Question: Can someone help me with this? During the current year, the following transactions affected its stockholders' equity accounts. Jan. 2 Purchased 4,000 shares of its

Can someone help me with this?

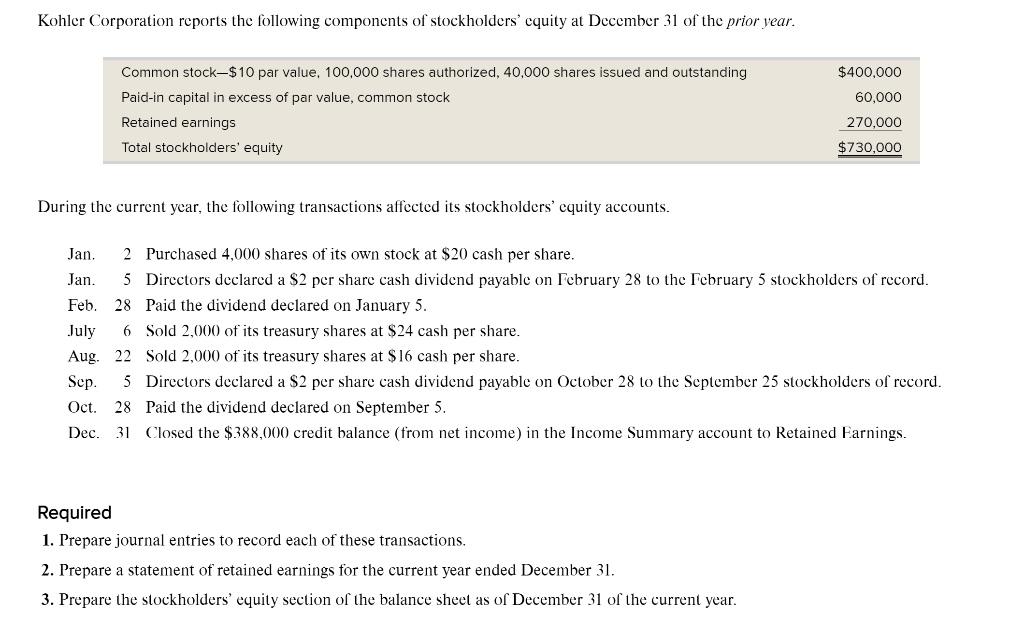

During the current year, the following transactions affected its stockholders' equity accounts. Jan. 2 Purchased 4,000 shares of its own stock at $20 cash per share. Jan. 5 Directors declared a $2 per share cash dividend payable on February 28 to the February 5 stockholders of record. Feb. 28 Paid the dividend declared on January 5. July 6 Sold 2,000 of its treasury shares at $24 cash per share. Aug. 22 Sold 2,000 of its treasury shares at $16 cash per share. Sep. 5 Directors declared a \$2 per share cash dividend payable on October 28 to the September 25 stockholders of record. Oct. 28 Paid the dividend declared on September 5. Dec. 31 Closed the $388,000 credit balance (from net income) in the Income Summary account to Retained Farnings. Required 1. Prepare journal entries to record each of these transactions. 2. Prepare a statement of retained earnings for the current year ended December 31 . 3. Prepare the stockholders' equity section of the balance sheet as of December 31 of the current year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts