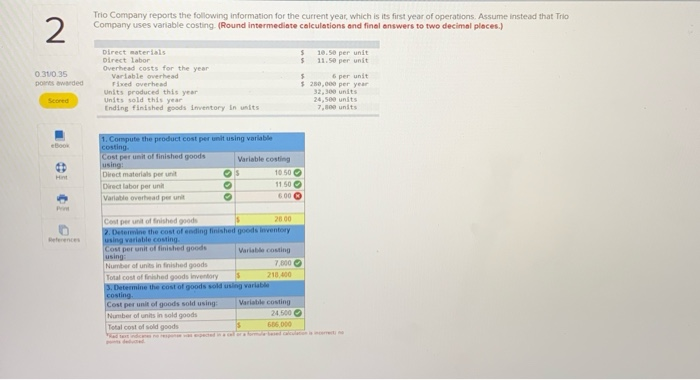

Question: I do not understand how the variable overhead per unit is not 6, please help! Trio Company reports the following information for the current year,

Trio Company reports the following information for the current year, which is its first year of operations. Assume instead that Trio Company uses variable costing. (Round intermediate calculations and final answers to two decimal places) 2 10.50 per unit 11.s0 per unit Direct materials Direct labor Overhead costs for the year Variable overhead Fixed overhead Units produced this year Units sold this year Ending finished goods inventory in units 0.31/0.35 6 per unit s280,000 per year 32,300 units 24,500 units 7,800 units points awarded Scored 1. Compute the product cost per unit using variable costing Cost per unit of finished goods using eBook Variable costing 10 50 s Direct materials per unit Hint Direct labor per unit 11.50 600 Variable overhead per unit Po Cost per unit of finished goods 2. Detemine the cost of ending finished goods inventory using variable costing Cost per unit of finished goods using Number of units in finished goods Total cost of finished goods inventory 3. Detemine the cost of goods sold usling variable costing Cost per unit of goods sold using Number of units in sold goods Total cost of sold goods 28 00 References Variable costing 7.800 s 218 400 Variable costing 24,500 686000 peted in sel ome daln i emt Rad test e dedud

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts