Question: Can someone help me with this problem? Attached is an example to help 5.3-5.4b#1 Question 1 1 pts On January 1, an investment account is

Can someone help me with this problem? Attached is an example to help

5.3-5.4b#1

5.3-5.4b#1

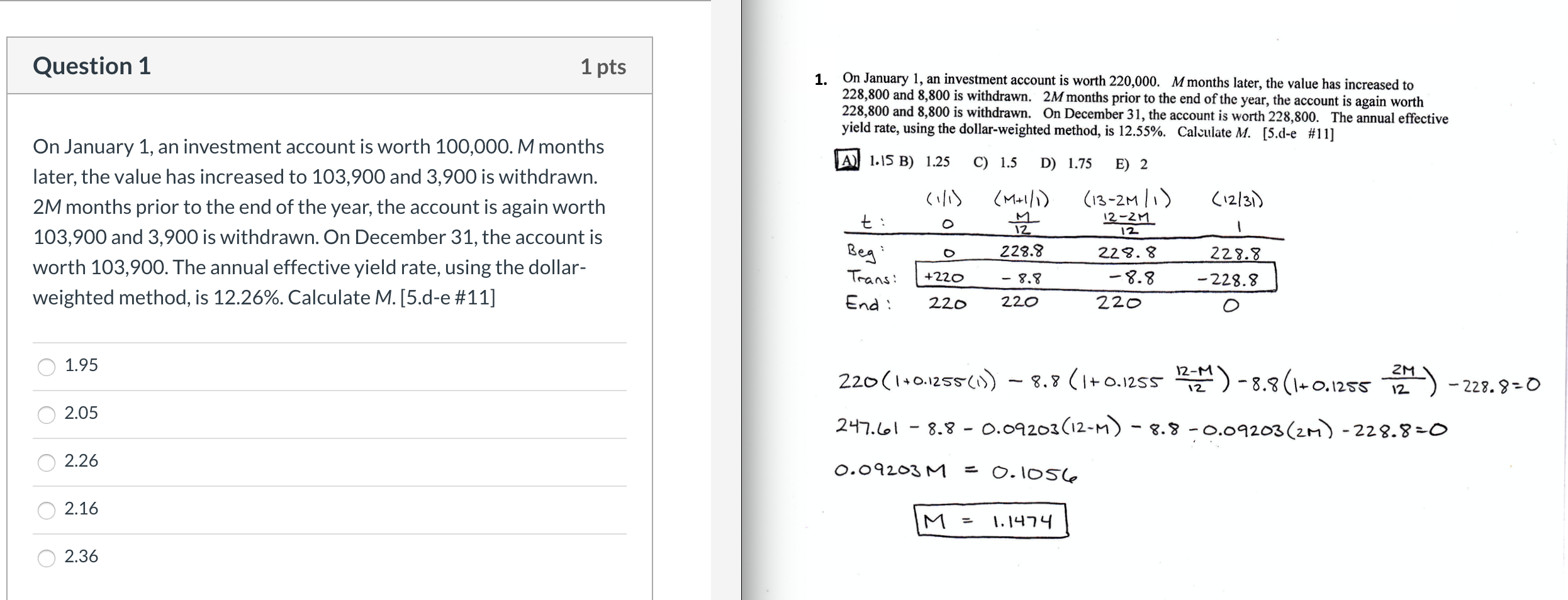

Question 1 1 pts On January 1, an investment account is worth 220,000. Mmonths later, the value has increased to 228,800 and 8,800 is withdrawn. 2M months prior to the end of the year, the account is again worth 228,800 and 8,800 is withdrawn. On December 31, the account is worth 228,800. The annual effective yield rate, using the dollar-weighted method, is 12.55%. Calculate M. (5.d-e #11] (12/31) On January 1, an investment account is worth 100,000. M months later, the value has increased to 103,900 and 3,900 is withdrawn. 2M months prior to the end of the year, the account is again worth 103,900 and 3,900 is withdrawn. On December 31, the account is worth 103,900. The annual effective yield rate, using the dollar- weighted method, is 12.26%. Calculate M. [5.d-e #11] A) 1.15 B) 1.25 B (1/1) t: o Beg! 0 Trans: +220 End: 220 C) 1.5 D) 1.75 E) 2 (M+1/1) (13-2M / 1) M 12 2M 228.8 228.8_ -8.8 -8.8 220 220 12 12 228.8 -228.8 O 1.95 02.05 220(1+0.1255()) 8.8 (1+0.1255 122) -8.8(1+0.1255 ) - 228.9-0 247.61 8.8 -0.09203(12-M) 8.8 -0.09203(2m) - 228.8=0 0.09203 M = 0.1056 o 2.26 02.16 M = 1.1474 02.36

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts