Question: can someone help? Merge Center $ - % 92 San Incest Delete Form Foot Conditional Format Cell Formatting Table Styles Style Sort Find Ainment G

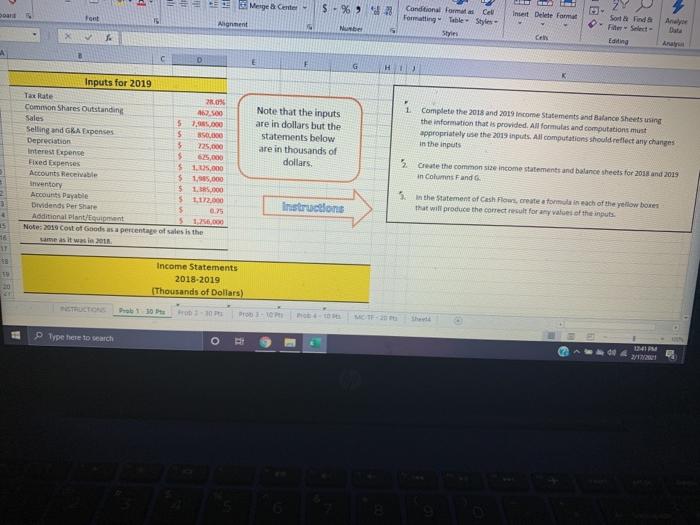

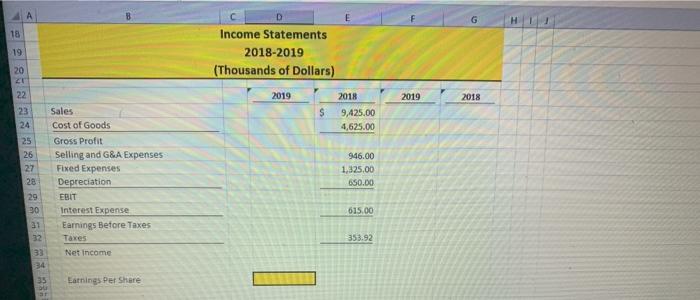

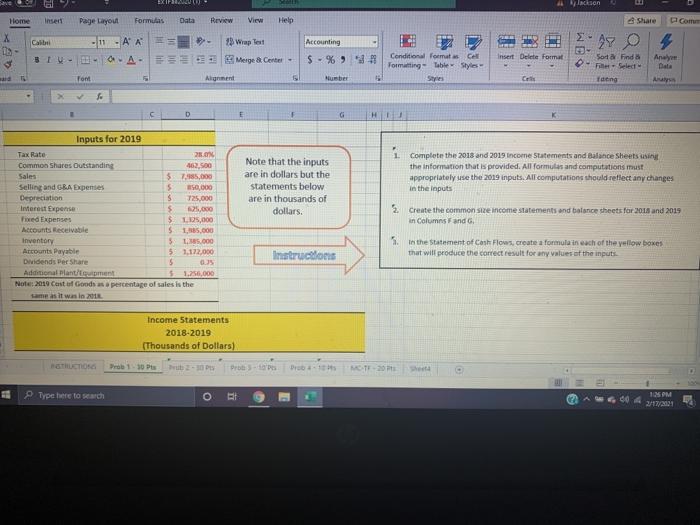

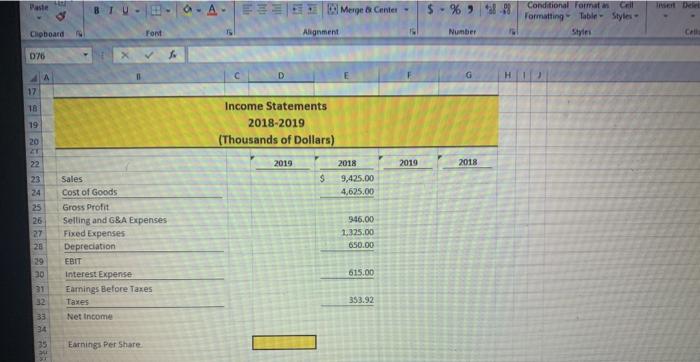

Merge Center $ - % 92 San Incest Delete Form Foot Conditional Format Cell Formatting Table Styles Style Sort Find Ainment G Nube Data 1 CE Editing G H1 1 Inputs for 2019 Tax Rate Common Shares Outstanding Sales Selling and GBA Expenses Depreciation Interest Expense Fixed Expenses Accounts Receivable Inventory Accounts Payable Drvidends Per Share Additional plantimant Notes 2018 Cost of Goods sa percentage Note that the inputs are in dollars but the statements below are in thousands of dollars. Complete the 2018 and 2019 income Statements and Balance Sheets using the information that is provided. All forms and computations must appropriately use the 2019 inputs. All computations should reflect any changes in the inputs 20.0% 16. 5 7.05.000 $ SO 5 225.000 $ 625.000 $ 1.135.000 $ 1,85,000 $ 115,000 5 1.17200 $ 0. $ 1.000 sales is the Create the common size income statements and balance sheets for 2018 2019 in Columns Fando 3 3 Instructions In the Statement of Cash Flows, create a formach of the yellow boxes that will produce the correct result for any ages of the inputs. Income Statements 2018-2019 Thousands of Dollars) ht Type fere to search 4 18 19 Income Statements 2018-2019 (Thousands of Dollars) 2019 2019 2018 S 2018 9,425.00 4,625.00 20 40 22 23 Sales 24 Cost of Goods 25 Gross Profit 26 Selling and G&A Expenses 27 Fixed Expenses 28 Depreciation 29 EBIT 30 Interest Expense 21 Earnings Before Taxes 32 Taxes Net Income 34 35 Earnings Per Share 946.00 1,325.00 650.00 615.00 353.92 EXPLW son Home Insert Page Layout Formulas Data Review View Help Com X 19 Calib -11 - AA 1 Wrap Test 10.A. Merge & Center - Font Alignment - AY O Accounting $ -% % -99 Insert Delete Format Analys Conditional formater Formatting - Table Styles Style Sort Find F. Select Tating Number Note that the inputs are in dollars but the statements below are in thousands of dollars. Inputs for 2019 Tax Rate 28. Common Shares Outstanding 462,00 Sales $75,000 Selling and GRAD pentes 5 50,000 Depreciation $ 725,000 Interest Expense 5 6.000 Fired Expenses 5 1. 25,000 Accounts Receivable S 1,135.000 Inventory 5 5.000 Arcounts Payable 5 1.122.000 Dividends Per Share $ . Additional plantament $ 1,256,000 Note:2019 Cost of Goods as percentage of sales is the same as it was in 2011 1 Complete the 2018 and 2019 Income Statements and Balance Sheets using the information that is provided. All formules and computations must appropriately use the 2019 inputs. All computations should reflect any changes in the inputs 2 create the common size income statements and balance sheets for 2018 and 2019 in Columns Fand 5. In the statement of Cash Flows, create a formula in each of the yellow boxes that will produce the correct result for any values of the inputs. Instructions Income Statements 2018-2019 (Thousands of Dollars) GUCTION P10 PE Dub - NOTE 20 Sheta Type here to search O 004 105 PM 2/12/2011 $ - %) 888 Merpe Ganter Alignment Conditional Format Chil Formatting Table Styles Chipboard Font Number Call 076 H 4 17 18 19 Income Statements 2018-2019 (Thousands of Dollars) 20 2019 2018 2019 2018 $ 9,425.00 4,625.00 22 23 24 25 26 27 20 Sales Cost of Goods Gross Profit Selling and G&A Expenses Fixed Expenses Depreciation EBIT Interest Expense Earnings Before Taxes Taxes Net Income 346.00 1.325.00 650.00 30 615.00 353.92 31 32 33 34 35 24 Earnings Per Share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts