Question: Can someone help with the question below? IT looks like what is currently in Chegg is wrong. Suppose you face the following situation. You have

Can someone help with the question below? IT looks like what is currently in Chegg is wrong.

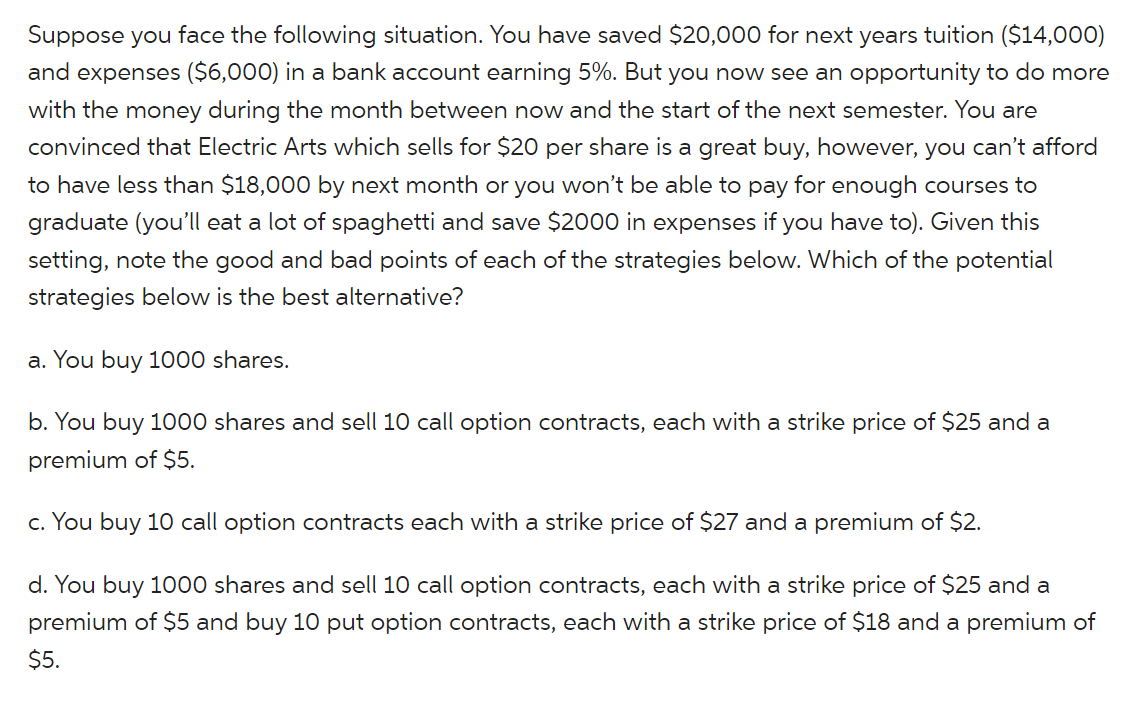

Suppose you face the following situation. You have saved $20,000 for next years tuition ($14,000) and expenses ($6,000) in a bank account earning 5%. But you now see an opportunity to do more with the money during the month between now and the start of the next semester. You are convinced that Electric Arts which sells for $20 per share is a great buy, however, you can't afford to have less than $18,000 by next month or you won't be able to pay for enough courses to graduate (you'll eat a lot of spaghetti and save \$2000 in expenses if you have to). Given this setting, note the good and bad points of each of the strategies below. Which of the potential strategies below is the best alternative? a. You buy 1000 shares. b. You buy 1000 shares and sell 10 call option contracts, each with a strike price of $25 and a premium of $5. c. You buy 10 call option contracts each with a strike price of $27 and a premium of $2. d. You buy 1000 shares and sell 10 call option contracts, each with a strike price of $25 and a premium of $5 and buy 10 put option contracts, each with a strike price of $18 and a premium of $5 Suppose you face the following situation. You have saved $20,000 for next years tuition ($14,000) and expenses ($6,000) in a bank account earning 5%. But you now see an opportunity to do more with the money during the month between now and the start of the next semester. You are convinced that Electric Arts which sells for $20 per share is a great buy, however, you can't afford to have less than $18,000 by next month or you won't be able to pay for enough courses to graduate (you'll eat a lot of spaghetti and save \$2000 in expenses if you have to). Given this setting, note the good and bad points of each of the strategies below. Which of the potential strategies below is the best alternative? a. You buy 1000 shares. b. You buy 1000 shares and sell 10 call option contracts, each with a strike price of $25 and a premium of $5. c. You buy 10 call option contracts each with a strike price of $27 and a premium of $2. d. You buy 1000 shares and sell 10 call option contracts, each with a strike price of $25 and a premium of $5 and buy 10 put option contracts, each with a strike price of $18 and a premium of $5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts