Question: Can someone help me with this question and provide a step by step solution with a detailed explantaion. Please give me a solution as well

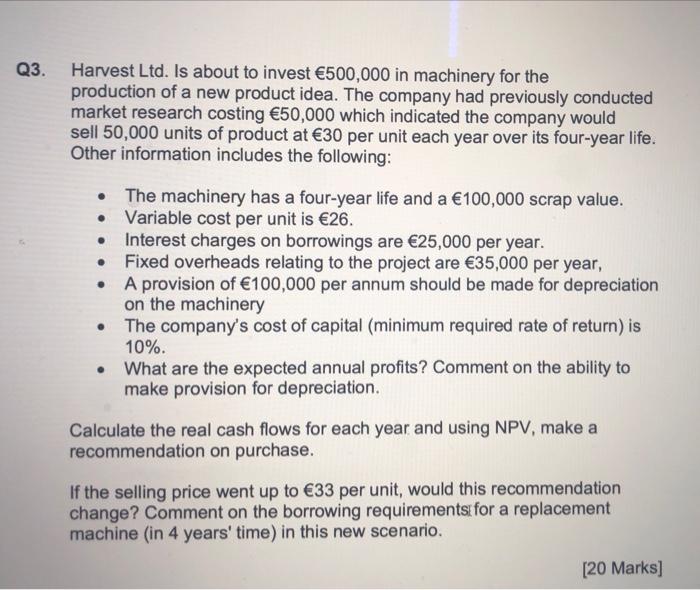

Q3. Harvest Ltd. Is about to invest 500,000 in machinery for the production of a new product idea. The company had previously conducted market research costing 50,000 which indicated the company would sell 50,000 units of product at 30 per unit each year over its four-year life. Other information includes the following: . . . . The machinery has a four-year life and a 100,000 scrap value. Variable cost per unit is 26. Interest charges on borrowings are 25,000 per year. Fixed overheads relating to the project are 35,000 per year, A provision of 100,000 per annum should be made for depreciation on the machinery The company's cost of capital (minimum required rate of return) is 10%. What are the expected annual profits ? Comment on the ability to make provision for depreciation. Calculate the real cash flows for each year and using NPV, make a recommendation on purchase. If the selling price went up to 33 per unit, would this recommendation change? Comment on the borrowing requirements for a replacement machine (in 4 years' time) in this new scenario. [20 Marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts