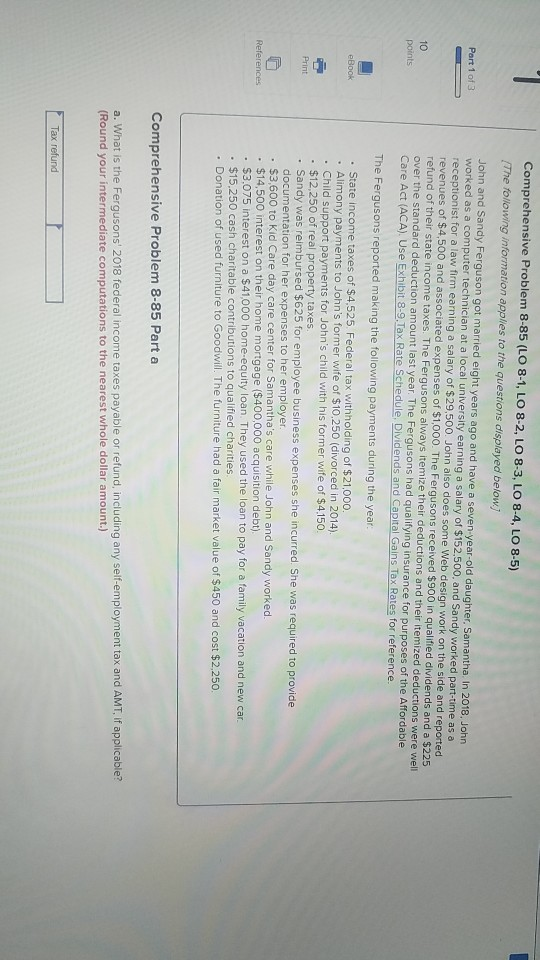

Question: Can someone help me with this ? Comprehensive Problem 8-85 (LO 8-1, LO 8-2, LO 8-3, LO 8-4, LO 8-5) The following information applies to

Can someone help me with this ?

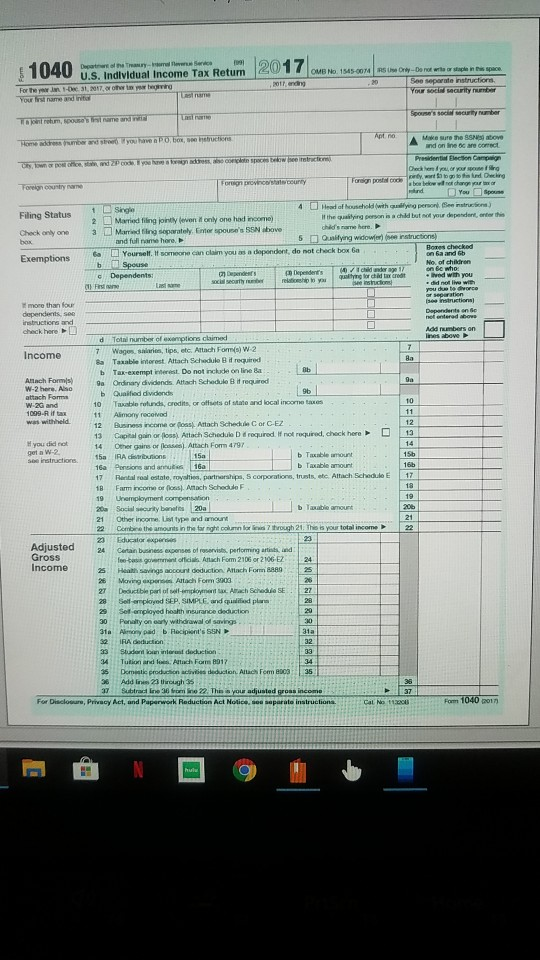

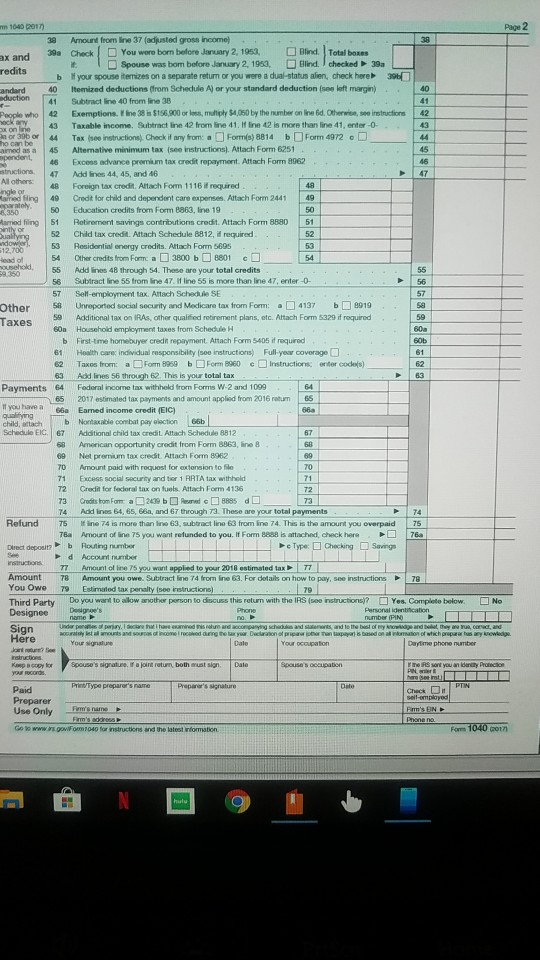

Comprehensive Problem 8-85 (LO 8-1, LO 8-2, LO 8-3, LO 8-4, LO 8-5) The following information applies to the questions displayed below Part 1 of 3 John and Sandy Ferguson got married eight years ago and have a seven-year-old daughter, Samantha In 2018, John worked as a computer technician at a local university earning a salary of $152,500, and Sandy worked part-time as a receptionist for a law firm eaming a salary of $29,500. John also does some Web design work on the side and reported revenues of $4,500 and associated expenses of $1,000. The Fergusons received $900 in qualified dividends and a $225 refund of their state income taxes. The Fergusons always itemize their deductions and their itemized deductions were well over the standard deduction amount last year. The Fergusons had qualifying insurance for purposes of the Affordable Care Act (ACA) Use Exhibit 8.9. Tax Rate Schedule Dividends and Capital Gains Tax Rates for reference points received $ always itemize the amount last year The Fergusons reported making the following payments during the year: ivorced in 2014). Print State income taxes of $4,525. Federal tax withholding of $21,000. Alimony payments to John's former wife of $10.250 (divorced in 2014). Child support payments for John's child with his former wife of $4.150 $12,250 of real property taxes. Sandy was reimbursed $625 for employee business expenses she incurred. She was required to provide documentation for her expenses to her employer $3,600 to Kid Care day care center for Samantha's care while John and Sandy worked $14,500 interest on their home mortgage ($400,000 acquisition debt). $3.075 interest on a $41000 home-equity loan. They used the loan to pay for a family vacation and new car $15,250 cash charitable contributions to qualified charities . Donation of used furniture to Goodwill. The furniture had a fair market value of $450 and cost $2.250. References Comprehensive Problem 8-85 Part a a. What is the Fergusons' 2018 federal income taxes payable or refund, including any self-employment tax and AMT, if applicable? (Round your intermediate computations to the nearest whole dollar amount.) Tax refund 2017 CME NO. 1845.001 ss he wordt CW O MB No MS.COM ETA Daerary TUU U.S. Individual Income Tax Retum For the yow - 31, 2017, or other Your first name and it Treme Yours security number BOSS SOM U ber Toretum, totame and Home address imbrandshol you have a PO, Box, nections Make sure the SSS above and on neer Con peal ho do you w a President Election Campaign nt. The Check you of your so n g ty, warto o d Decking Foreignty one Foreign province/statcounty Foreign postal code abon below to change your wor und You Spouse 1 Single 4 Head of household with i n person. Se intron) Filing Status 2 Married filing joint even if only one had income) the lying person is ach but not your dependent on this Check only one 3 Married filing separately or one'SSNwbove Child's name here. and full name here 5 Qualifying widowers instructions) to Yourself. If someone can claim you as a dependent, do not check box 6a Exemptions bu Spouse Dependent's relationship to you ng for child tax credit Firse more than four dependents, so check here Tot imbol extins claim Wages , tips, etc, Attach Form ) W2 - Income Ba Taxable interest. Altach Schedule Bit required b Tax-exempt interest. Do not include online : Anach Forms) ga Ordinary dividends. Attach Schedule of required attach Form Qualified dividends 10 Table rounds, credits, or oth of state and local income taxes 1099-R ifta 11 Alimony received 12 Business income or oss. Attach Schedule Cor CEZ 13 Capital gain or loss. Attach Schedule D d required. If not required, check here you did not 14 Other Gains or Attach For 4797 get a W-2 15a IRA buions 150 Table amount 16a Pensions and annus 16a Taable amount 17 Rental real estate, roys, paraships, corporations, frustste Attach Schedule 18 Farm income or los Altach Schedule 19 Unemployment compensation 20a Social security benes 20a 21 Other Income List type and amount 22 Combine the amounts in the far right column widthrough 21. This is your Educator expres . . Adjusted 24 Certain business expenses of reservists, performing artist and Gross fee basis officiis Atach Form 2106 2106 EZ Income 25 Heath savings account deduction Altach Form8889 26 Moving expert Altach Form 3903 27 Deductible part of imployment Altach Schedule SE. 28 Self-employed SEP. SIMPLE, and quid plan 29 Selemployed health insurance deduction 30 Ponally on early withdrawal of savings 31a Alcoy paid b Recipient's SSN 32 IRA deduction 33 Studentinoru dauction 4 Tudici and to Attach Foam 2017 15 Derite producon deduction Altach Form 2003 36 Add in through 35 27 Subtrale 36 from no 22. This is you adjusted gross in For Disclosure, Privacy Act, and Paperwork Reduction Act Notice so separate instructions Cal No 1.2 Form 1040 2017 40 ndows 58 1040 2017 Page 2 38 Amount from line 37 (adjusted gross income) . . ax and 39a Check You were born before January 2, 1953, Blind. Total boxes Spouse was bom before January 2, 1953, Blind. I checked 39a redits b your spouse itemizes on a separate return or you were a dual-status alien, check here 3000 andard 40 itemized deductions (from Schedule A or your standard deduction (see left margin) aduction 41 Subtract line 40 from line 33 - People who 42 Exemptions. Wine 38 is $156,900 or less multiply 1.050 by the number on line 6d. Otherwise restructions 42 hockey Taxable income. Subtract line 42 from line 41. If line 42 is more than line 41, enter- In or 39 or 44 Tax see instructions. Check it any from: a Form(s) 8814 b Form 4972 ) ained as a 45 Alternative minimum tax see instructions). Attach Form 6251 pendent, Excess advance premium tax credit repayment. Attach Form 1062 structions Add line 44, 45, and 46 All others Foreign tax credit. Altach Form 1116 if required ingle or Cameling Credit for child and dependent care expenses. Attach Form 2441 Education credits from Form 8863, line 19 Harried filing Retirement savings contributions credit. Attach Form 3880 51 52 Child tax credit. Attach Schedule 8812, if required 512,700 53 Residential energy credits. Attach Form 5695 tead of 54 Other credits from Forma 3800 b 8801 c household 55 Add lines 48 through 54. These are your total credits 59.350 56 Subtract line 55 from line 47 line 55 is more than line 47, enter-O- 57 Self-employment tax. Attach Schedule SE 57 Other 58 Unreported social security and Medicare tax from Form: 4137 b 8919 59 Additional tax on IRAs other qualified retirement plans, etc. Attach Form 5329 if required Taxes 60m Household employment taxes from Schedule First-time homebuyer credit repayment. Altach Form 5405 if required 61 Health care individual responsibility (Soe instructions) Full-year coverage 62 Taxes from a Form 8969 b Form 8960 Instructions enter codes) 63 AddIines 56 through 2 This is your total tax Payments 64 Federal income tax withheld from Forms W-2 and 1099 65 2017 estimated tax payments and amount applied from 2016 ratur 65 Eamed income credit (EIC) qualifying child, attach b Nontable combat pay Blection 66 Schedule EIC. 67 Additional child tax credit Altach Schedule 8812 68 American opportunity credit from Form 8862, line 8 69 Net premium tax credit Altach Form 8962 70 Amount paid with request for extension to file 71 Faces social security and tier 1 RRTA tax withhold 72 Credit for federal tax on fuels. Attach Form 4136 73 Credits from Forme a 2000 b 85 do 73 74 Add line 64, 65, 66, and 67 through 73. These are your total payments - 74 Refund 75 line 74 is more than line 63, subtract line 63 from ine 74. This is the amount you overpaid 75 760 Amount of line 75 you want refunded to you. If Form BBB is attached, check here 76 Direct deposit b ouling number 1 e Type: Checking Savings d Account number 77 Amount of line 75 you want applied to your 2018 estimated tax 77 Amount 78 Amount you owe. Subtract line 74 from line 63. For details on how to pay, see instructions 78 You Owe 79 Estimated tax penalty is instructions) . . . . 79 Third Party Do you want to allow another person to discuss this return with the IRS ( se instructions? Yes. Complete below. No Designee Personal identification number ( PINO T Under Don ny. I am Sign and the best of and the n worlystal amounts and come o d ng baywar. Declaration of prepar a pas based on al ation of which preparar as my knowledge Here Your occupation Daytime phone number a 3 2 & 3 If you have a be Spouse's signature. I a joint return both must sign Te sant you and Protection Kop og for YO Gords Check PrintType preparer's name Preparar's signature Paid Preparer Use Only Firms name Firm's address Go to www.insgowFm1040 for instructions and the latest Information Form 1040 con Comprehensive Problem 8-85 (LO 8-1, LO 8-2, LO 8-3, LO 8-4, LO 8-5) The following information applies to the questions displayed below Part 1 of 3 John and Sandy Ferguson got married eight years ago and have a seven-year-old daughter, Samantha In 2018, John worked as a computer technician at a local university earning a salary of $152,500, and Sandy worked part-time as a receptionist for a law firm eaming a salary of $29,500. John also does some Web design work on the side and reported revenues of $4,500 and associated expenses of $1,000. The Fergusons received $900 in qualified dividends and a $225 refund of their state income taxes. The Fergusons always itemize their deductions and their itemized deductions were well over the standard deduction amount last year. The Fergusons had qualifying insurance for purposes of the Affordable Care Act (ACA) Use Exhibit 8.9. Tax Rate Schedule Dividends and Capital Gains Tax Rates for reference points received $ always itemize the amount last year The Fergusons reported making the following payments during the year: ivorced in 2014). Print State income taxes of $4,525. Federal tax withholding of $21,000. Alimony payments to John's former wife of $10.250 (divorced in 2014). Child support payments for John's child with his former wife of $4.150 $12,250 of real property taxes. Sandy was reimbursed $625 for employee business expenses she incurred. She was required to provide documentation for her expenses to her employer $3,600 to Kid Care day care center for Samantha's care while John and Sandy worked $14,500 interest on their home mortgage ($400,000 acquisition debt). $3.075 interest on a $41000 home-equity loan. They used the loan to pay for a family vacation and new car $15,250 cash charitable contributions to qualified charities . Donation of used furniture to Goodwill. The furniture had a fair market value of $450 and cost $2.250. References Comprehensive Problem 8-85 Part a a. What is the Fergusons' 2018 federal income taxes payable or refund, including any self-employment tax and AMT, if applicable? (Round your intermediate computations to the nearest whole dollar amount.) Tax refund 2017 CME NO. 1845.001 ss he wordt CW O MB No MS.COM ETA Daerary TUU U.S. Individual Income Tax Retum For the yow - 31, 2017, or other Your first name and it Treme Yours security number BOSS SOM U ber Toretum, totame and Home address imbrandshol you have a PO, Box, nections Make sure the SSS above and on neer Con peal ho do you w a President Election Campaign nt. The Check you of your so n g ty, warto o d Decking Foreignty one Foreign province/statcounty Foreign postal code abon below to change your wor und You Spouse 1 Single 4 Head of household with i n person. Se intron) Filing Status 2 Married filing joint even if only one had income) the lying person is ach but not your dependent on this Check only one 3 Married filing separately or one'SSNwbove Child's name here. and full name here 5 Qualifying widowers instructions) to Yourself. If someone can claim you as a dependent, do not check box 6a Exemptions bu Spouse Dependent's relationship to you ng for child tax credit Firse more than four dependents, so check here Tot imbol extins claim Wages , tips, etc, Attach Form ) W2 - Income Ba Taxable interest. Altach Schedule Bit required b Tax-exempt interest. Do not include online : Anach Forms) ga Ordinary dividends. Attach Schedule of required attach Form Qualified dividends 10 Table rounds, credits, or oth of state and local income taxes 1099-R ifta 11 Alimony received 12 Business income or oss. Attach Schedule Cor CEZ 13 Capital gain or loss. Attach Schedule D d required. If not required, check here you did not 14 Other Gains or Attach For 4797 get a W-2 15a IRA buions 150 Table amount 16a Pensions and annus 16a Taable amount 17 Rental real estate, roys, paraships, corporations, frustste Attach Schedule 18 Farm income or los Altach Schedule 19 Unemployment compensation 20a Social security benes 20a 21 Other Income List type and amount 22 Combine the amounts in the far right column widthrough 21. This is your Educator expres . . Adjusted 24 Certain business expenses of reservists, performing artist and Gross fee basis officiis Atach Form 2106 2106 EZ Income 25 Heath savings account deduction Altach Form8889 26 Moving expert Altach Form 3903 27 Deductible part of imployment Altach Schedule SE. 28 Self-employed SEP. SIMPLE, and quid plan 29 Selemployed health insurance deduction 30 Ponally on early withdrawal of savings 31a Alcoy paid b Recipient's SSN 32 IRA deduction 33 Studentinoru dauction 4 Tudici and to Attach Foam 2017 15 Derite producon deduction Altach Form 2003 36 Add in through 35 27 Subtrale 36 from no 22. This is you adjusted gross in For Disclosure, Privacy Act, and Paperwork Reduction Act Notice so separate instructions Cal No 1.2 Form 1040 2017 40 ndows 58 1040 2017 Page 2 38 Amount from line 37 (adjusted gross income) . . ax and 39a Check You were born before January 2, 1953, Blind. Total boxes Spouse was bom before January 2, 1953, Blind. I checked 39a redits b your spouse itemizes on a separate return or you were a dual-status alien, check here 3000 andard 40 itemized deductions (from Schedule A or your standard deduction (see left margin) aduction 41 Subtract line 40 from line 33 - People who 42 Exemptions. Wine 38 is $156,900 or less multiply 1.050 by the number on line 6d. Otherwise restructions 42 hockey Taxable income. Subtract line 42 from line 41. If line 42 is more than line 41, enter- In or 39 or 44 Tax see instructions. Check it any from: a Form(s) 8814 b Form 4972 ) ained as a 45 Alternative minimum tax see instructions). Attach Form 6251 pendent, Excess advance premium tax credit repayment. Attach Form 1062 structions Add line 44, 45, and 46 All others Foreign tax credit. Altach Form 1116 if required ingle or Cameling Credit for child and dependent care expenses. Attach Form 2441 Education credits from Form 8863, line 19 Harried filing Retirement savings contributions credit. Attach Form 3880 51 52 Child tax credit. Attach Schedule 8812, if required 512,700 53 Residential energy credits. Attach Form 5695 tead of 54 Other credits from Forma 3800 b 8801 c household 55 Add lines 48 through 54. These are your total credits 59.350 56 Subtract line 55 from line 47 line 55 is more than line 47, enter-O- 57 Self-employment tax. Attach Schedule SE 57 Other 58 Unreported social security and Medicare tax from Form: 4137 b 8919 59 Additional tax on IRAs other qualified retirement plans, etc. Attach Form 5329 if required Taxes 60m Household employment taxes from Schedule First-time homebuyer credit repayment. Altach Form 5405 if required 61 Health care individual responsibility (Soe instructions) Full-year coverage 62 Taxes from a Form 8969 b Form 8960 Instructions enter codes) 63 AddIines 56 through 2 This is your total tax Payments 64 Federal income tax withheld from Forms W-2 and 1099 65 2017 estimated tax payments and amount applied from 2016 ratur 65 Eamed income credit (EIC) qualifying child, attach b Nontable combat pay Blection 66 Schedule EIC. 67 Additional child tax credit Altach Schedule 8812 68 American opportunity credit from Form 8862, line 8 69 Net premium tax credit Altach Form 8962 70 Amount paid with request for extension to file 71 Faces social security and tier 1 RRTA tax withhold 72 Credit for federal tax on fuels. Attach Form 4136 73 Credits from Forme a 2000 b 85 do 73 74 Add line 64, 65, 66, and 67 through 73. These are your total payments - 74 Refund 75 line 74 is more than line 63, subtract line 63 from ine 74. This is the amount you overpaid 75 760 Amount of line 75 you want refunded to you. If Form BBB is attached, check here 76 Direct deposit b ouling number 1 e Type: Checking Savings d Account number 77 Amount of line 75 you want applied to your 2018 estimated tax 77 Amount 78 Amount you owe. Subtract line 74 from line 63. For details on how to pay, see instructions 78 You Owe 79 Estimated tax penalty is instructions) . . . . 79 Third Party Do you want to allow another person to discuss this return with the IRS ( se instructions? Yes. Complete below. No Designee Personal identification number ( PINO T Under Don ny. I am Sign and the best of and the n worlystal amounts and come o d ng baywar. Declaration of prepar a pas based on al ation of which preparar as my knowledge Here Your occupation Daytime phone number a 3 2 & 3 If you have a be Spouse's signature. I a joint return both must sign Te sant you and Protection Kop og for YO Gords Check PrintType preparer's name Preparar's signature Paid Preparer Use Only Firms name Firm's address Go to www.insgowFm1040 for instructions and the latest Information Form 1040 con

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts