Question: Can someone help with this question? Thank you! 2 2 = + Problem 8. Consider an Asian option written on a stock index that expires

Can someone help with this question? Thank you!

Can someone help with this question? Thank you!

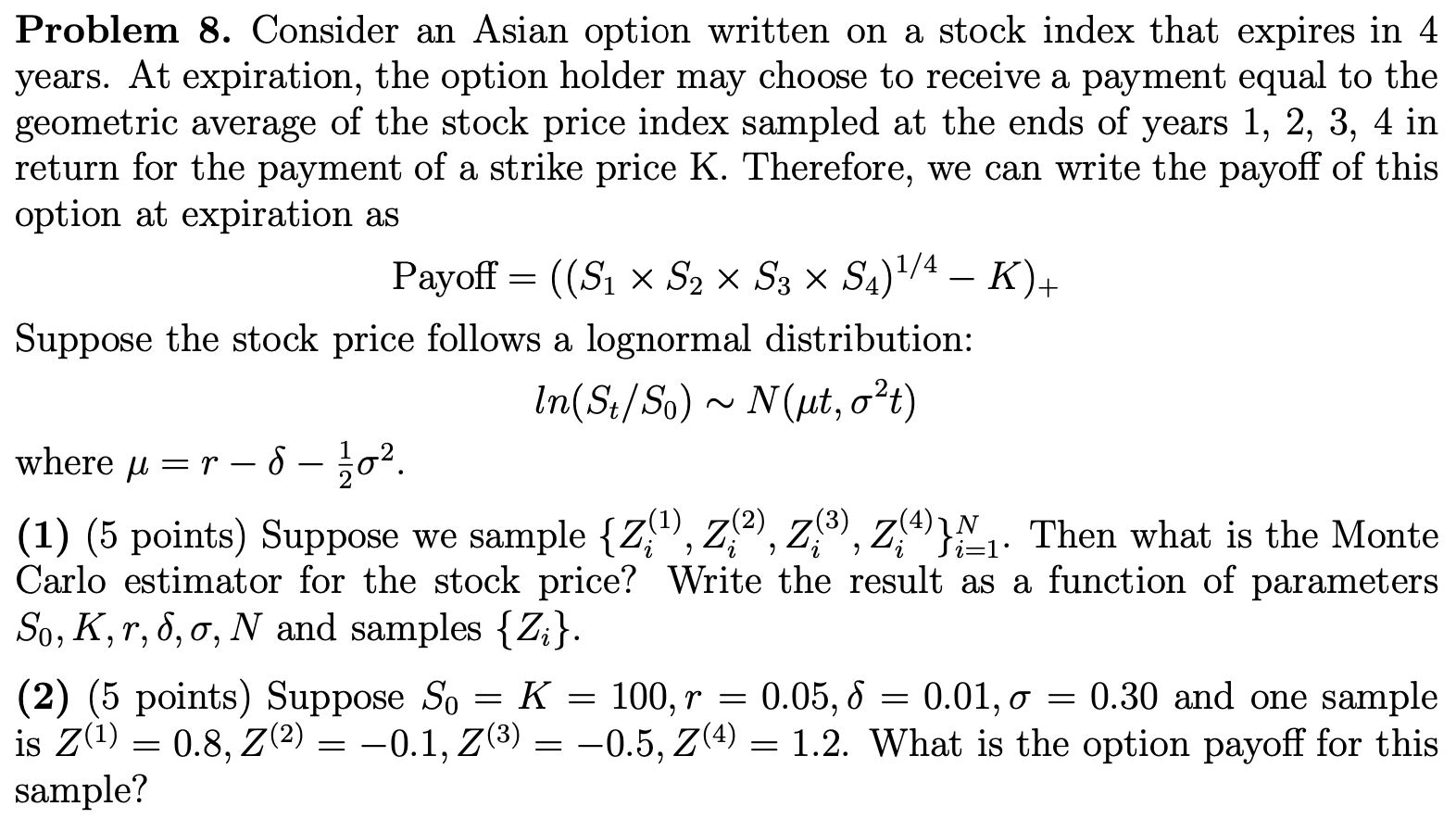

2 2 = + Problem 8. Consider an Asian option written on a stock index that expires in 4 years. At expiration, the option holder may choose to receive a payment equal to the geometric average of the stock price index sampled at the ends of years 1, 2, 3, 4 in return for the payment of a strike price K. Therefore, we can write the payoff of this option at expiration as Payoff = ((Sz x S2 x Sz x 54)1/4 K)+ Suppose the stock price follows a lognormal distribution: In(St/So) ~ N(ut, ot) where u =r-8-202. (1) (5 points) Suppose we sample {z(1), 7(2), 2(3), 2(4)}N1. Then what is the Monte 1) Carlo estimator for the stock price? Write the result as a function of parameters So, K, r,8,0, N and samples {Z;}. (2) (5 points) Suppose So = K = 100, r = 0.05, 8 = 0.01, 0 = 0.30 and one sample K o = is Z(1) = 0.8, Z(2) = -0.1, 2(3) = -0.5, 7(4) = 1.2. What is the option payoff for this Z sample? 4 > 2 2 : 2 2 = = = = = = 2 2 = + Problem 8. Consider an Asian option written on a stock index that expires in 4 years. At expiration, the option holder may choose to receive a payment equal to the geometric average of the stock price index sampled at the ends of years 1, 2, 3, 4 in return for the payment of a strike price K. Therefore, we can write the payoff of this option at expiration as Payoff = ((Sz x S2 x Sz x 54)1/4 K)+ Suppose the stock price follows a lognormal distribution: In(St/So) ~ N(ut, ot) where u =r-8-202. (1) (5 points) Suppose we sample {z(1), 7(2), 2(3), 2(4)}N1. Then what is the Monte 1) Carlo estimator for the stock price? Write the result as a function of parameters So, K, r,8,0, N and samples {Z;}. (2) (5 points) Suppose So = K = 100, r = 0.05, 8 = 0.01, 0 = 0.30 and one sample K o = is Z(1) = 0.8, Z(2) = -0.1, 2(3) = -0.5, 7(4) = 1.2. What is the option payoff for this Z sample? 4 > 2 2 : 2 2 = = = = = =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts