Question: can someone please answer this question. i have a final tommorow and im so lost. thank you Problem 3: You are a hedge fund in

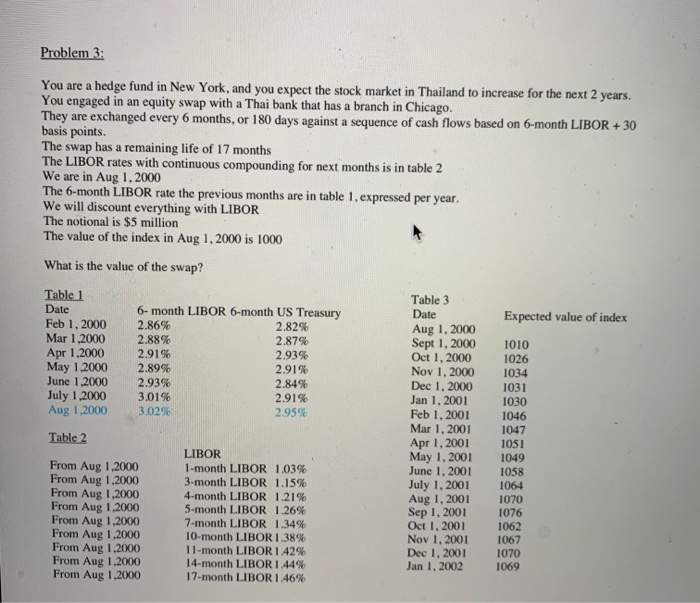

Problem 3: You are a hedge fund in New York, and you expect the stock market in Thailand to increase for the next 2 years. You engaged in an equity swap with a Thai bank that has a branch in Chicago. They are exchanged every 6 months, or 180 days against a sequence of cash flows based on 6-month LIBOR + 30 basis points. The swap has a remaining life of 17 months The LIBOR rates with continuous compounding for next months is in table 2 We are in Aug 1, 2000 The 6-month LIBOR rate the previous months are in table 1, expressed per year. We will discount everything with LIBOR The notional is $5 million The value of the index in Aug 1, 2000 is 1000 What is the value of the swap? Expected value of index Table 1 Date Feb 1, 2000 Mar 1,2000 Apr 1.2000 May 1.2000 June 1.2000 July 1,2000 Aug 1,2000 6-month LIBOR 6-month US Treasury 2.86% 2.82% 2.88% 2.87% 2.91% 2.93% 2.89% 2.91% 2.93% 2.84% 3.01% 2.91% 3.02% 2.95% Table 2 Table 3 Date Aug 1, 2000 Sept 1, 2000 Oct 1, 2000 Nov 1, 2000 Dec 1, 2000 Jan 1.2001 Feb 1, 2001 Mar 1.2001 Apr 1.2001 May 1, 2001 June 1, 2001 July 1, 2001 Aug 1, 2001 Sep 1, 2001 Oct 1, 2001 Nov 1, 2001 Dec 1, 2001 Jan 1, 2002 1010 1026 1034 1031 1030 1046 1047 1051 1049 1058 1064 1070 1076 1062 1067 1070 1069 LIBOR 1-month LIBOR 1.03% 3-month LIBOR 1.15% 4-month LIBOR 1.21% 5-month LIBOR 1.26% 7-month LIBOR 1.34% 10-month LIBOR 1.38% 11-month LIBOR 1.42% 14-month LIBOR 1.44% 17-month LIBOR 1.46% From Aug 1,2000 From Aug 1,2000 From Aug 1,2000 From Aug 1,2000 From Aug 1,2000 From Aug 1,2000 From Aug 1,2000 From Aug 1,2000 From Aug 1,2000 Problem 3: You are a hedge fund in New York, and you expect the stock market in Thailand to increase for the next 2 years. You engaged in an equity swap with a Thai bank that has a branch in Chicago. They are exchanged every 6 months, or 180 days against a sequence of cash flows based on 6-month LIBOR + 30 basis points. The swap has a remaining life of 17 months The LIBOR rates with continuous compounding for next months is in table 2 We are in Aug 1, 2000 The 6-month LIBOR rate the previous months are in table 1, expressed per year. We will discount everything with LIBOR The notional is $5 million The value of the index in Aug 1, 2000 is 1000 What is the value of the swap? Expected value of index Table 1 Date Feb 1, 2000 Mar 1,2000 Apr 1.2000 May 1.2000 June 1.2000 July 1,2000 Aug 1,2000 6-month LIBOR 6-month US Treasury 2.86% 2.82% 2.88% 2.87% 2.91% 2.93% 2.89% 2.91% 2.93% 2.84% 3.01% 2.91% 3.02% 2.95% Table 2 Table 3 Date Aug 1, 2000 Sept 1, 2000 Oct 1, 2000 Nov 1, 2000 Dec 1, 2000 Jan 1.2001 Feb 1, 2001 Mar 1.2001 Apr 1.2001 May 1, 2001 June 1, 2001 July 1, 2001 Aug 1, 2001 Sep 1, 2001 Oct 1, 2001 Nov 1, 2001 Dec 1, 2001 Jan 1, 2002 1010 1026 1034 1031 1030 1046 1047 1051 1049 1058 1064 1070 1076 1062 1067 1070 1069 LIBOR 1-month LIBOR 1.03% 3-month LIBOR 1.15% 4-month LIBOR 1.21% 5-month LIBOR 1.26% 7-month LIBOR 1.34% 10-month LIBOR 1.38% 11-month LIBOR 1.42% 14-month LIBOR 1.44% 17-month LIBOR 1.46% From Aug 1,2000 From Aug 1,2000 From Aug 1,2000 From Aug 1,2000 From Aug 1,2000 From Aug 1,2000 From Aug 1,2000 From Aug 1,2000 From Aug 1,2000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts