Question: can someone please answer the ones below how did they solve 2. ABC Inc., a publicly traded company, 100,000 granted stock options on January 1,

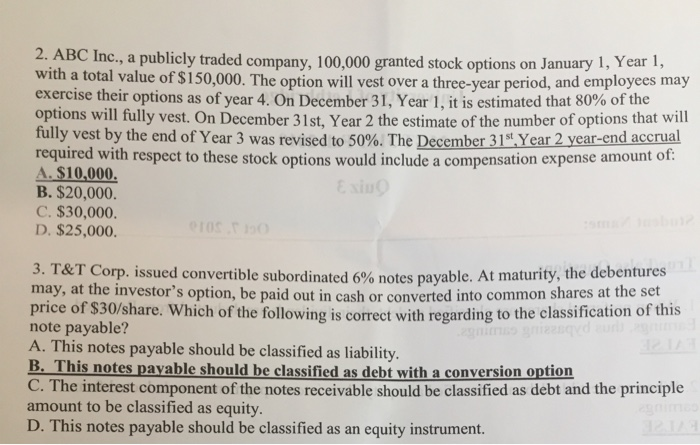

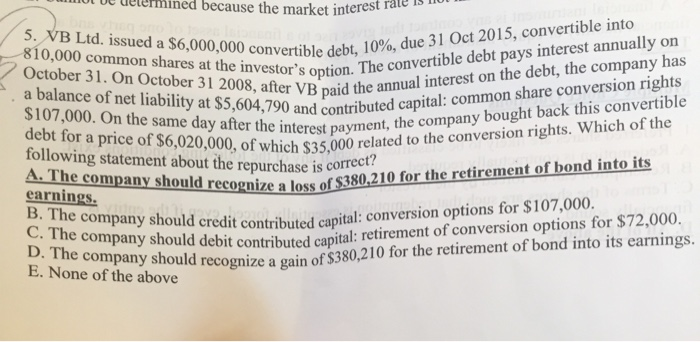

2. ABC Inc., a publicly traded company, 100,000 granted stock options on January 1, I can with a total value of $150,000. The option will vest over a three-year period, and employees may exercise their options as of year 4. On December 31, Year 1. it is estimated that 80% of the options will fully vest. On December 31st, Year 2 the estimate of the number of options that will fully vest by the end of Year 3 was revised to 50%. The December 31s', Year 2 year-end accrua required with respect to these stock options would include a compensation expense amo A. $10,000. E B. $20,000. C. $30,000. D. $25,000. OTOSHO 3. T&T Corp. issued convertible subordinated 6% notes payable. At matu linated 6% notes payable. At maturity, the debentures may, at the investor's option, be paid out in cash or converted into common shares at the price of $30/share. Which of the following is correct with regarding to the classic note payable? A. This notes payable should be classified as liability, B. This notes payable should be classified as debt with a conversion option C. The interest component of the notes receivable should be classified as debt and the principle amount to be classified as equity. D. This notes payable should be classified as an equity instrument. o e uetermined because the market interest rate 15 5. VB Ltd. issued a $6,000,000 convertible debt, 810,000 common shares at the investor's option. 1 October 31. On October 31 2008, after VB paid the a balance of net liability at $5,604,790 and contributed ca $107,000. On the same day after the interest payment, debt for a price of $6,020,000, of which $35,000 r following statement about the repurchase is correc A. The company should recognize a loss of $38 earnings. B. The company should credit contribute C. The company should debit contribute D. The company should recognize a gain E. None of the above Onvertible debt, 10%, due 31 Oct 2015, convertible into vestor's option. The convertible debt pays interest annually on alter VB paid the annual interest on the debt, the company has O and contributed capital: common share conversion rights e interest payment, the company bought back this convertible 00, of which $35,000 related to the conversion rights. Which of the hould recognize a loss of $380,210 for the retirement of bond into its should credit contributed capital: conversion options for $107,000. ould debit contributed capital: retirement of conversion options for $72,000. hy should recognize a gain of $380,210 for the retirement of bond into its earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts