Question: Can someone let me know if my answer is correct For companies using the accrual method of accounting, why is there almost always a difference

Can someone let me know if my answer is correct

Can someone let me know if my answer is correct

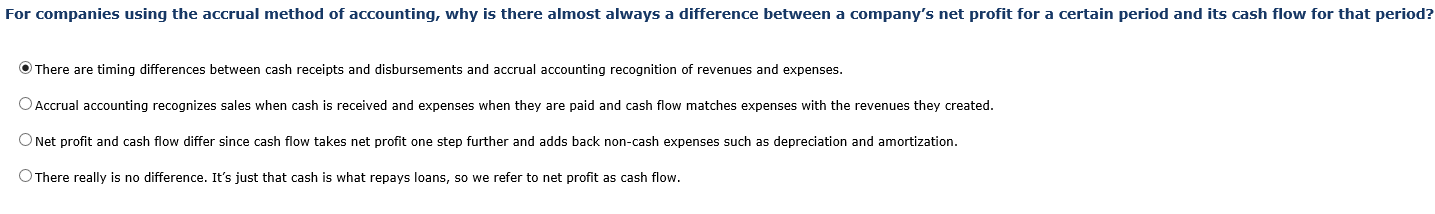

For companies using the accrual method of accounting, why is there almost always a difference between a company's net profit for a certain period and its cash flow for that period? There are timing differences between cash receipts and disbursements and accrual accounting recognition of revenues and expenses. O Accrual accounting recognizes sales when cash is received and expenses when they are paid and cash flow matches expenses with the revenues they created. O Net profit and cash flow differ since cash flow takes net profit one step further and adds back non-cash expenses such as depreciation and amortization. There really is no difference. It's just that cash is what repays loans, so we refer to net profit as cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts