Question: Can someone help me with this problem? Attached is an example to help Question 3 1 pts 3. A one year $1000 Treasury bond with

Can someone help me with this problem? Attached is an example to help

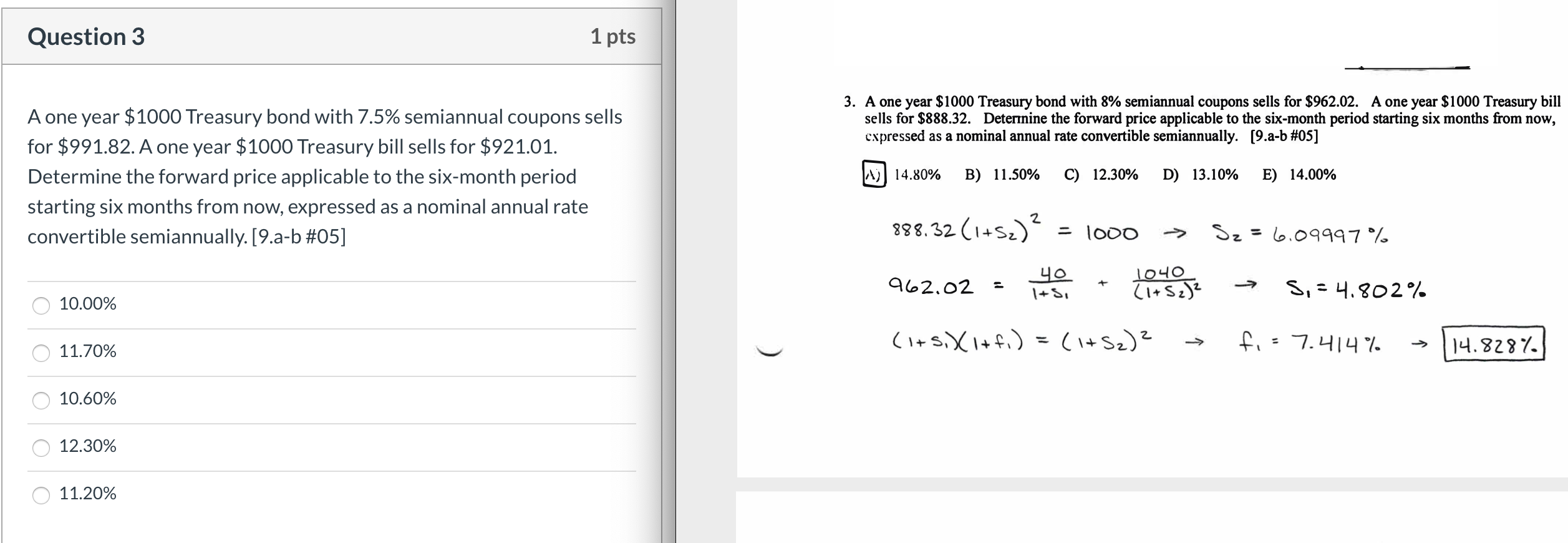

Question 3 1 pts 3. A one year $1000 Treasury bond with 8% semiannual coupons sells for $962.02. A one year $1000 Treasury bill sells for $888.32. Deterrnine the forward price applicable to the six-month period starting six months from now, cxpressed as a nominal annual rate convertible semiannually. [9.a-b #05] A one year $1000 Treasury bond with 7.5% semiannual coupons sells for $991.82. A one year $1000 Treasury bill sells for $921.01. Determine the forward price applicable to the six-month period starting six months from now, expressed as a nominal annual rate convertible semiannually. [9.a-b #05] 14.80% B) 11.50% C) 12.30% D) 13.10% E) 14.00% 888.32(1+52)? = 1000 > 52= 6.09997% 962.02 = Men Love to get = 5,=4.802% (1+5.X1+fi) = (1+52)2 = f. = 7.414% > 14.82871 10.00% 0 11.70% 0 10.60% 0 12.30% O 11.20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts