Question: Can someone please answer question B D E 500 words for each question? I'd really appreciate it. Thank you. 1. Rationale You are the Chief

Can someone please answer question B D E 500 words for each question? I'd really appreciate it. Thank you.

Can someone please answer question B D E 500 words for each question? I'd really appreciate it. Thank you.

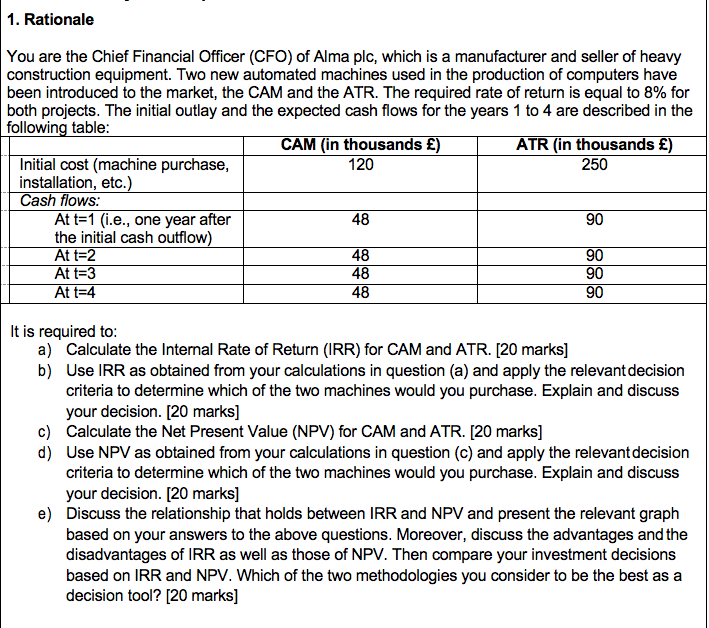

1. Rationale You are the Chief Financial Officer (CFO) of Alma plc, which is a manufacturer and seller of heavy construction equipment. Two new automated machines used in the production of computers have been introduced to the market, the CAM and the ATR. The required rate of return is equal to 8% for both projects. The initial outlay and the expected cash flows for the years 1 to 4 are described in the following table: CAM (in thousands ) ATR (in thousands ) Initial cost (machine purchase, 120 250 installation, etc.) Cash flows: At t=1 (i.e., one year after 48 90 the initial cash outflow) At t=2 48 90 At t=3 48 90 At t=4 48 90 It is required to: a) Calculate the Internal Rate of Return (IRR) for CAM and ATR. [20 marks] b) Use IRR as obtained from your calculations in question (a) and apply the relevant decision criteria to determine which of the two machines would you purchase. Explain and discuss your decision. [20 marks] c) Calculate the Net Present Value (NPV) for CAM and ATR. [20 marks] d) Use NPV as obtained from your calculations in question (C) and apply the relevant decision criteria to determine which of the two machines would you purchase. Explain and discuss your decision. [20 marks] e) Discuss the relationship that holds between IRR and NPV and present the relevant graph based on your answers to the above questions. Moreover, discuss the advantages and the disadvantages of IRR as well as those of NPV. Then compare your investment decisions based on IRR and NPV. Which of the two methodologies you consider to be the best as a decision tool? [20 marks] 1. Rationale You are the Chief Financial Officer (CFO) of Alma plc, which is a manufacturer and seller of heavy construction equipment. Two new automated machines used in the production of computers have been introduced to the market, the CAM and the ATR. The required rate of return is equal to 8% for both projects. The initial outlay and the expected cash flows for the years 1 to 4 are described in the following table: CAM (in thousands ) ATR (in thousands ) Initial cost (machine purchase, 120 250 installation, etc.) Cash flows: At t=1 (i.e., one year after 48 90 the initial cash outflow) At t=2 48 90 At t=3 48 90 At t=4 48 90 It is required to: a) Calculate the Internal Rate of Return (IRR) for CAM and ATR. [20 marks] b) Use IRR as obtained from your calculations in question (a) and apply the relevant decision criteria to determine which of the two machines would you purchase. Explain and discuss your decision. [20 marks] c) Calculate the Net Present Value (NPV) for CAM and ATR. [20 marks] d) Use NPV as obtained from your calculations in question (C) and apply the relevant decision criteria to determine which of the two machines would you purchase. Explain and discuss your decision. [20 marks] e) Discuss the relationship that holds between IRR and NPV and present the relevant graph based on your answers to the above questions. Moreover, discuss the advantages and the disadvantages of IRR as well as those of NPV. Then compare your investment decisions based on IRR and NPV. Which of the two methodologies you consider to be the best as a decision tool? [20 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts