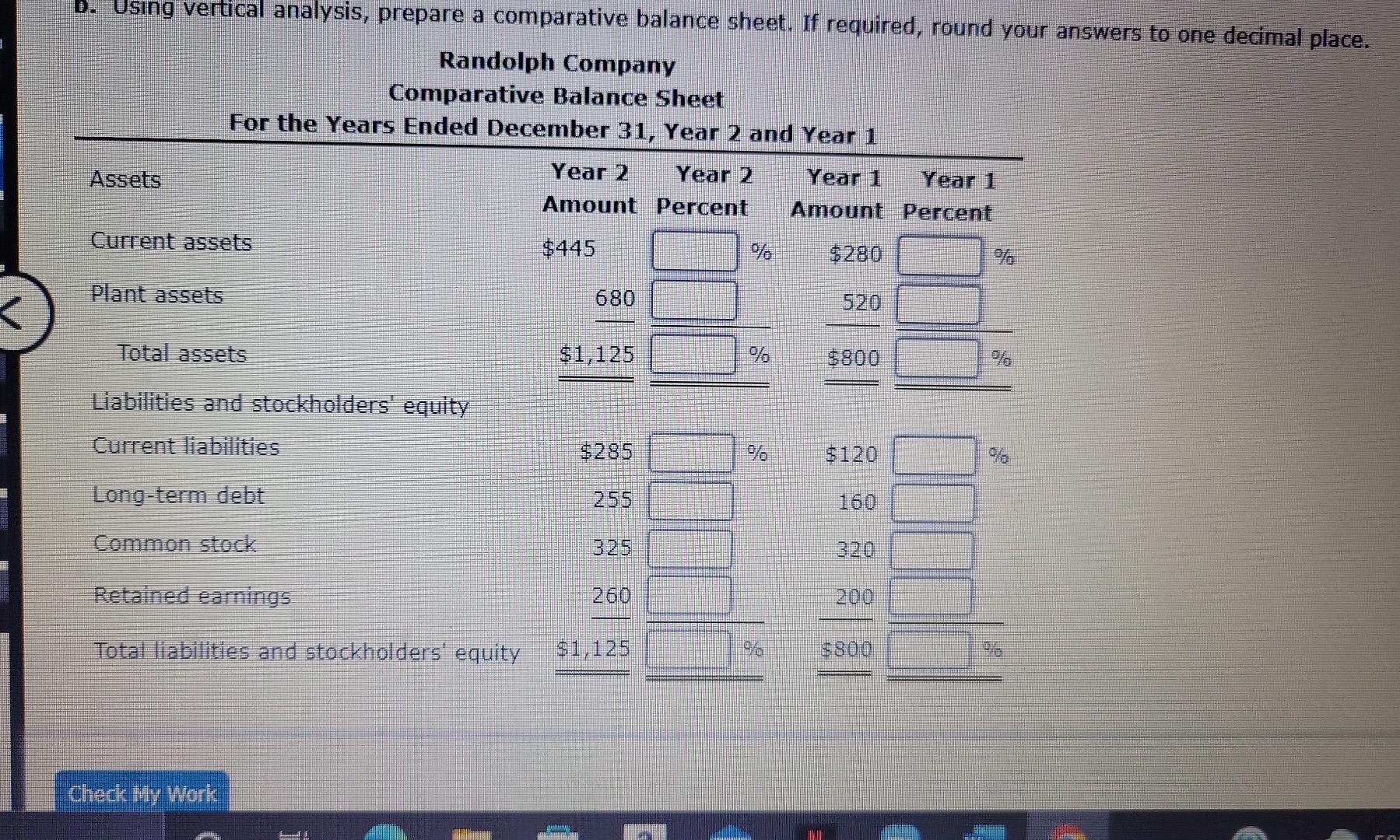

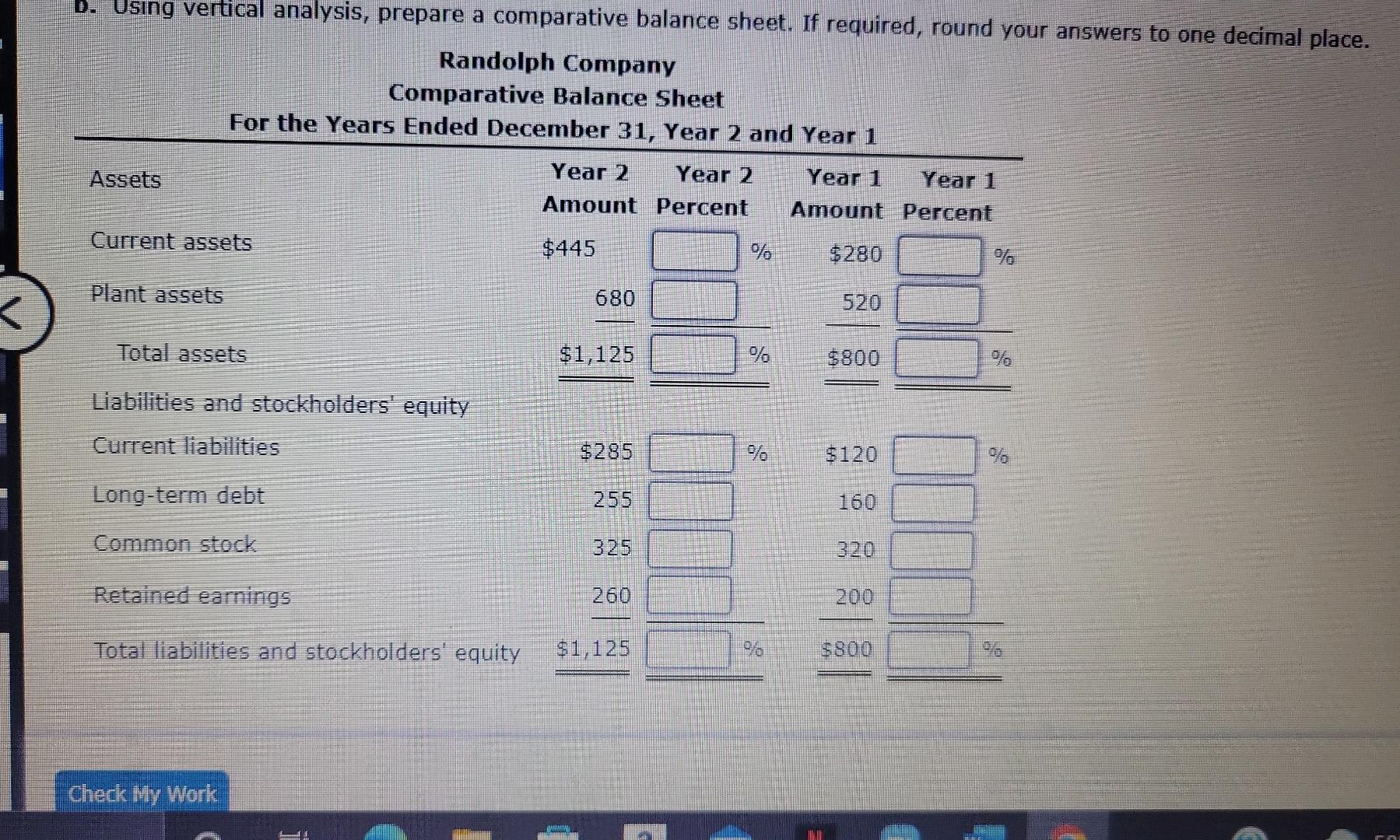

Question: can someone help me with this ? b. Using vertical analysis, prepare a comparative balance sheet. If required, round your answers to one decimal place.

can someone help me with this ?

b. Using vertical analysis, prepare a comparative balance sheet. If required, round your answers to one decimal place. Randolph Company Comparative Balance Sheet For the Years Ended December 31, Year 2 and Year 1 Assets Year 2 Year 2 Amount Percent Year 1 Year 1 Amount Percent Current assets $445 % $280 Plant assets 680 Total assets $1,125 % $800 Liabilities and stockholders' equity Current liabilities $285 $120 Long-term debt 255 Common stock 325 320 Retained earnings 260 200 Total liabilities and stockholders' equity $1,125 $800 Check My Work % C cmal 20 b. Using vertical analysis, prepare a comparative balance sheet. If required, round your answers to one decimal place. Randolph Company Comparative Balance Sheet For the Years Ended December 31, Year 2 and Year 1 Assets Year 2 Year 2 Amount Percent Year 1 Year 1 Amount Percent Current assets $445 % $280 Plant assets 680 Total assets $1,125 % $800 Liabilities and stockholders' equity Current liabilities $285 $120 Long-term debt 255 Common stock 325 320 Retained earnings 260 200 Total liabilities and stockholders' equity $1,125 $800 Check My Work % C cmal 20 b. Using vertical analysis, prepare a comparative balance sheet. If required, round your answers to one decimal place. Randolph Company Comparative Balance Sheet For the Years Ended December 31, Year 2 and Year 1 Assets Year 2 Year 2 Amount Percent Year 1 Year 1 Amount Percent Current assets $445 % $280 Plant assets 680 Total assets $1,125 % $800 Liabilities and stockholders' equity Current liabilities $285 $120 Long-term debt 255 Common stock 325 320 Retained earnings 260 200 Total liabilities and stockholders' equity $1,125 $800 Check My Work % C cmal 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts