Question: can someone help with this problem step by step? Thank you Suppose a project has capital expenditures of $300,000. The firm uses the same depreciation

can someone help with this problem step by step? Thank you

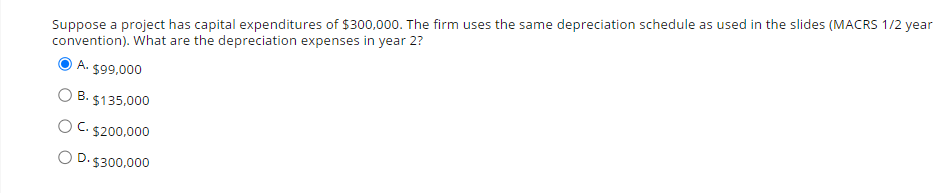

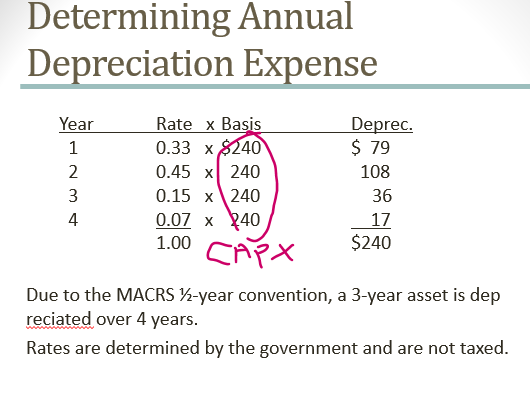

Suppose a project has capital expenditures of $300,000. The firm uses the same depreciation schedule as used in the slides (MACRS 1/2 year convention). What are the depreciation expenses in year 2? A. 599,000 B. $135,000 OC. $200,000 D. $300,000 Determining Annual Depreciation Expense 36 Year Rate x Basis Deprec. 1 0.33 x $240 $ 79 2 0.45 x 240 108 3 0.15 x 240 4 0.07 x 440 17 1.00 $240 CAPX Due to the MACRS 12-year convention, a 3-year asset is dep reciated over 4 years. Rates are determined by the government and are not taxed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts