Question: II. Alice Jordan, an international pension fund manager, plans to sell equities (their current market value: 900 million denominated in Swiss Francs (CHF)] and

![(their current market value: 900 million denominated in Swiss Francs (CHF)] and](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2021/03/6048a65ecccd8_1615373916929.jpg)

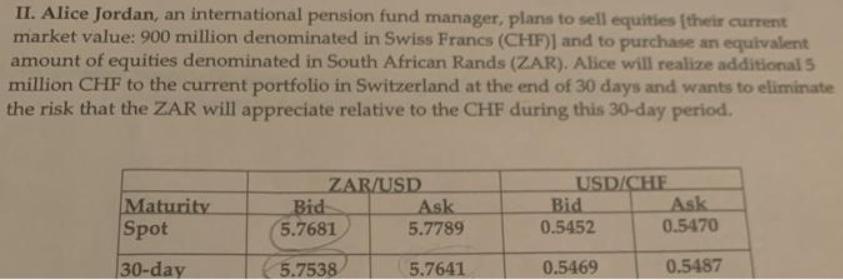

II. Alice Jordan, an international pension fund manager, plans to sell equities (their current market value: 900 million denominated in Swiss Francs (CHF)] and to purchase an equivalent amount of equities denominated in South African Rands (ZAR). Alice will realize additional 5 million CHF to the current portfolio in Switzerland at the end of 30 days and wants to eliminate the risk that the ZAR will appreciate relative to the CHF during this 30-day period. Maturity Spot Bid 5.7681 ZAR/USD Ask 5.7789 USD/CHE Ask 0.5470 Bid 0.5452 30-day (5.7538 5.7641 0.5469 0.5487 4. (15 points) Compute the annualized premium or discount at which CHF is trading to ZAR (Hint: Compute the percentage change in the forward cross bid rates).

Step by Step Solution

3.58 Rating (155 Votes )

There are 3 Steps involved in it

Calculation of Bid Rates of CHF to ZAR Spot Rate CHFZAR CHFUSD US... View full answer

Get step-by-step solutions from verified subject matter experts