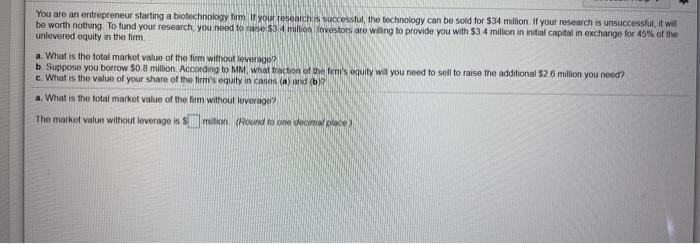

Question: can someone help me with this practice problem You are an entrepreneur starting a biotechnology firm your research is successful the technology can be sold

You are an entrepreneur starting a biotechnology firm your research is successful the technology can be sold for $34 million. If your research is unsuccessful, it wil be worth nothing to fund your research, you need to raise $3 million Investors are willing to provide you with $3 4 million in initial capital in exchange for 45% of the unlovered equity in the firm a. What is the total market value of the firm without lovago? b. Suppose you borrow $0.8 million. According to MM, what fraction of the fami's cuity will you need to sell to raise the additional $26 million you need? c. What is the value of your share of the firm's equity in cases (a) and (b)? a. What is the total market value of the firm without loverage The market value without loverage is si milion (Round to one dewallace

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts