Question: can someone help me with this Saved Help You received partial credit in the previous attempt View previous attempt You have been asked by the

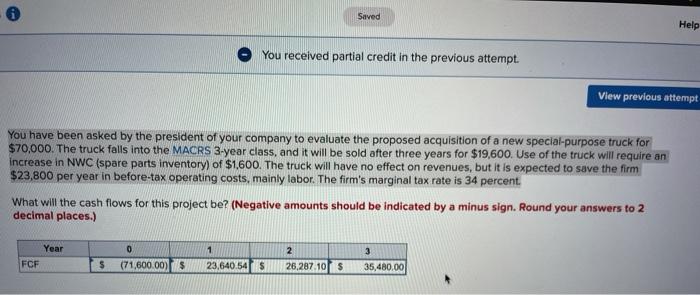

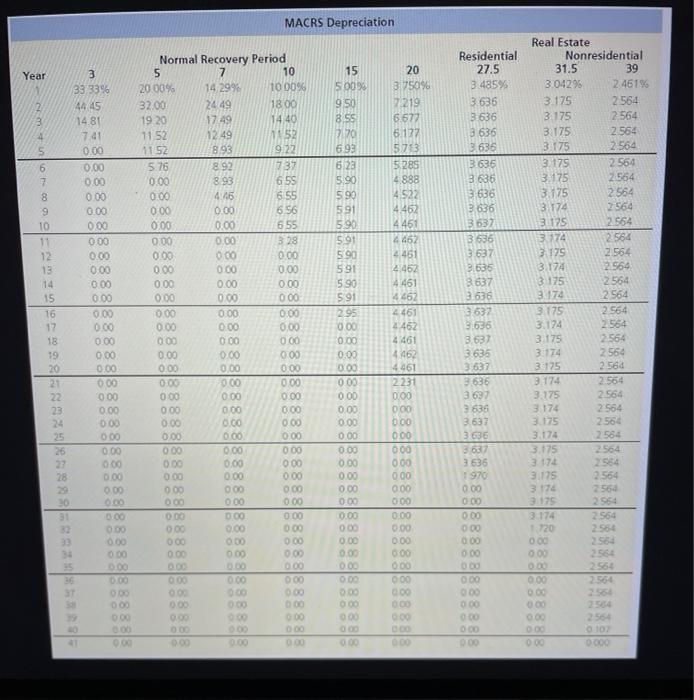

Saved Help You received partial credit in the previous attempt View previous attempt You have been asked by the president of your company to evaluate the proposed acquisition of a new special-purpose truck for $70,000. The truck falls into the MACRS 3-year class, and it will be sold after three years for $19,600. Use of the truck will require an increase in NWC (spare parts inventory) of $1,600. The truck will have no effect on revenues, but it is expected to save the firm $23,800 per year in before-tax operating costs, mainly labor. The firm's marginal tax rate is 34 percent. What will the cash flows for this project be? (Negative amounts should be indicated by a minus sign. Round your answers to 2 decimal places.) 3 Year FCF 0 (71,600.00) $ 1 23,640.54 $ $ 2 26,287.10 s 35,480.00 MACRS Depreciation 0.00 0.00 2.orageBREEBEA Year 3 33,33% 2 44 45 14 81 7.41 S 0.00 6 0.00 0.00 8 0.00 0.00 10 000 11 0.00 12 0.00 13 0.00 0.00 15 0.00 16 0.00 0.00 18 0.00 19 000 20 0.00 21 000 000 23 0.00 0.00 25 000 26 0.00 23 0.00 0.00 000 20 0.00 30 000 0.00 3 000 DOO Normal Recovery Period 5 7 10 20.00% 14,29% 10 0096 32.00 24.49 1800 19.20 17:49 14.40 11 52 12:49 152 1152 8.93 9:22 5.76 8.92 737 0.00 8 93 655 0.00 4.46 6.55 0.00 0.00 6.56 0.00 0.00 655 0.00 0.00 328 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 000 0.00 0.00 0.00 000 0.00 0.00 0.00 0.00 0.00 0.00 0.00 000 0.00 0.00 0.00 0:00 0.00 0.00 0.00 0.00 0.00 0.00 000 0.00 0.00 0.00 0.00 000 0.00 0.00 0.00 000 0.00 0.00 0.00 0.00 0:00 0.00 0.00 000 0.00 0.00 00 000 000 DO 0:00 00 000 000 000 OD OLO 00 000 000 15 5009 9.50 8.55 3.70 6.93 623 5.90 5.90 591 5.90 5.91 5.90 591 5.90 5.91 2.95 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 000 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 000 0.00 Residential 27.5 3.485% 3.636 3636 3636 3.636 3636 3 636 3636 3636 3637 3636 3 637 3.636 8637 3.636 3637 3.636 3.637 3635 3637 3.636 3637 3636 3637 3.636 3637 3 636 1970 0.00 0.00 0.00 000 0.00 20 8.750% 7219 6.677 6.177 573 5.285 4.888 4.522 4.462 4451 4462 4.461 2.462 4.461 4.462 2461 2.462 4.461 4462 4.461 2231 0.00 000 0.00 0.00 0.00 000 000 0.00 G00 0.00 0.00 000 DOO 0.00 000 000 000 0.00 Real Estate Nonresidential 31.5 39 304296 2.46196 3.175 2564 3.175 2564 3.175 2.564 3:175 2.564 3.175 2 564 3.175 2564 3.175 2564 3.174 2.564 31175 2.564 3 174 2564 3 175 2.564 3.174 2.564 3 175 2564 3.172 2564 3.175 2.964 3.174 2564 3175 2564 3.174 2564 3175 2.568 3.174 2:564 3.175 2564 3.174 2564 3.175 2564 3.174 2564 3.175 2564 3 174 2584 3.175 2564 3.174 2564 3 175 2564 3.174 2564 720 2564 000 3560 000 2.564 0.00 2564 2564 0.00 ST DO 0.00 000 2564 DOO 000 000 0 10 DOO 000 DO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts